Listen to me. You were warned in advance of an impending rally from America’s biggest bear and did nothing about it. Now your losses are strewn across your portfolios as you listen to former hedge fund managers on acid for your top ideas. The past of maximum resistance is the path we’re on. The spring mud will soon harden under drought and the wheels of war will hasten, so you ought to be ready for breakouts.

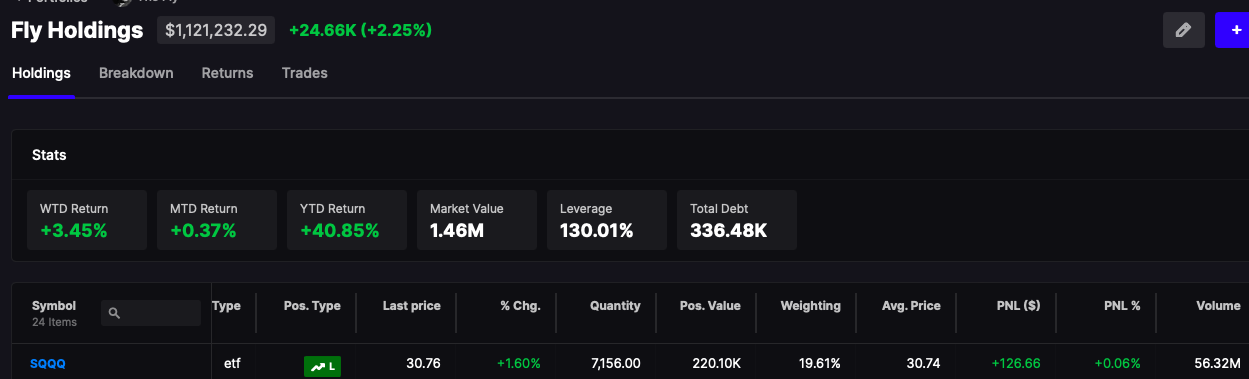

My gains amount to +225bps for the session and it would’ve been a lot more — had I actually traded from the open. Nevertheless, the indices might not be ripping higher — but the smaller capped high risk plays are indeud soaring and at the vanguard is BTC. To play this, I had some IREN at the open but have now moved onto others, such as WULF and SDIG. I have hedged my portfolio with a 20% SQQQ position to arb the divergence between oil stocks/higher risk and large cap tech. This week’s quant is heavily leaning towards oil stocks.

When you’re reading me and following me you’re also following a consummate professional — a man very capable of making money in any market at any time. It’s not very hard and if you’d only listen and shut the fuck up — you too can set aside your feeeeeeelings and trade well.

Comments »