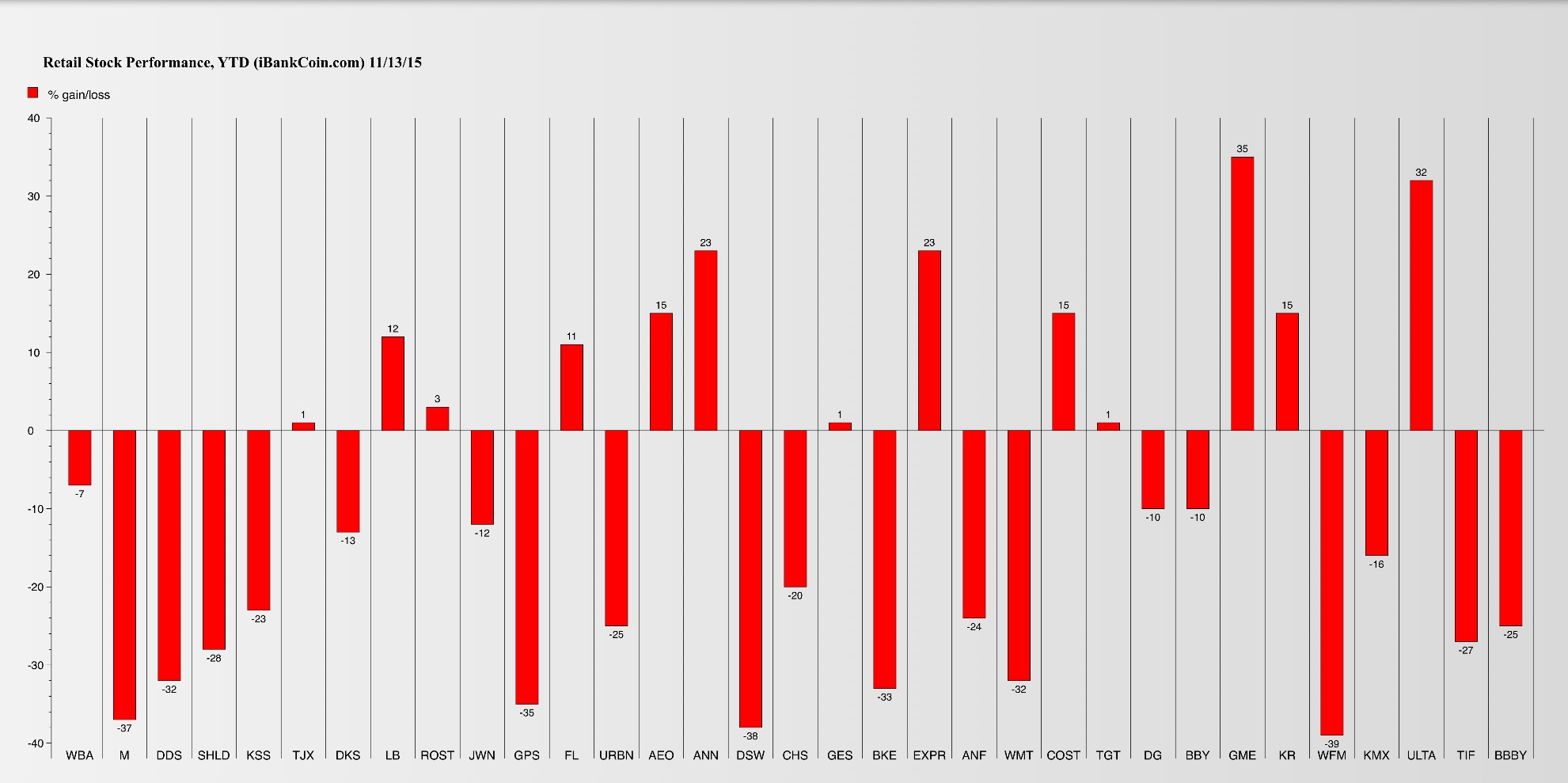

The market got absolutely poleaxed this weak, led lower by crude and retail stocks. There is a very tangible concern about this holiday season, after seeing numbers out of Macy’s and Nordstrom. Home furnishing stores also took to the bottle, with big ass losses in BBBY, KIRK and PIR.

Both GME and HGG led electronic stores lower. And there were about a dozen or so retail stores with shares down in the double digits.

Oil and gas was a sideshow, but also lower–as crude threatens to trade with a 3 handle. It’s clear to me, as well as many others, that the Fed is causing a problem with markets. Their incessant obsession to begin a series of rate hikes has people running away from anything that isn’t MSFT and FB.

The only sector, out of 200+ inside Exodus, that was higher this week was brewers–because people are getting drunk as fuck.

Europe is being invaded by zombie hordes of savage middle easterners. America is overrun with bad burritos from CMG. And Asia is a giant spiraling toilet bowl waiting to be flushed.

These are hardly times for us to be celebrating the revival of American exceptionalism, something the Fed seems to be doing.

For the week, I shed an enormous amount of gains. Every down day was worse than the previous one. The Option Addict has been seeing the market with clear eyes and is giving a 5 day mini boot camp to rehash recent events and provide the content that was given during the iBC conference. For those of you who were unable to make it out to NYC this year, make sure you sign up for our online version, which begins next week.

My only point of hope for today is in my PAH position, one that has been sold and sold again, like a fucking whore in the south of Bronx. It looks like Bill Ackman caught his footing in VRX today. As such, his other positions are responding in kind.

Is that where we are now in this market, watching, tick by tick, the stocks of billionaire hedge fund managers to determine whether or not they will make it?

Comments »