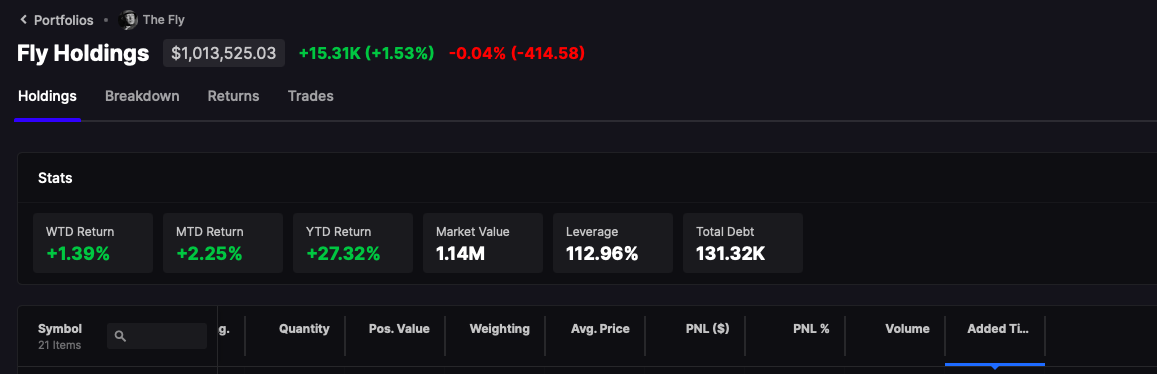

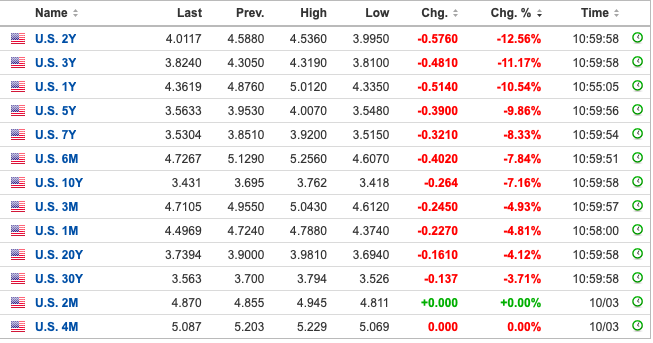

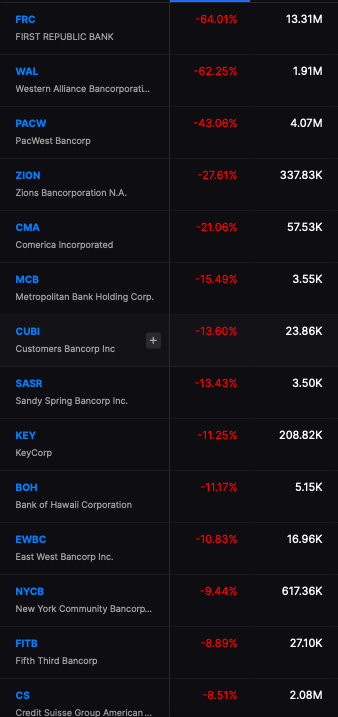

You don’t really give a fuck about what I did today — only what I think will happen tomorrow. So I’ll get all of the selfish shit out of the way first. I was +96bps and I covered my massive bank and semi shorts and opened JUST IN CASE a 12% long in UVIX, along with some additional longs. I am net long here with only the VIX for dramatic effect.

We were supposed to dive down and bury ourselves alive — but we didn’t. Lots of regionals, like ZION and LOB, reversed and went higher. Charles Fucking Schwab was pinned to highs all day. I know and I get it — it’s annoying.

But this is what is likely to occur.

The cunts in power will weasel out of this for a short while. They’ll do some joint ECB-FED plan to paper over the banks, offer unlimited this and that. All of that will make us feeeeel real good and markets will climb. In a few months the economy will prove to be NOT AS RESILIENT and we might crescendo lower again.

If forced to make a call, I’d say as of right now — the globohomo won. Today was the day we had to press their faces into the griddle. Now it’s our faces being panini’d and if we’re not careful we might become sandwiches for some faggot bulls.

Look, all I am saying is give yourselves a break — you’ve earned it. Take a few months off from trading. Go to Europe like me and see the continent before it’s completely destroyed by Belarus. I will be here trading and will continue to trade, even from beyond the grave. It was a very sad and somber day for the bears. All we want is for GLOBAL COLLAPSE AMIDST COLOSSAL SIZED LOSSES — GRAVE REVOLTS — AND PEOPLE SKINNED ALIVE AT THE GIBBET.

It’s entirely possible that it might be I skinned alive by some shithead tranny in a NY Yankees dress. I am aware of the peril I place myself in and to be honest — I look forward to the occasion!

Comments »