Turns out investors liked the FOMC minutes.

The fun thing about auction theory is it gives you cues, like when to press a position overnight.

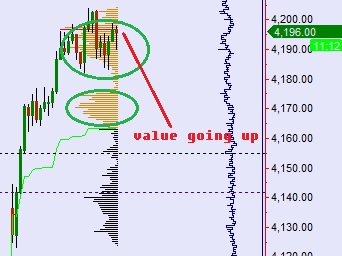

Yesterday it was the neutral extreme. Today, it is the double distribution trend day, BEHOLD:

Statistically, odds are strong sellers step in tomorrow.

Statistically, odds are strong sellers step in tomorrow.

Contextually auction theory says press longs, FOMC minutes were a buy, and Friday is OPEX after bears were caught up on that lean.

In short, what’s a goon to a goblin?

If you enjoy the content at iBankCoin, please follow us on Twitter

I’m a tad confused.

What do you mean by “press longs”?

That to say that bears may still get squeezed so keep backing up the truck with getting long // or are you saying that “longs” will get pressed i.e. squeezed b/c the buying has been too lumpy?

And what’s the significance of opex this Friday for auction theory? I was under the impression that open days were more often than not, violent down days.

Thanks

sorry for confusion, I mean press existing longs

context for me is the combination of statistics, auction theory, and economic events. OPEX is not auction theory, but the recent trend (last 4-6 months, not all of them but several) has been to rally into OPEX. Check the bluestar archives, he did a write-up on it

Will do & thanks for the clarification.

Well, I don’t know about auction theory, but a visual backtest doesn’t say a whole lot good for the next few sessions with QQQ’s that have back to back gaps.

Working against a day 4 unidirectional stat too. Definitely thin ice.

Prolly get a nice shakeout tomorrow, catch some weak bulls before one last squeeze up to the Google earnings gap (FEB 1) before rolling over. All just predictions really.

Visual backtests are great for developing an idea, but it would benefit you immensely to put some concrete stays behind your observation of the ‘double gap’