It goes without saying, the new rich aka arriviste are more despised than any class of person in America, specifically because to have money and not be “high born” is more or less an anathema to those with winning genetic lottery tickets. You have to understand the psychology and try to empathize with their plight.

These people always had an abundance of things, sent to the best schools, provided the best advice by well meaning and educated parents. They were bred to lead and succeed, and rightly so. Their parents have provided them with love and care and a high IQ, and never once had they played “Step on the Waterbug” inside the sewers of Brooklyn as small boys.

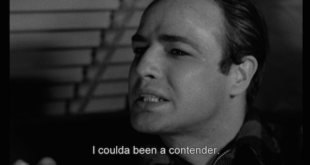

So when they see you, a low born pleb, exceeds their levels of success and dominate a field they could only dream of — a natural hatred develops and they want to dislodge you in whatever way possible. In a sense, this is humanity 101 and this game between classes has played out for thousands of years.

In the past your name determined who you were by the prestige it possessed — established by your forefathers by military rank or business wealth. Today, thankfully, the playing field is a little flatter and if you work really hard and smart — you too can live your best life. With discipline and avoidance of vice, any many in America today, regardless of your color, can achieve greatness.

Three things destroy men.

1. Bad women

2. Booze

3. Greed

Booze and drugs are the hardest one’s since it’s part of the American culture to indulge and when things go badly — lots of men turn to booze to satiate their angst. Speaking from the heart here, I can tell you that I’ve often become depressed and “walked the black dog” — but made it a point to never dull those senses with the assistance of alcohol or drugs — because they’re crutches and before you know it you won’t be able to walk without them.

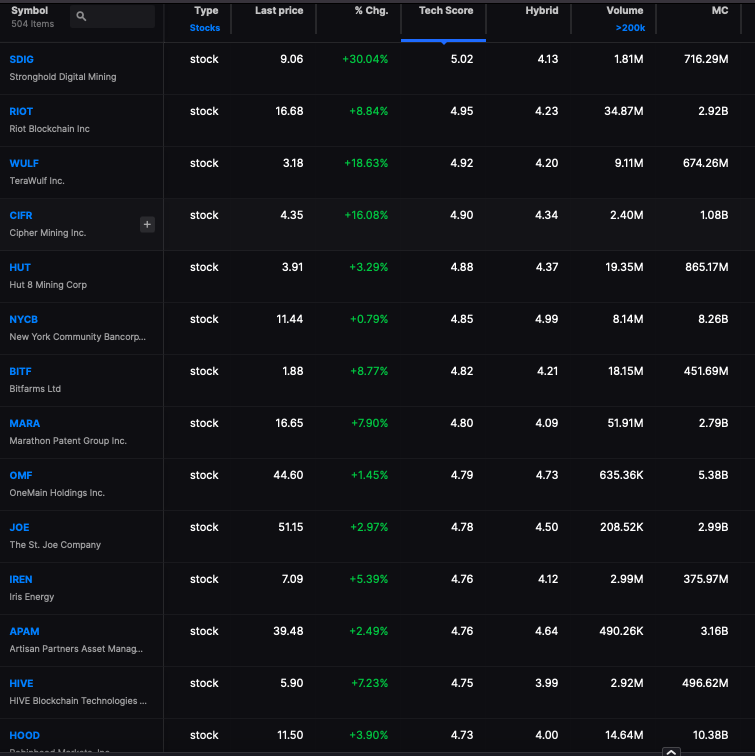

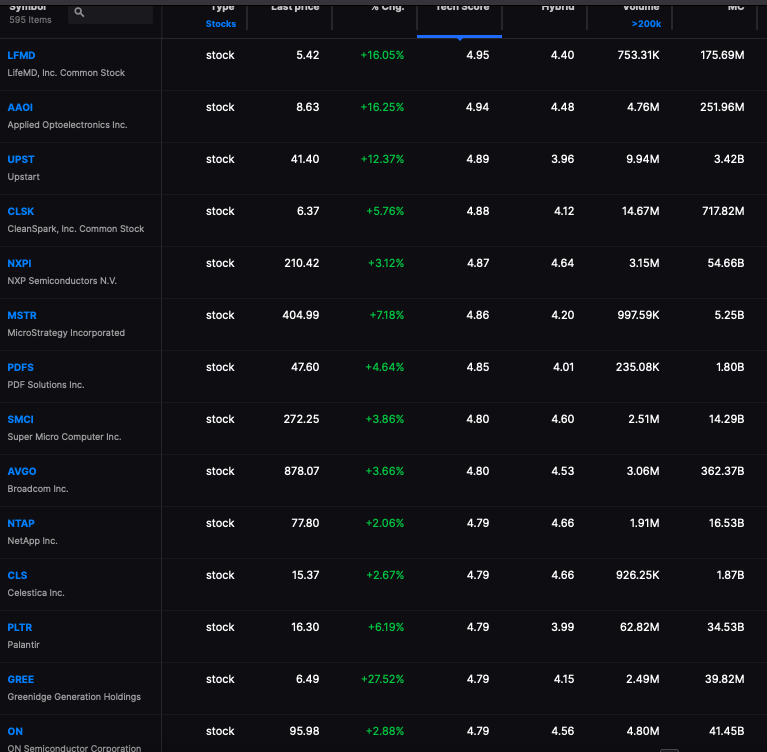

My market advice isn’t needed today. You know where stocks are going.

Comments »