You can search far and wide for a looming economic disaster in the US and you’d be hard pressed to find a potential flash point. For a while, earlier in the year, we were entreated to a wonderful regional banking collapse — fueled by ‘cash sorting’ — which is a modern bank run by motivated customers to place their dollars where they can receive the highest risk free rate of return. People left Schwab in droves in favor of T-Bills. This, potentially, is still a major concern and I have hopes that this black flower can blossom this fall and collapse the system.

But that aside, inflation is abating. Unemployment is low. Housing starts are in the tank — but this isn’t causing a housing collapse — indicated by the very low delinquency rates. Consumer confidence is milquetoast, in the 70s, on par with an indifferent Pax Americana. National and private debt are fucking soaring to RECOURD HIGHS — but no one seems to care. No one cares because of the boy who cried wolf analogy. People have heard these tales before, about how this debt was going to blow up the banking sector — but alas we are still here sending Ukraine $24b per month.

So what can change this scenario?

The answer is simple: kill the stock market.

Everything about this house of cards is predicated on confidence. This confidence, like in all ponzis, is reliant upon status quo and the positive wealth status of those participating in the scheme. Bernie Maddoff (RIP) would never have gotten caught if not for the wonderful collapse of 2008.

Over the past 2 weeks, aka a fortnight for you British homosexuals, stocks have started to reel. Names like NVDA, ABNB, SHOP, PYPL, PANW, VALE, and 988 others are down more than 10% aka “a correction”.

Other names have underwent a much more severe pullback.

GNRC -27%, SEDG -27%, ZI -25%, IEP -24%, SMCI -23%, FTNT -22%.

I know exactly what you’re thinking. “Who gives a fuck about those bench warmers?” Get those B-listers the fuck out of my face!”

When is the real collapse gonna happen?

Two week returns for America’s best:

AAPL -9%, MSFT -3%, GOOGL +0.14%, AMZN +4.7%, NVDA -11%, BRK +2.6%, META -3%, TSLA -5%, JPM -1%

Clearly if you’re super bearish and betting heavily for downside pin action — you are mentally addled. The fucking VIX is less than 15, oil is soaring, and the leadership stocks are yawning at this minor pullback.

HOWEVER, there is still hope for you ursine piece of shits. September literally looms and before you know it — Junior at the trading turret is told to fuck off — as the real money managers come back from their cocaine fueled sojourns. Those fuckers are going to sell shit the fuck down, as is customary in almost every September — which is the worst month for stocks historically.

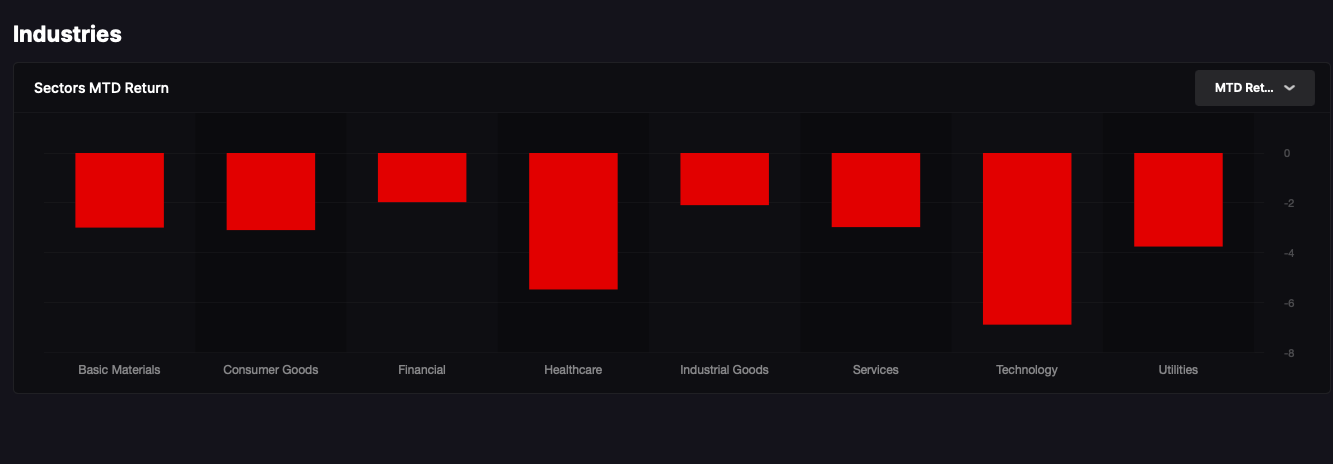

Data by Stocklabs

Bottom line: we are weakening, but the economic backdrop is stable. Let’s hope that the stock market can crack lower, which will then create a cascading effect that will rip through the economy and cause a terminal decline. If not, we can always buy stocks and make money off the scam.

Comments »