**NASDAQ FUTS UP 35**

Higher

Beer stocks are burping higher, after Imbev’s alcoholic induced decision to bid $104 billion for SAB Miller. Naturally, SAB rejected the offer, likely due to not fully understanding what was going on–thanks to alcohol intoxication.

STZ +1% Gold stocks the fuck higher, as well as oil, off weaker dollars and higher commodities. MS +1% on an upgrade, JNPR up on takeover rumors

Chinese related names are higher, including WYNN–because Steve Wynn, for all intents and purposes, is as Chinese as they come.

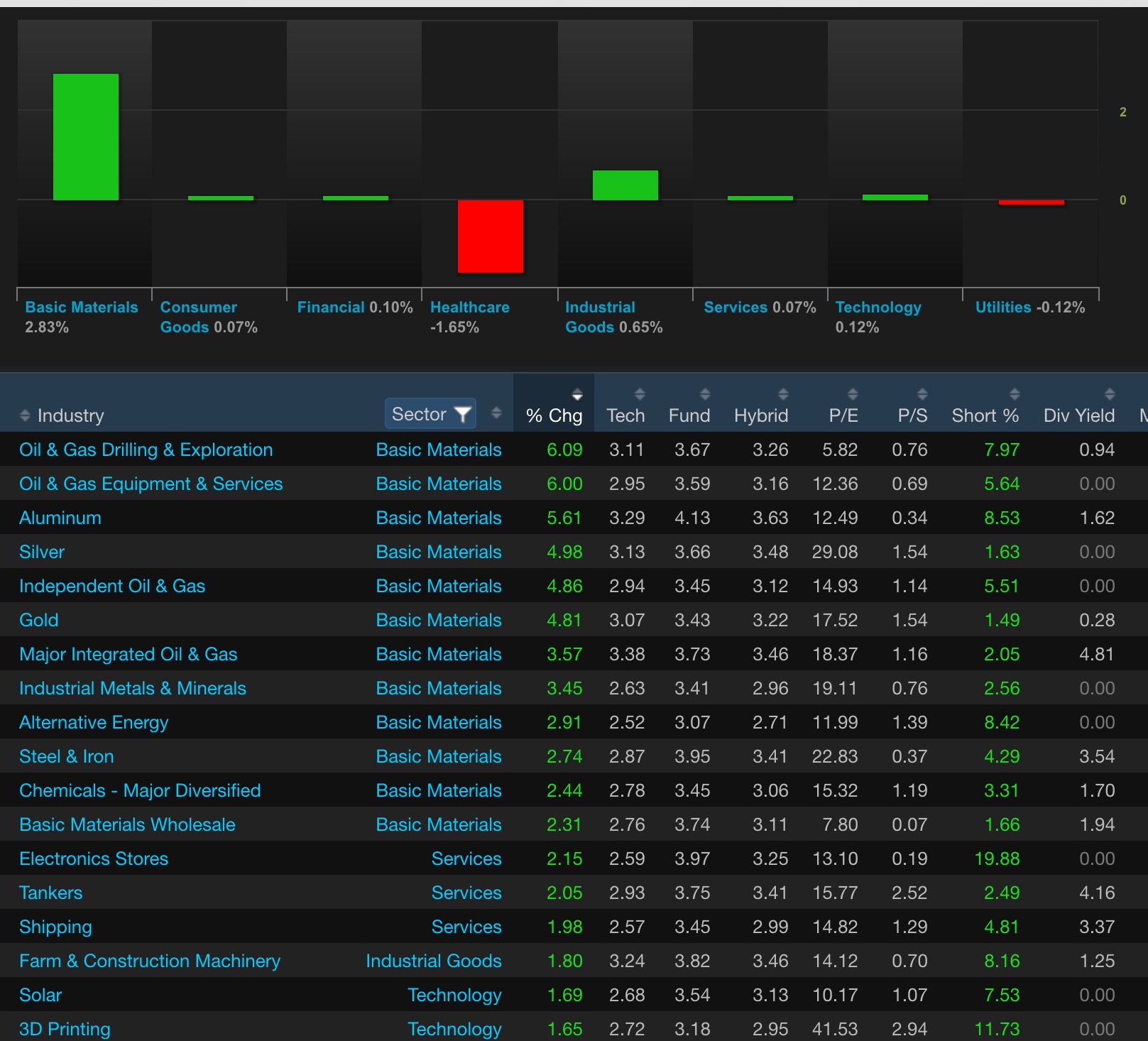

Here are those metals popping higher again: MT +8.6%, HMY +5.4%, BBL +4.2%, BHP +3.8%, FCX +3.3%, AU +3.1%, VALE +3.1%, GOLD +2.9%, X +2.8%, AKS +2.5%, AA +1.9%, RIO higher by 9.5% on supreme shit talking by an analyst.

And here are them black gold stocks: Select oil/gas related names showing strength: SDRL +5.9%, SD +4.8%, SSL +4.3%, BP +4.1%, DNR +3.9%, PBR +3.7%, TOT +3.5%, RIG +2.8%, RDS.A +2.7%, NE +2.5%, CHK +1.9%, COP +1.5%

TWTR the fuck higher by 1.5% on Prince Alwaleed stake claim.

Lower

YUM -15% because their food is 100% shit and China is keen to them, NUS -15% continuing a rich history of sucking and destroying shareholders in their ponzi, MON -4% after embarassing themselves with the biggest earnings miss since reinsurance company Pompeii Limited went bankrupt following the city getting swallowed whole by a fucking volcano,

TSLA -2% on another analyst downgrade. They do this every day, as a routine. Wake up, drink coffee, downgrade TSLA.

NEON -16% because God hates them, RPM, PAH and ADBE all lower; fucked.

Pharma weak again because it’s not about them anymore: AZN, TEVA, SNY, SHPG all lower.

AXPW -55% in clowns coming out from small car, laugh out loud, fashion. They played themselves. ADXS -20%: fucked, CTRV -14%; bad offering, fucked, SUNE -3%; out to kill Einhorn, MCD -1.4%; yuck, GPRO -2.3% on a timely Morgan Stanley downgrade, JCP -2% on a Citi initiation of “holy shit how is this still around Sell.” Talk about if you don’t have anything good to say…

Comments »