I told you to prepare yourselves for this eventuality. We were NARROWING and WEAKENING over the past week — yet you did nothing.

I will now proceed to boast, which doesn’t serve you any good other than perhaps a sentence or two which might remotely amuse you.

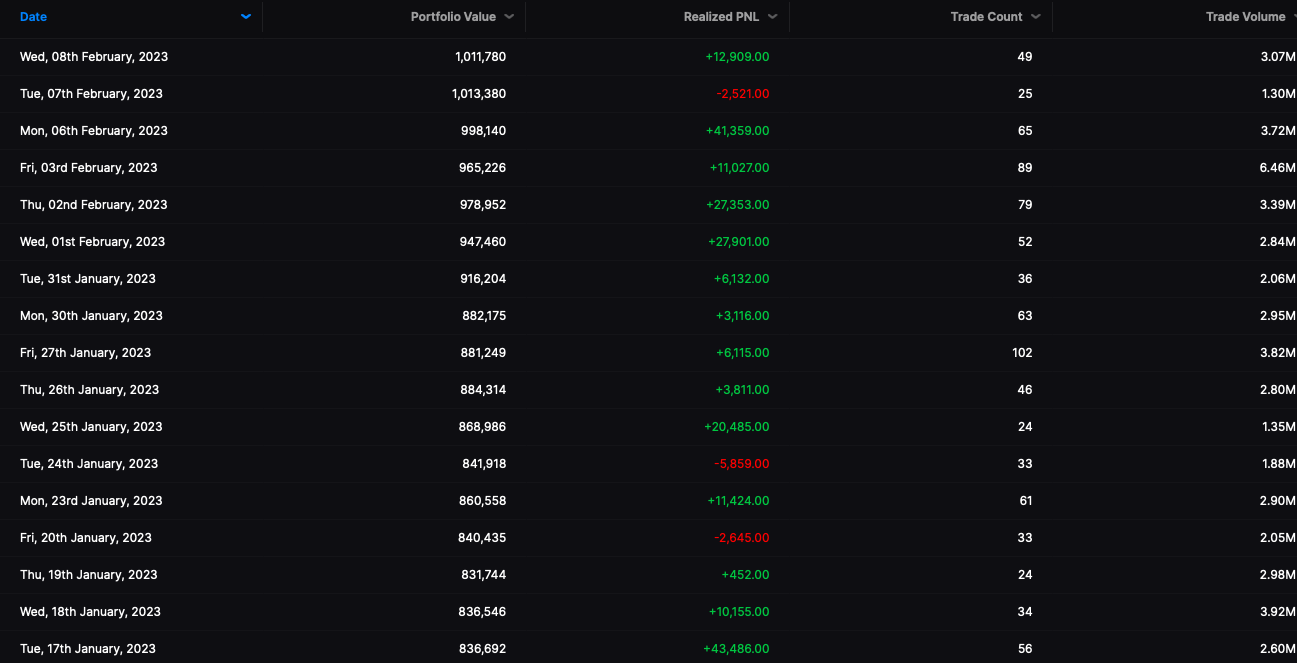

I started the session +230bps because I was King. I then weakened and before I went to walk the fucking dogs — I errantly closed out my 4x SQQQ position when I was +80bps. Upon returning, I had weakened again to +10bps as the market dragged lower amidst a flurry of sell tickets.

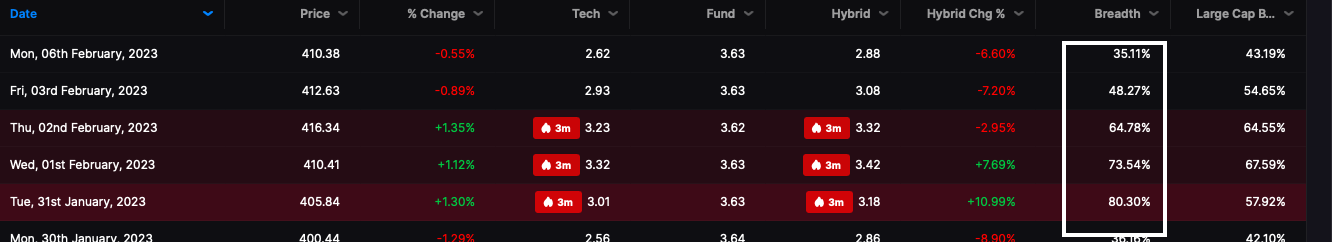

I viewed the drop as part and parcel of what had been occurring — weakening breadth and pervasive strength in the worst stocks known to mankind.

I later took an 8x position in TZA — because I felt the Russell had no muscle — and was richly rewarded for it.

I then took a floater in LTRY and it jacked higher into the close — placing me +80bps for the session with a 143% leveraged book — 40% short via TZA.

This is where you might gain insight.

We are on the cusp of decisive action, and it looks to be lower. Markets have enjoyed a rather handsome start, led higher by the biggest steaming pile of shits for 2022. This is not a sustainable breakout and it won’t be long until we at least revert back to the mean and draw some serious consternation from the permanent bull class of investor who have been lavishing themselves with deals since late 2022.

Comments »