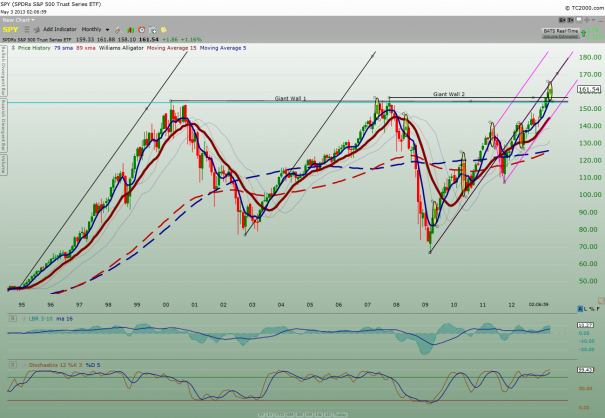

Take a look at the monthly $SPY chart below:

Did you see the three red May bars going back? There was a green May bar four years ago. Are we due for a green May in 2013?

In the same token, after three red in a roll, what is the odd of black appearing in the next roulette spin?

Some say there is no statistical significance for the black to come out next since the roulette wheel doesn’t have memory. How ’bout if I flip a coin with three heads in a roll? Will a tail comes out next?

Let’s try another example. What if I rig the roulette wheel so that if I press a button, it tilts the wheel to increase the odd of black appearing more frequently? Isn’t that how the wild west riverboat gambling casino of the past cheated you out of your money?

How’ bout if I bend the coin in a way such that if I flip the coin certain way, it will most likely end up with head on the back of my hand?

Following the same analogy, I believe the market for 2013 is rigged to have a bullish May.

Don’t believe me?

Pay a little close attention to the past bullish May bars, did you see how each of those bullish May bar reflected a significant higher high from the previous April bar? Now, take a look at the past three red bearish May bars (2010, 2011, and 2012), did you see that two of those red bars (2010 and 2012) had a lower high and a lower low? The lower high is the key point here. 2011 was a mixed bar since it had an insignificant higher high but close lower than April to form a red bar.

Giving the logical patterns from the past bullish and bearish May bars, my conclusion is that the current May of 2013 has a high probability of being a bullish May bar simply because we have a higher high established today.

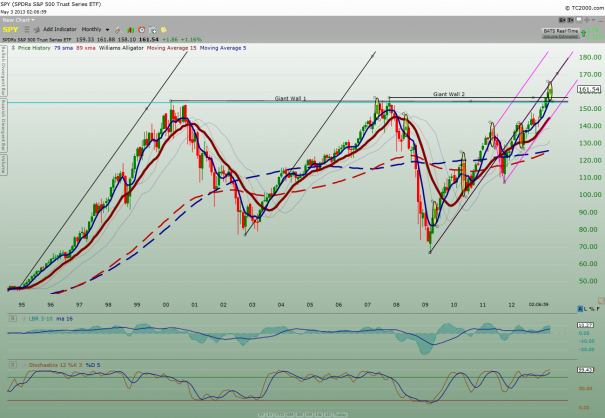

Take a look at the monthly $SPY chart below again.

Did you see that the current May bar is right above the highs of the past two bull trends? May I remind you that that the current bull trend has a steeper angle than the other two uptrends?

What does it mean?

Like Mr. Partridge always say, “we are in a bull market…”; only this time, the bull market is on steroid.

My 2 cents.

Comments »