My advantage over most people trading is my passion for stocks. On my own time, I study it and really enjoy trading. If I had no money at all, I’d still follow it and pick ideas that could make me money. I do not trade out of necessity and would do it for free.

I built the tools for Stocklabs, not to profit by luring people into the service — but to help me trade better. The tools are custom designed for me and hopefully people who use them can find how it can help them.

What is my trading ethos?

Only accept what you see and do not pretend there is a conspiracy afoot and fall into traps. This is especially important for someone like me, as I am naturally inclined to hate governments and believe in all types of bullshit. In my natural state I would always short stocks. But there is also a side of me who truly loves humanity and the innovation from which it produces great and wonderful things. The proper mindset is to never relax and always be on the lookout for COLLAPSE — but to chase innovation, momentum, and be a good sport about losses.

I like to say “it’s over for me” when losing — because it helps motivate me to prove that statement wrong. If I do not have an enemy to fight, I make up some — sometimes I am my own enemy.

The single most important thing to accept when trading is the losses aren’t personal. The stock didn’t drop because you bought it. You are not a fading factor. If it feeeeels that way, you’re simply out of sync and need to change it up.

How?

This is the easiest thing to do. Buy stocks near or at 52 week highs and expand upon that by buying stocks within 1% of session highs, with strong technicals. After you’ve enjoyed some success — keep it by taking profits quickly and hedging with inverse ETFs if and when markets begin to look sour. If markets move higher and the thesis for your hedge is negated, close them out.

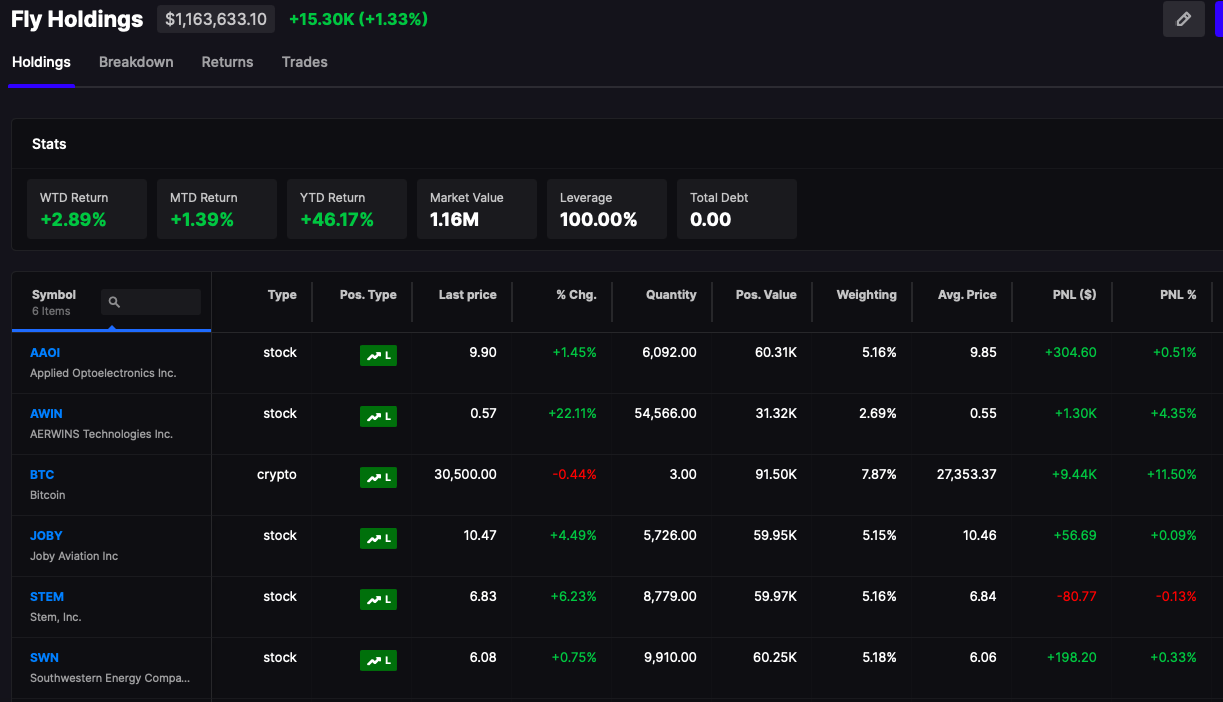

You have to hold yourself accountable and never fall into dreams of becoming rich fast. To dream is folly and this train of thought will cause you to make errors. Position sizes should be no bigger than 5% and losses should never exceed 10%. Most of my losses are 1-4% — because I prefer to day trade and use volatility to my advantage — scalping dozens of 1-4% gains to the upside in a never-ending gambit to achieve high returns by being right more often than being wrong.

If you enjoy the content at iBankCoin, please follow us on Twitter

Love this.

Don’t be a dreamer when it comes to the stock market.

Dreams without goals are just dreams, and will ultimately fuel disappointment. Between goals and achievement are Discipline and Consistency.

This mothod DOES NOT WORK because you have to trade against a spread.

During extended hour trading the spread is huge and any limit order will not fill.

During regular hours the spread is narrower, but if your limit order fills

YOU WILL BE SORRY. The Market Makers know the entire book.

If you go with market orders you will regret ANY fills.

Did you ever think of making a video of one of your trading days. You could wear a mask or just edit your face out or change it to a badger.