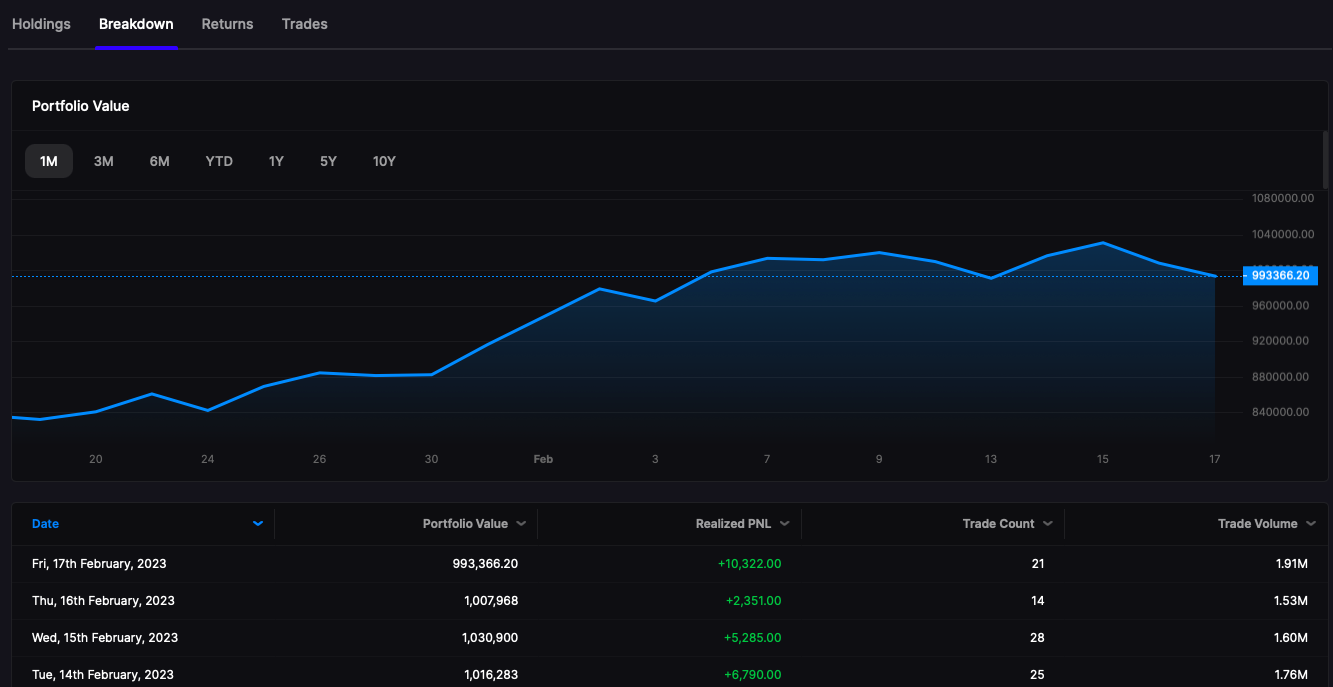

We jumped up at the open and soon collapsed under the gravity of technical deterioration. I measure this, as a matter of fact, inside Stocklabs. That’s right, I’m not just an odious visage — but also someone who keenly analyzes these things and likes to believe that I know more than everyone else — mostly due to an overwhelming desire to compensate for the charming life I lead in a most under-achieving manner.

There is no need to over think this. Markets are a bit weak, which doesn’t mean this is “the end” — but instead only means we are taking a little break. Is it possible we can crash? YES — but not likely.

The most likely path is the one we’re on. We had a nice run in January, but now it’s over. The market is all of a sudden skeptical, which means gains will be paired with losses and for the most part markets will CONSOLIDATE and wait for more clarity. This, in my opinion, is what creates an environment for frustration, the hemming and hawing — indecision at a time when traders just want to snort cocaine and create money out from thinned air.

BOTTON LINE: I have a fully long book paired with a 31% position in SQQQ, down 35bps for the session. My intent is to close out the SQQQ and hopefully get a little upside before I reopen it and pray for the worst.

Comments »