I have most unpleasant mood for my bearish readers out there: markets are not likely to crash this spring. Don’t take my word for it — go ahead and look at the data. We, on occasion, get some summer doldrums, and most certainly CRASH THROUGH THE FUCKING FLOORBOARDS during Fall. But in the spring, a time for renewal, we are likely to plod along and drift a little higher or a little lower.

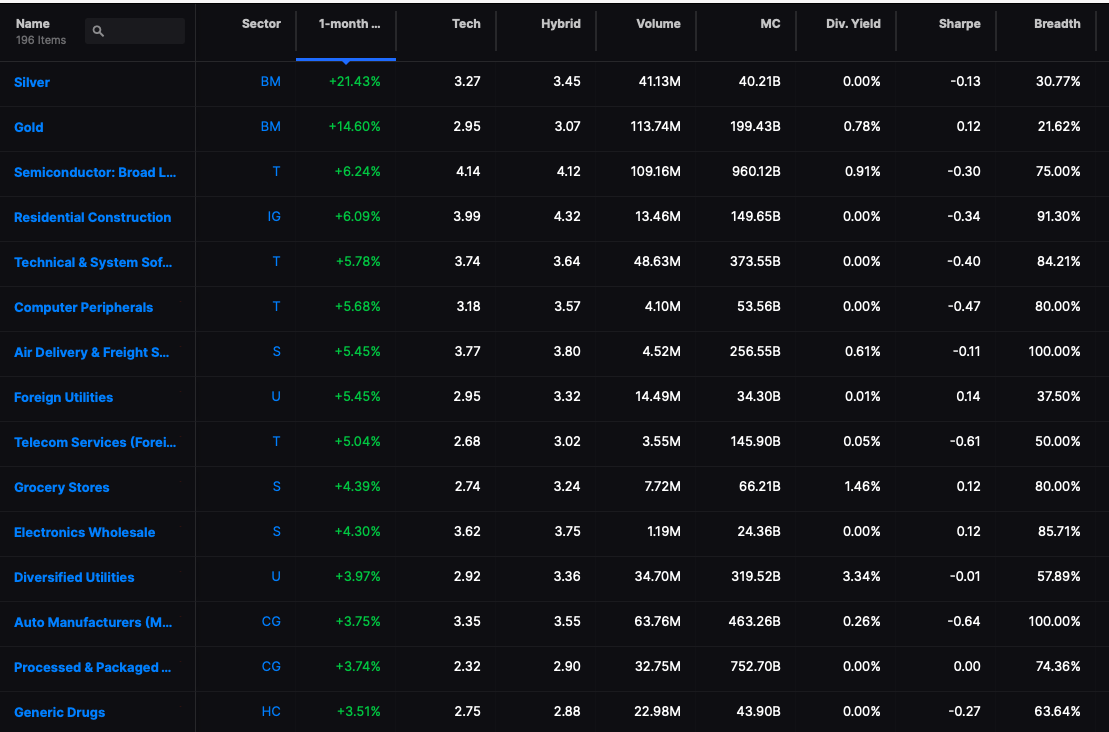

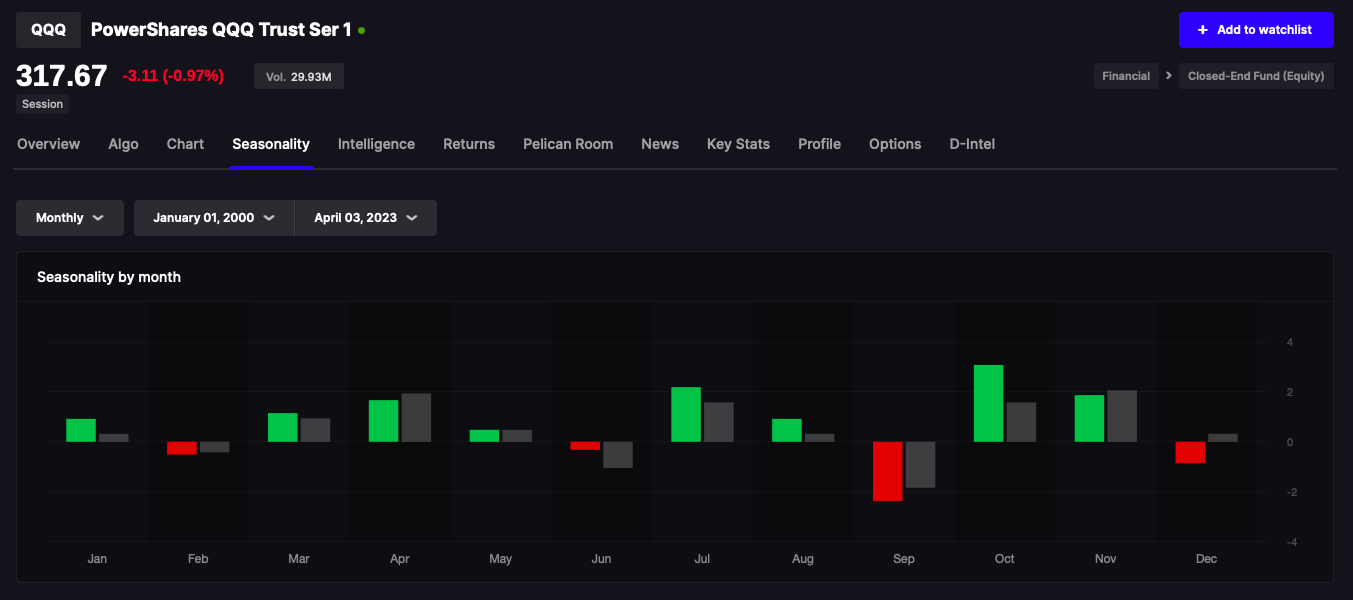

Stocklabs seasonality for QQQ 2000-date

I know it sucks and we might be better off with stocks much lower and PAX AMERICANA as we know it in shambles. Alas, the tranny parade continues and the degeneracy of our people commences amidst pomp and circumstance and a general dumbing down by way or vice. We can get angry about it in the same way BASED ROMANS were upset in 400 AD. The simple fact of the matter is, as a species the dominant rule, one way or another, and those fuckers who dominant can lead people towards the path of grace or ruin. We are, without question, heading for a HISTORICAL COLLAPSE OF EPIC PROPORTIONS and I’m afraid the only way out is through the fires.

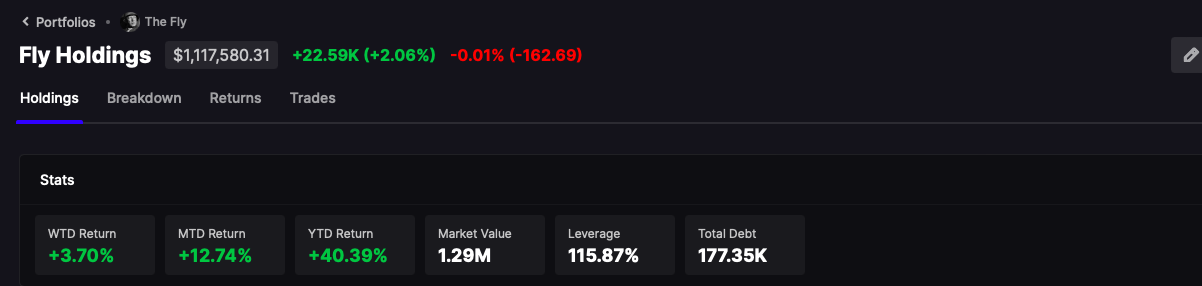

That said, I once again am up 90bps, fully invested with mild hedges. I also, for the first time ever, added $BTC as a permanent 5% holding and will add to it monthly to ensure it maintains 5%.

What do I think will happen next?

I just fucking said it: drift a little higher or a little lower.

PREPARE YOURSELVES for melancholy times amidst gin and tonics, orange twist — small splash of bitters and a gentle breeze in a sun washed environ — overseeing blossoming flowers and bright green lawns. Your portfolios will not be threatened until June.

Comments »