Please refrain from offering me financial advice. On occasion, after I pen a rather glum attestation of my trading, my email box is FESTOONED with advice blurbs by random actors attempting to impress upon me some sort of wisdom that can be gleaned and polished in order to permit me to achieve some level of success in the markets. I will remind you, I am a professional manager of money, licensed BY LAW to be a fiduciary. I am what others might call “an expert” or “an authority” on all things finance.

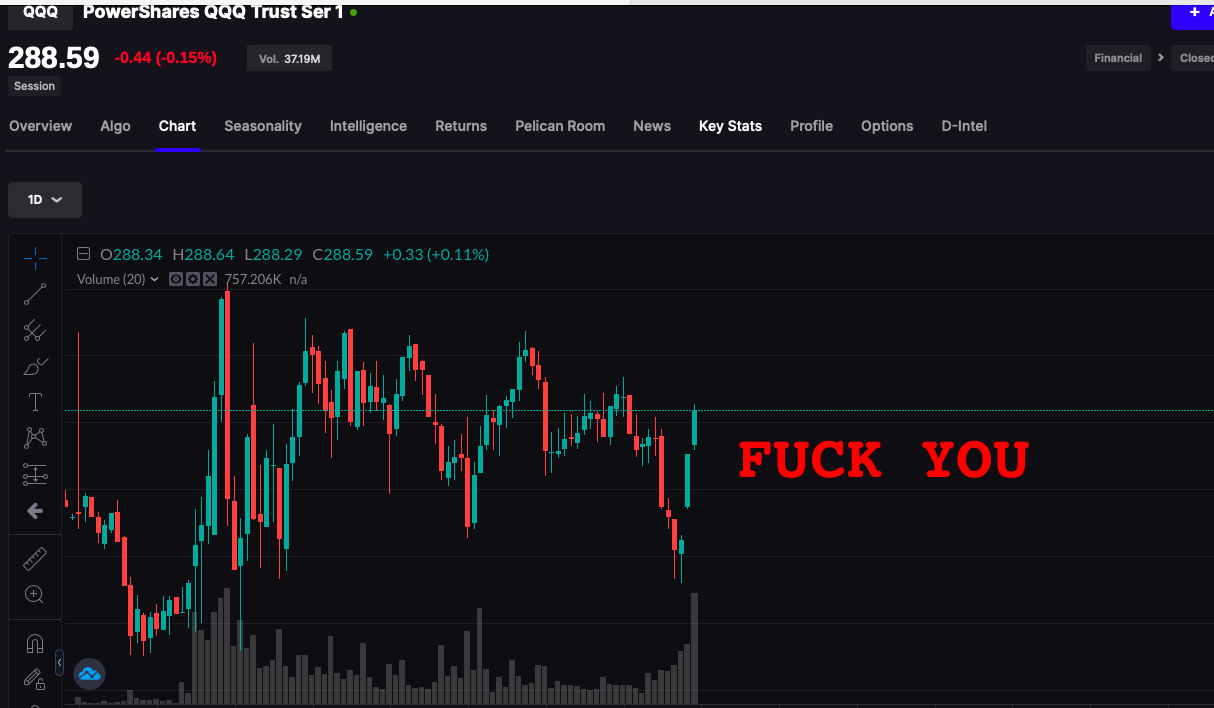

Early this morning I was tempted to believe in the sinking boat theory but was quickly reminded “YOU ARE A PROFESSIONAL SIR. Take the easy trade”. And so I did.

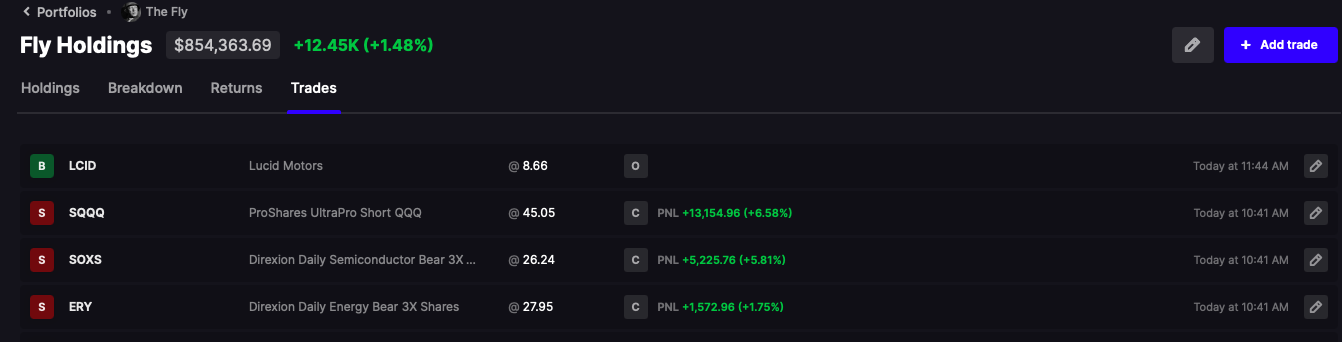

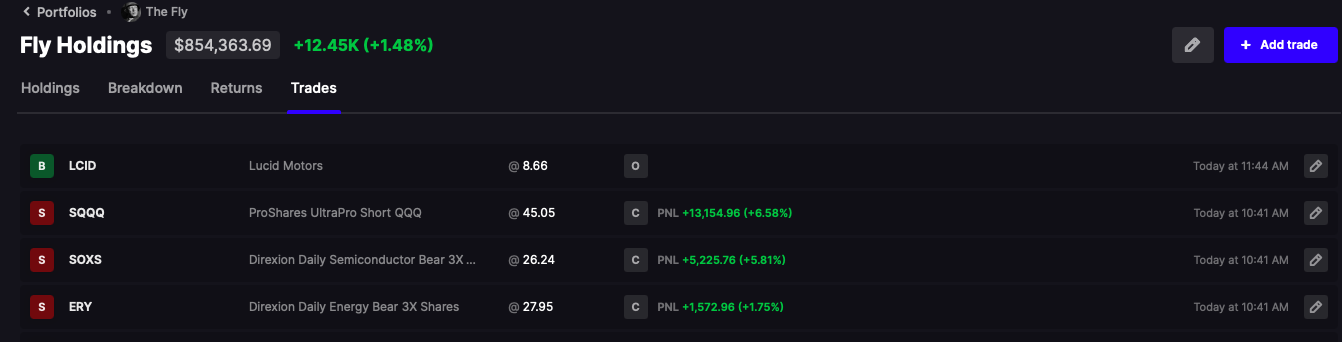

This win is important, +150bps, because most of you, the reader class, have been hung by the neck for dead. The entire market was blown out this morning and a great many of you got chased out and chased into inverse ETFs. I will pass this piece of advice down to you, since I believe it has relived me a great deal since late 2022.

GET IN 100% LONG and trade around it.

Easy and simple — but it isn’t if you aren’t following a religion as I am.

The weekly quant in Stocklabs selects my longs each Monday and I do not touch them until the next Monday — NO MATTER WHAT. They are static positions, a reality of life, and I just have to deal with them. This permits me to focus on day trades and overnight hedges: my wheelhouse.

Now some of you might say “but Fly, what about picking stocks?”

WHAT ABOUT IT? The fucking Quant returned 7% last year in monthly holds in a year when the market got blown the fuck out. It has proven to pick good stocks — because it’s simply looking at the best stocks fundamentally and technically. Whilst I might be able to do better, psychologically — this frees me to do other things.

Into the close, I am likely to add back hedges.

Comments »