Just yesterday I was fooled into believing Pax Americana was back, if only for 1 more day. I had plummed visions of fat people dancing in their trans-gendered costumes celebrating their stocked market gains via popping rainbow colored corks right into each others cocks. There would be fun an excess for all — drugs and free items from Target and CVS — and we’d all generally ENJOY ourselves at the expense of others.

But today’s tape has reminded me of the evils that lurk not too far under the surface. It is a sober reminder to never relax and never succumb to the alluring nature of free items from CVS.

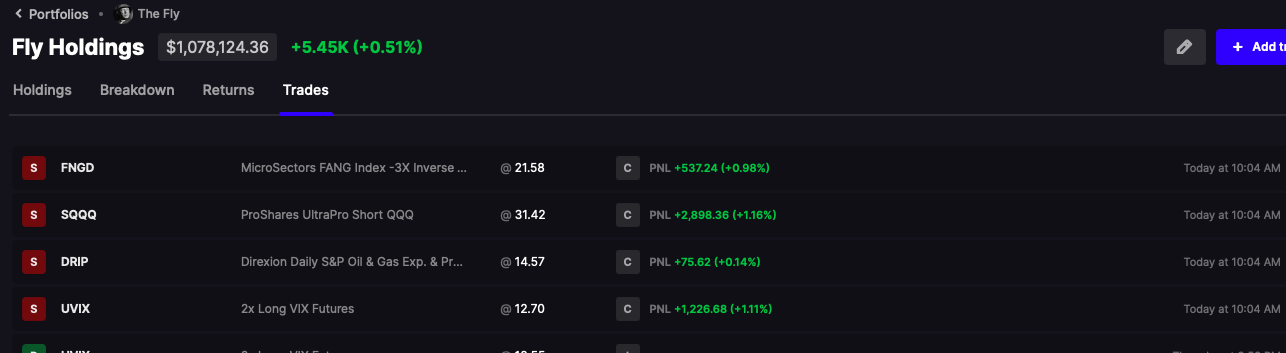

I have been trading well today, but still find myself down 1.75% in a long only book. My hedges have been intermittent and I wished I had done them yesterday — but I didn’t.

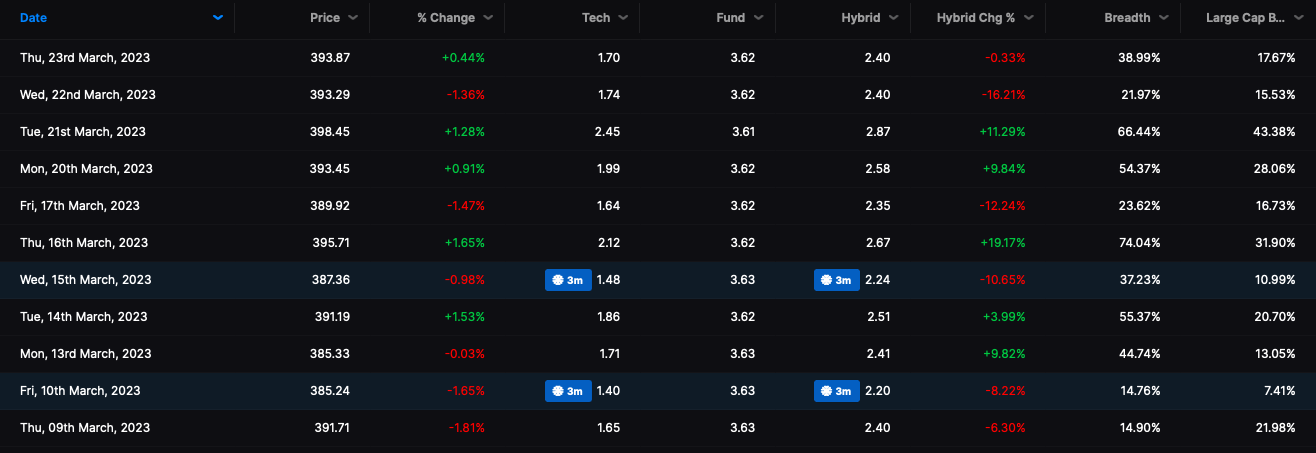

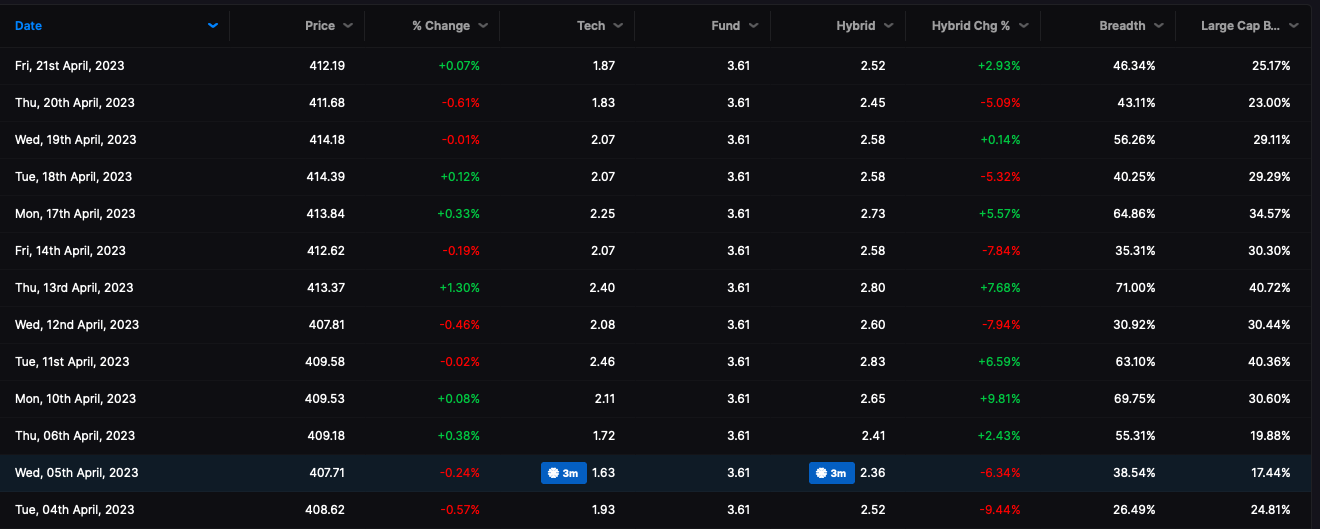

Today we have KNIFE TO FACE action in FRC, PACW, TENB, CVNA, UPS, ZS, NTES, CRWD, ADM — the whole fucking kit and caboodle has gone wayward and overboard. We are in the midst of a rout and the Stocklabs mean reversion algorithms are not oversold.

Let me clarify, we are OS on the 3mos, but not on the 6 or 12 — and with breadth at 25% and 11% of large capped stocks rated strongly inside the platform — it would BEHOOVE me to not tell you we probably have lower prices to achieve.

How can I get away with saying that — when just yesterday I declared on this very blog I was bullish? Well, I just did. Who will stop me?

I just closed out my TZA hedge and will try to give the market a chance to rally from now until 3pm — but I am likely to heavily hedge into the close — given this catastrophe unfolding.

Comments »