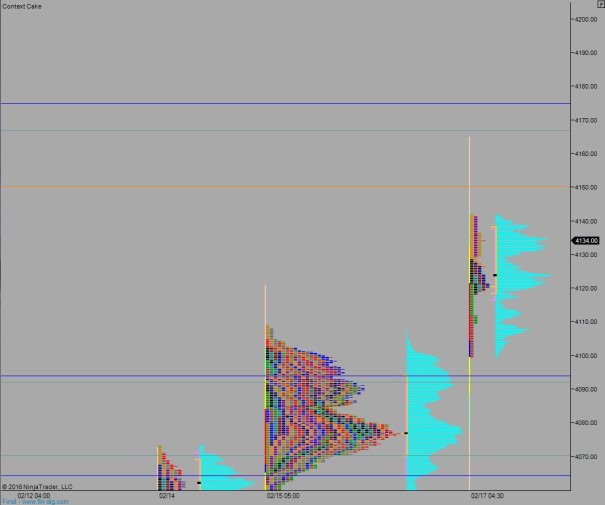

NASDAQ futures are priced to gap up into Wednesday after a Globex session featuring extreme range on elevated volume. Price rotated down through the well-established value area before finding a strong responsive bid at value area low. The market then rallied up through most of the 02/05 liquidation day’s range. At 8:30am Housing Starts and Building Permits data was mixed but mostly in-line.

Also on the economic calendar today we have Industrial/Manufacturing Production at 9:15am, a 4-week T-Bill auction at 11:30am, and FOMC Minutes at 2pm.

Yesterday we printed a neutral extreme up. The morning featured selling which continued just after the first hour of trade to go range extension down. Right around 4050 (a globex support level) responsive buyers (responsive relative to the open, initiative relative to last week’s close) stepped in. We then rallied up through the entire range to go neutral and closed in the upper quadrant to be extreme.

Heading into today my primary expectation is for seller to work into the overnight inventory and close the gap down to 4092.50. Look for a strong responsive buyer here and two way trade to ensue but not take out overnight high 4141.75.

Hypo 2 buyers continue higher off the open, take out overnight high 4141.75. They continue climbing until finding responsive sellers up near 4166.75. From here two way trade ensues north of 4100.

Hypo 3 sellers get aggressive. The day 4 unidirectional statistic which is a study that has a 82% probability of a down day after 4 up days is in play. After a gap fill down to 4092.50 sellers continue trading lower to take out overnight low 4068.25 before two way trade ensues.

Hypo 4, trend day up. Buyers take out 4166.75 early and sustain trade above it setting up a move to target the 4200 century mark.

Levels:

Volume profiles, gaps, and measured levels:

No sellers in sight.

Crude off highs & Gold mini-bounce may mean something.

Looks like it’s a risk-on push ahead of Fed Minutes.

Cant wait to see the outcome @2