They just don’t go down. American culture, as pervasively toxic as it is is mirrored and parroted by most western nations and looked up to by many eastern people. Our military preserves the status quo and although the leadership class are inflicting punitive measures on its people by importing their replacements and attempting to dumb down the median IQ — stocks simply do not care.

See when you only view things through the prism of money, which many people do, societal degradation is easy to ignore. Hey, I’m doing well who care about Joe Blow in Ohio. The doomsayers will point to all of the things I just said and believe “collapse is imminent.” This is plain narcissism talking. We can have up stocks and societal collapse at the same damn time. In order to realize a crisis point we’d need to see the strains in the financial and consumer sectors — and we have just not endured enough looting to make that a reality.

Delinquencies for student loans, autos, homes, and general consumption just aren’t at levels to cause worry over. On top of that, inflation has abated and growth seem just fine, unfortunately. I’d love nothing more than to provide you with bad news — but the only bad news I have for you is that there isn’t any.

Let’s review three things:

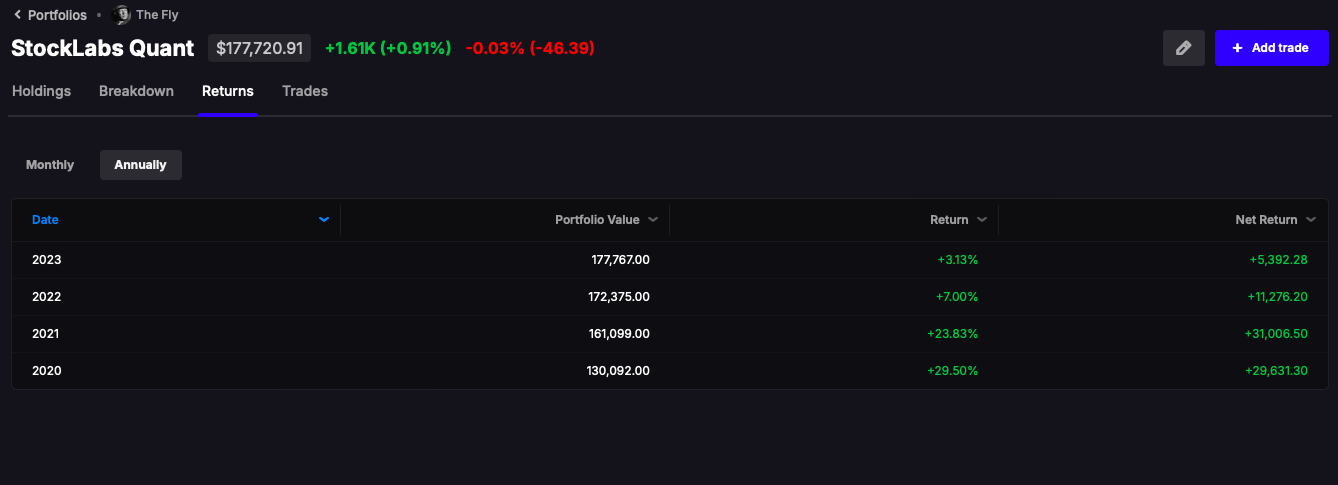

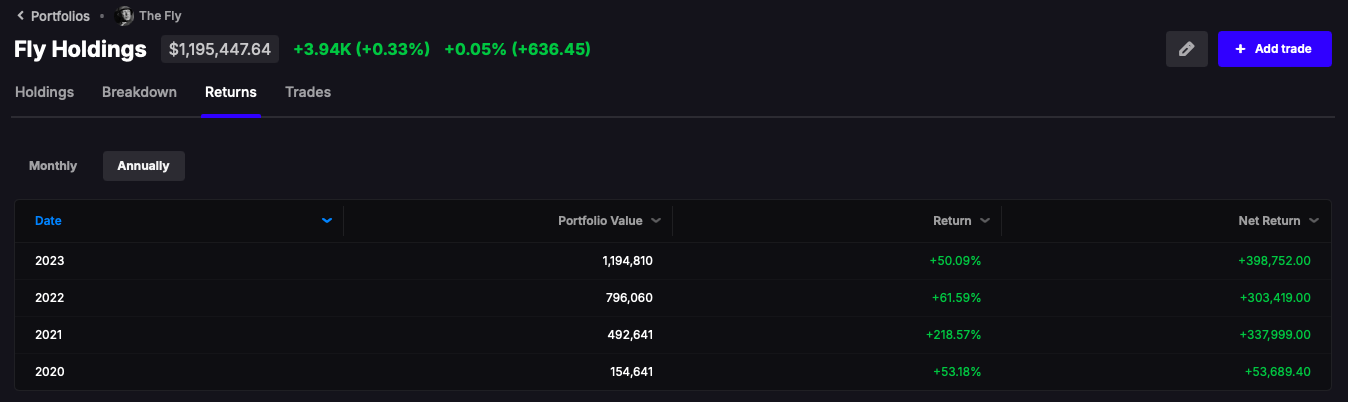

A look at small cap, large cap trends — and tech scores of the biggest companies per sector in Stocklabs (supporting Le Fly is joining not reading this for free you miserly piece of shits).

Small caps: good

Large Caps: excellent

Tech scores range from 1 (terrible) to 5 (flawless) with 3+ being good.

MEDIAN MARKET CAPS OVER $10B

BASIC MATERIALS: 3.01

CONSUMER GOODS: 2.43

FINANCIALS: 2.84

HEALTHCARE: 1.6

INDUSTRIALS: 2.4

SERVICES 2.24

TECH 2.58

UTES 3.04

A cursory look here would suggest defensive areas of the market are leading. But this isn’t exactly true today.

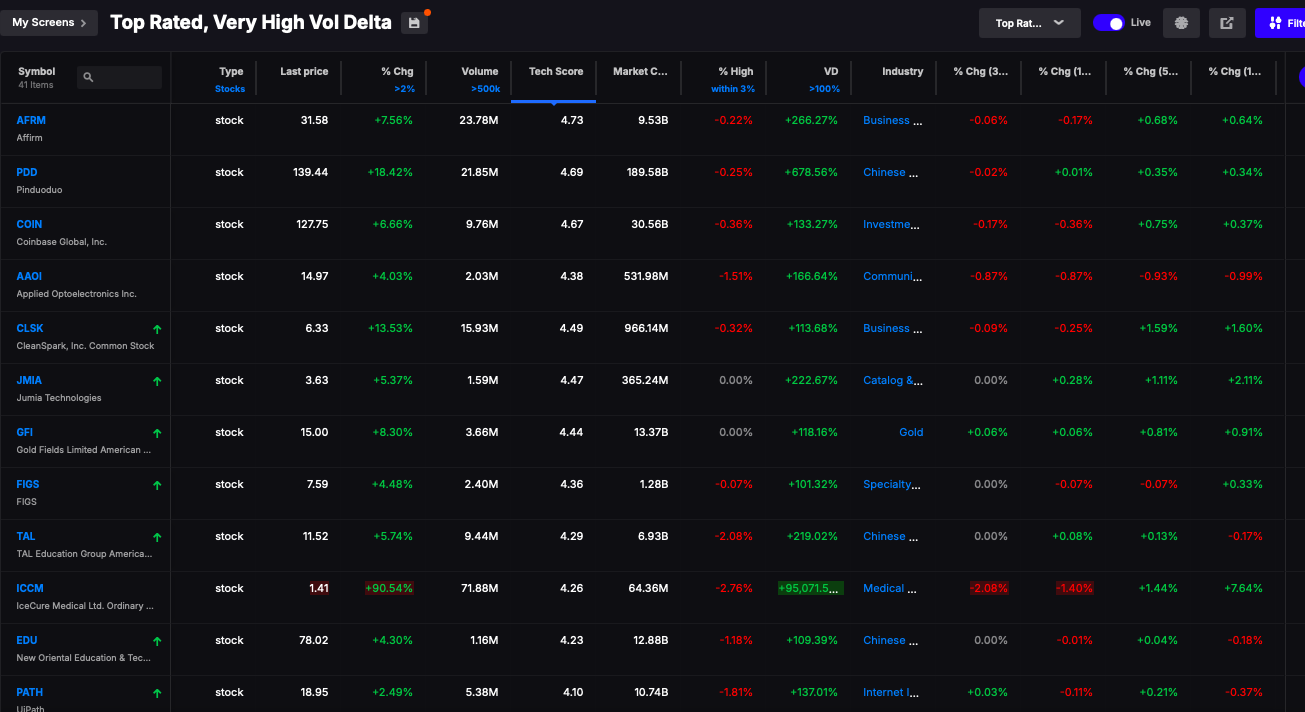

Here is our proprietary volume delta screen, which measures volume by the minute pro-rated over 30 days to highlight spikes.

It seems, and I could always be proven wrong, things are just about to heat up now and bust loose. Look at those risk on names.

Comments »