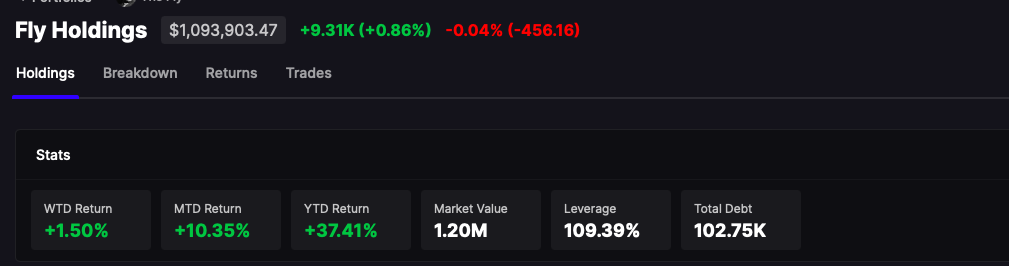

SCHW has been dealing with the ‘cash sorting’ issue for about a year. In layman’s terms, there has been on ongoing run on the Charles Schwab bank for a year, as clients transfer out of their weak money market accounts in exchange for treasuries. The simple fact of the matter is, banks cannot compete with the Fed and now need to figure out alternative methods to keep cash in house.

A downward spiraling stock market doesn’t help.

Today we are seeing -30% PIN ACTION in MCB. But that doesn’t matter. Nothing matters other than FRC, PACW and SCHW. Even if the FDIC guaranteed all assets, it would not change consumer behavior — which is to find higher yields for their money.

Because of this, the FOMC will need to LOWER RATES and soon. If not, all eyes on the likes of SCHW as they circle the drain to $00.00.

Fear mongering 101 demands that if SCHW opens down 5% tomorrow, on a Friday, people will panic the fuck out of stocks — out of systemic risk fears. On the matter of systemic risk, we are seeing how people behave during a mini crisis — barreling headlong into BTC and GLD. I’d advise you to take measures to build both or at least one into your asset allocation models.

Comments »