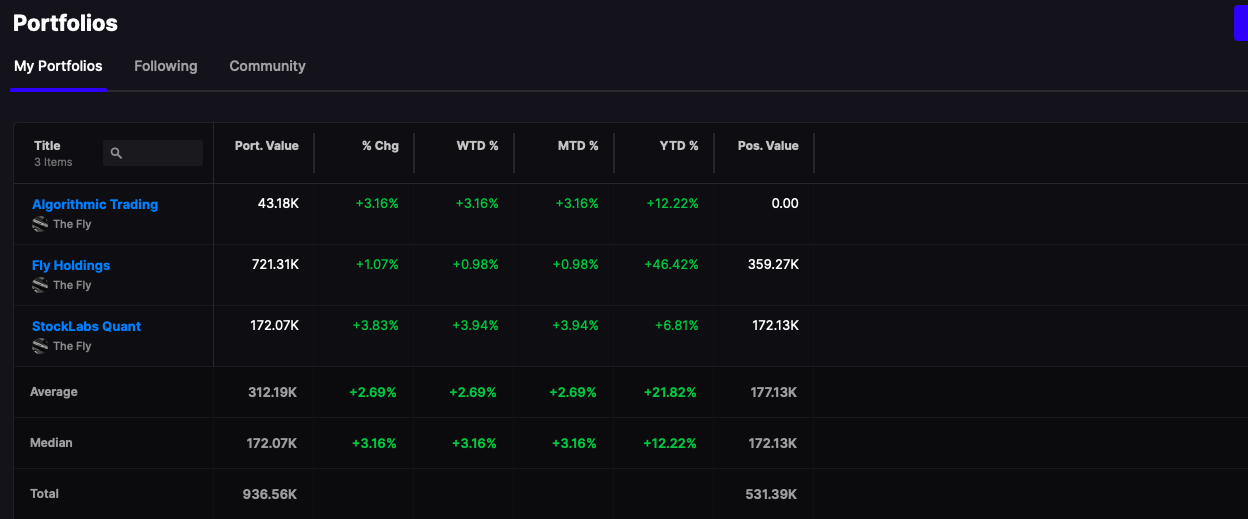

Once again fooled by The Devil. My damage isn’t too extensive, as I liquidated some of my longs at the opening tick and kept the UVIX. I’m off by 55bps and to be honest, I’d be better off in all cash rather than playing whack-a-mole with this piece of shit market.

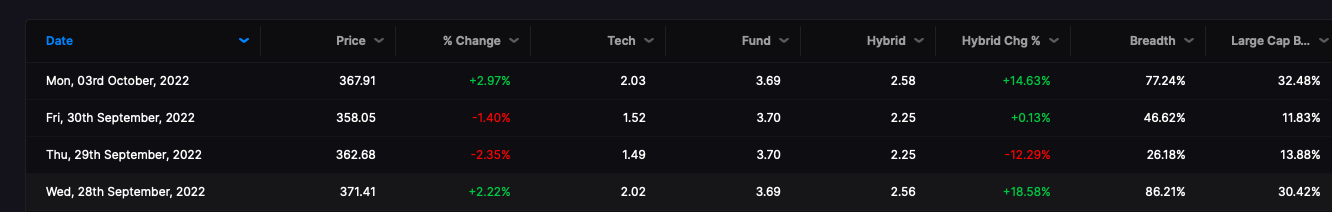

OPEC plus rapes the US and slashes by 2 mill barrels per day

The EURO sinks (good, I am short euros)

Oil ticks up slightly

We are back on inflation watch

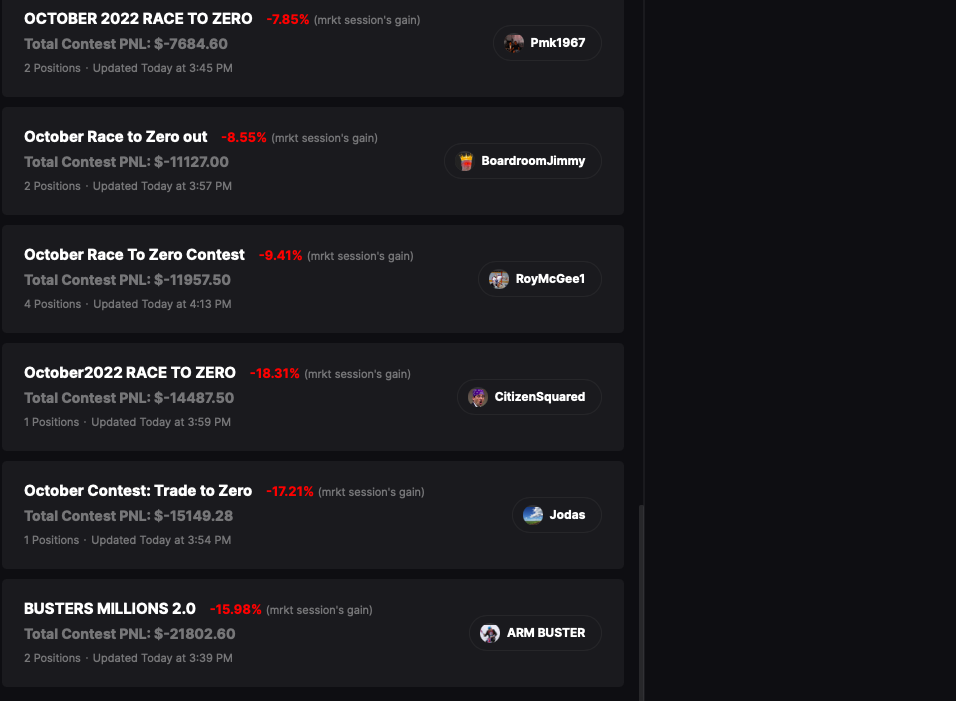

I added SQQQ to my hedges because according to the stock market rules book, we should MCPLUNGE today and tomorrow and for the rest of eternity, or until the inflation boogeyman is marginalized and we are accustomed to horrifying rates. Let’s remember back in 73-74 when the US has terrible inflation, markets rebounded after 74 and eventually we got used to never being able to afford a mortgage.

I suspect we are not there yet, which is why I’ve always felt the COVID lows was a nice comfy place to start.

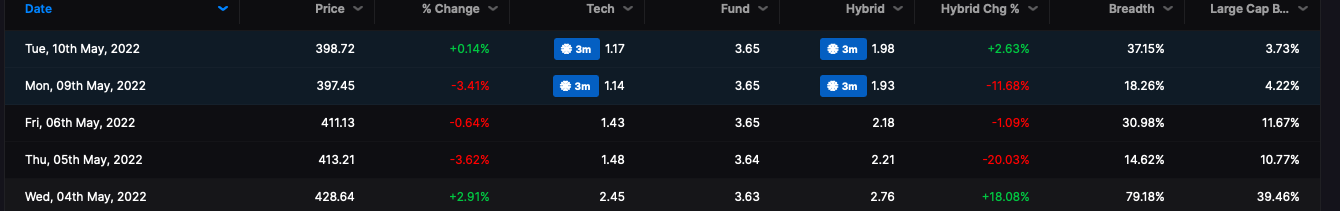

Bottom line: in yesterday’s blog I predicted markets would rise and if they did not we would buy the dip. That will not happen if the euro is getting hammered and US rates are heading up. Who knows? The day is young and breadth is 45%. But for now, I’m cautious.

Comments »