Early this morning rumors of President Xi being placed under house arrest made the tin foilers on Twitter go fucking nuts. Then we had rumors of war and Blinken meddling in Iranian affairs — providing “INTERNET ACCESS” for those who wish to overthrow the Iranian govt. It’s an endless stream of fuckery and on par with crisis.

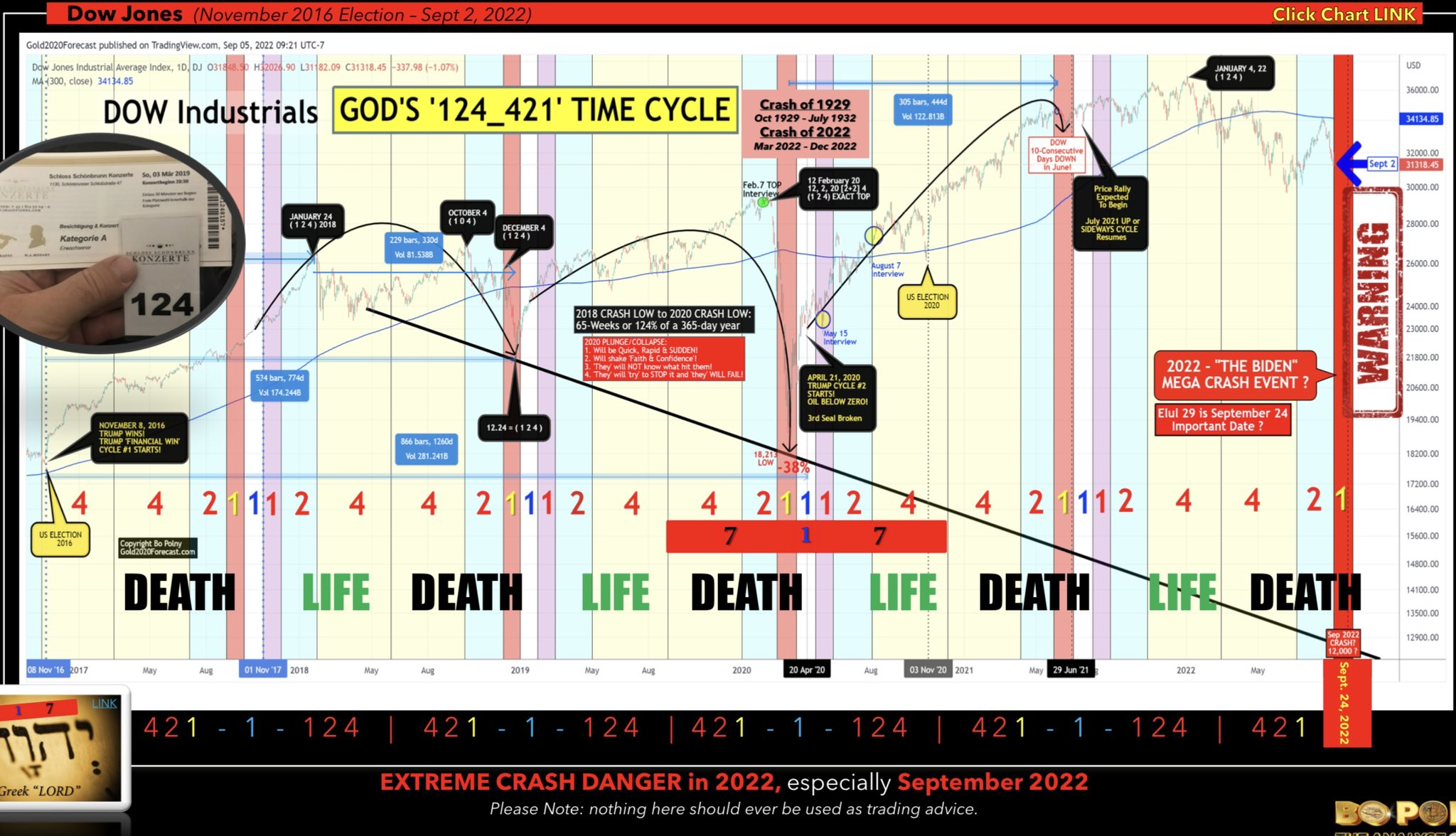

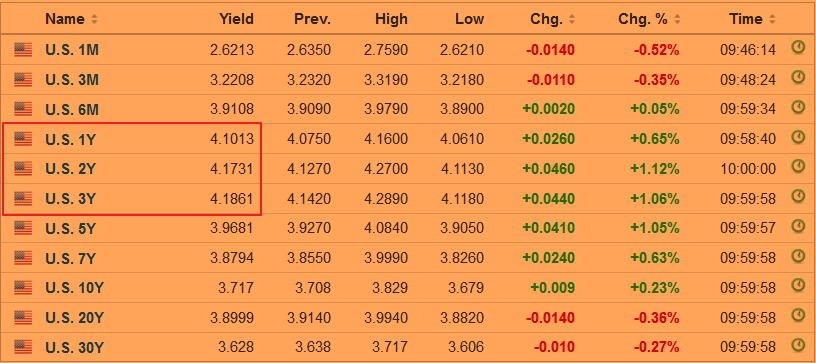

At the core of this current squall is DEMAND FOR DOLLARS, best seen in FX market crosses in Europe. The dollar is at 37 year highs against the pound and drilling the Euro on a daily basis. We also saw USD/CNY cross at 2015 crisis lows.

Let’s not forget SHMITA.

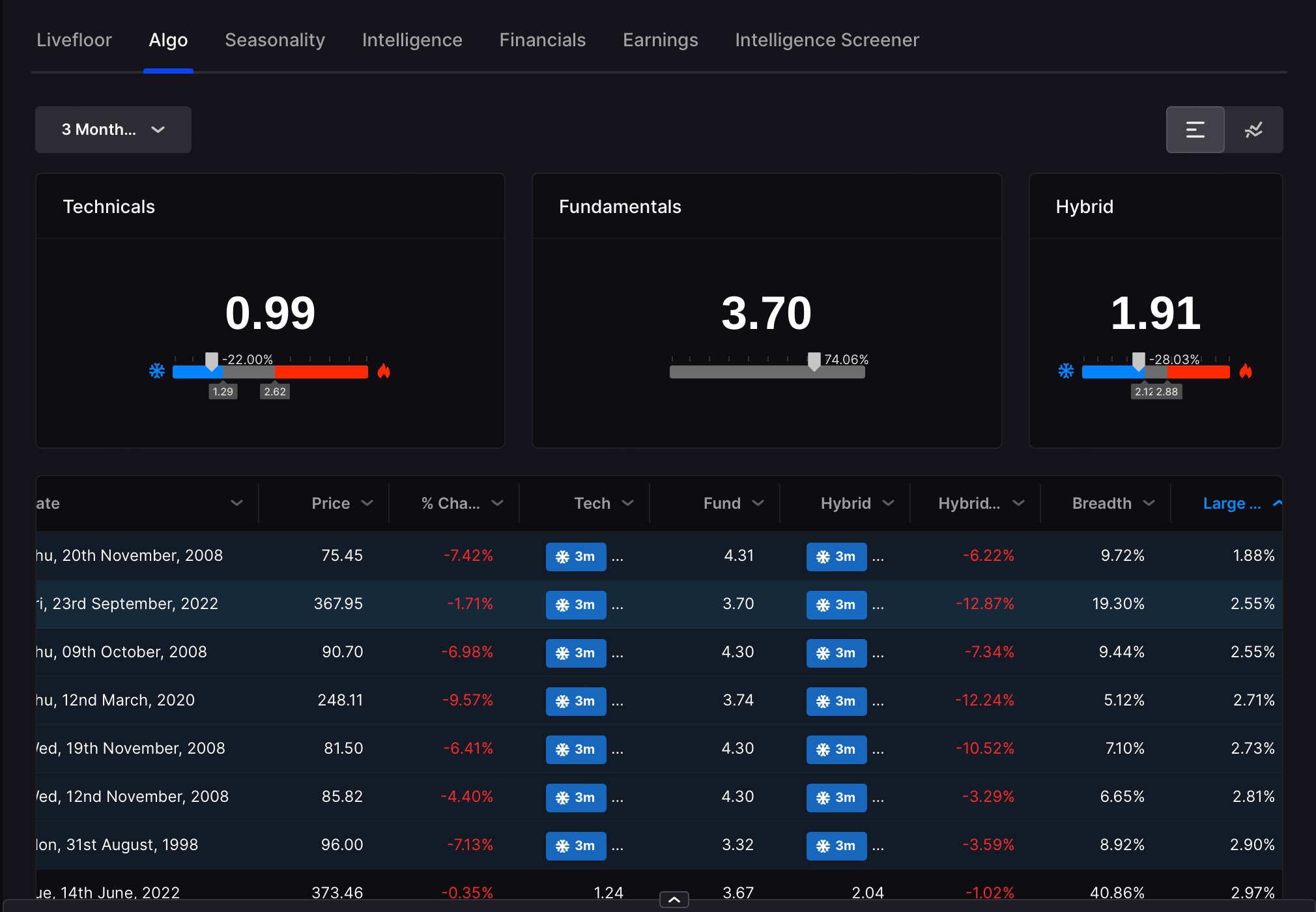

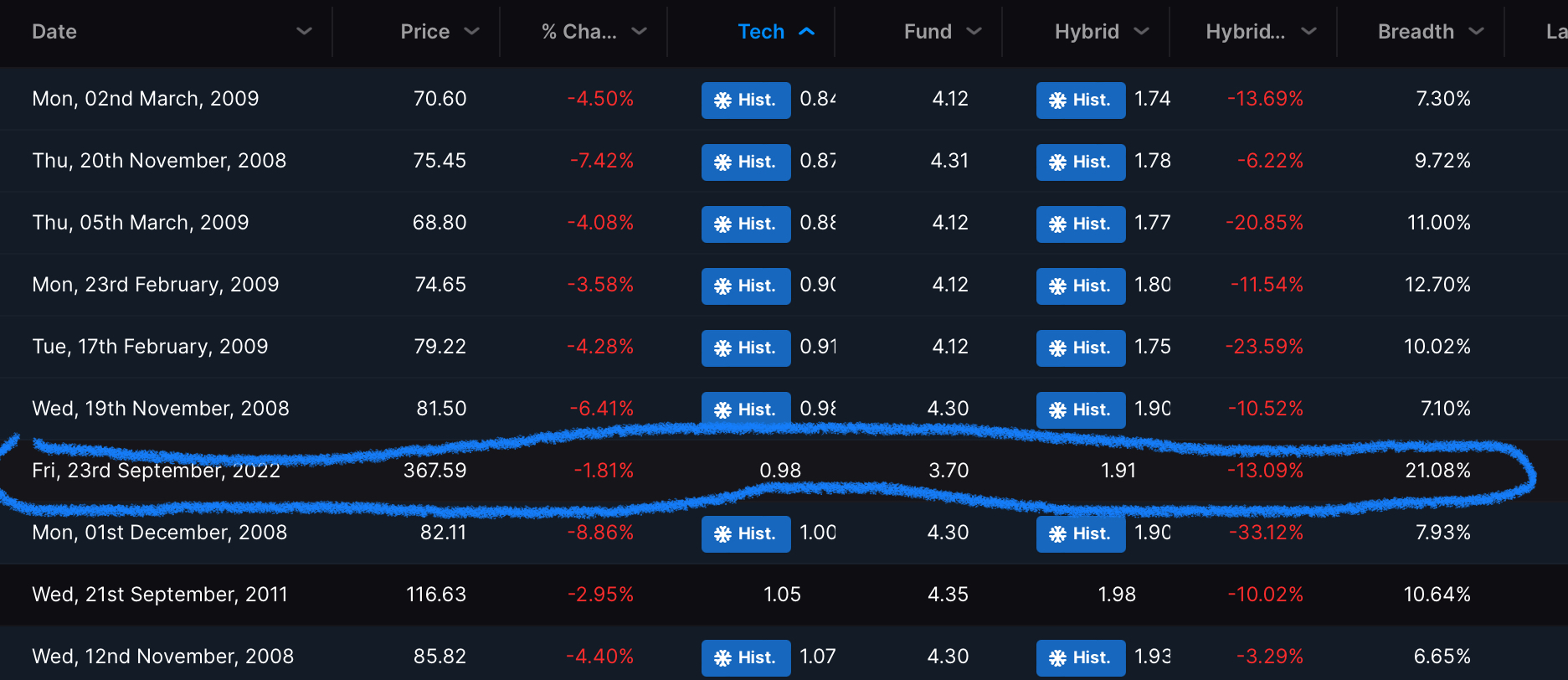

I had 65% cash into this absolute carnage and had been adding to just 3 stocks: TNA, BTU, DK. I got drilled to the tune of 2.8% today and I took a 10% UVIX position at the close, in order to prevent a truly horrible Monday crash opening. If God is great, American stocks will crater on Monday to the tune of 25%. Under the present conditions, the VIX will skyrocket and my losses will be manageable. I am most keenly interested in buying and drinking the blood of those letting out. At my core, I am a Vampire and hail from Transylvania when markets careen lower. It’s important to never panic and always keep composure. But most importantly, it’s imperative to NOT be fooled and go all in for some final battle as if this were a fucking movie.

LISTEN TO ME: PAX AMERICAN IS OVER. You will have plenty of time to SHORT THIS SHIT DOWN TO THE 2009 lows, 82% down from here. But before that happens, we’ll have a symphony of true believers, late empire shills, running out into the hills to pick strawberries for their villagers. On their way back with baskets of fruit and cream, their arms will be cut off.

The hills will bleed.

HAGW!

Comments »