For many years since I created the mean reversion algos of The PPT, then Exodus and now Stocklabs, I search for ways to use the signals for short term trading. Most of the time the signals were accurate and one buy would suffice. But on occasion, there would be broken elevator trading action and the OS signals were laughed at by the market and dove lower through them.

But I think I have solved the issue in regards to position sizing and timing my buys — using the signals.

This is how I do it now.

Upon an OS signal, before market close I made a 33% allocation into either TQQQ or TNA. The holding period of this position is 5 trading days — win lose or draw. The holding period can be extended only if another OS signal appears, at which point I add another 33% and reset the holding period to another 5 days.

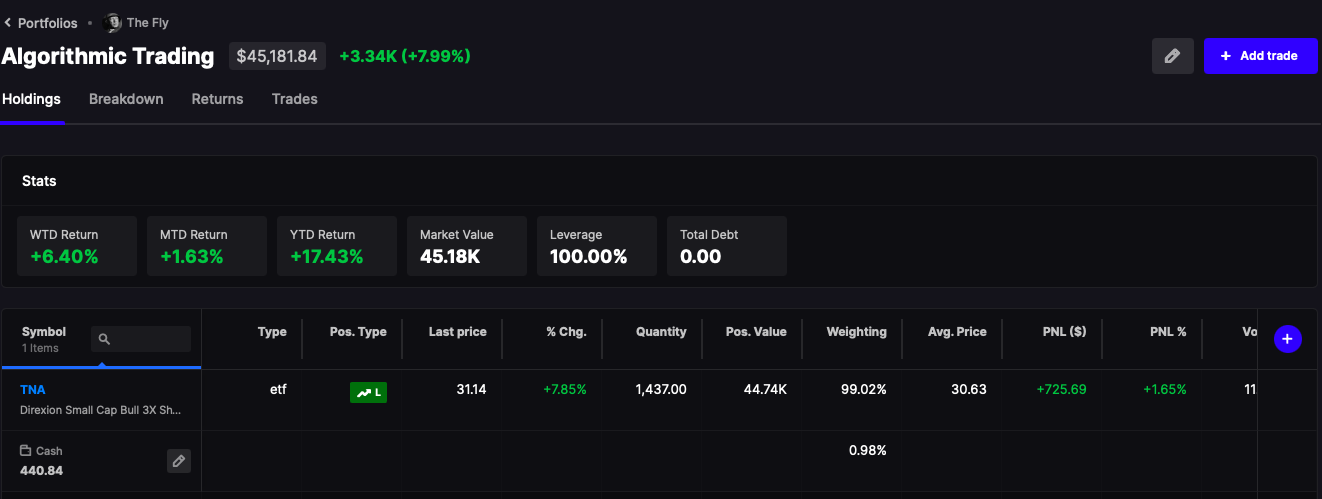

Presently I am 100% long TNA due to consecutive OS signals. This account has done maybe 7 trades all year, +18% at annual highs.

I am tempted to sell being up 8% for the session, but cannot. Rules are rules. This TNA position will remain in place until Monday.

Comments »