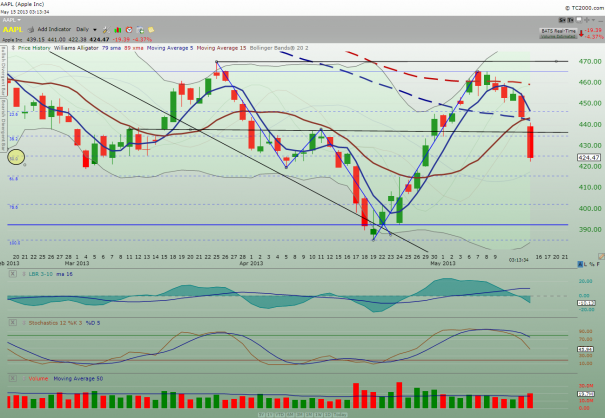

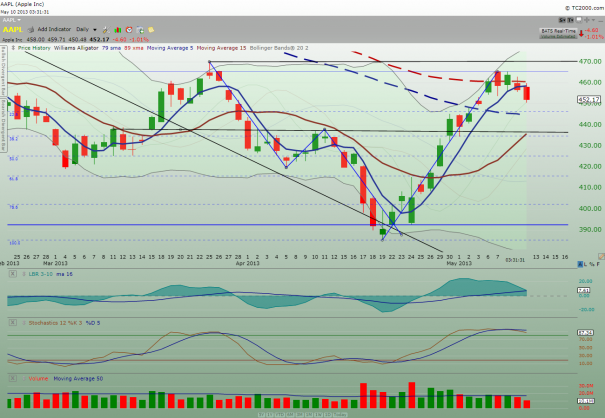

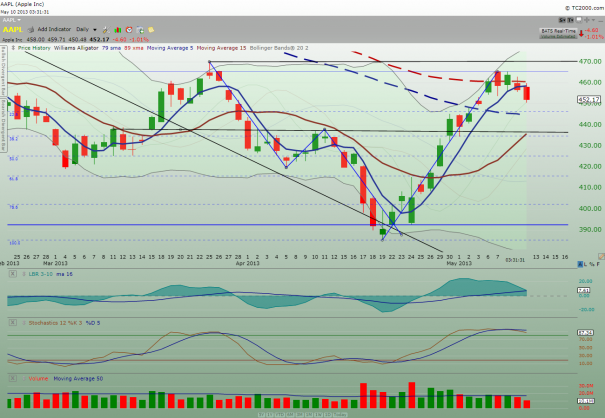

$AAPL down bar today reflects a confirmed correction to the downside simply because it has taken out the low of the bar from Tuesday, May 7th. The daily bars of Wednesday and Thursday failed to take out the Tuesday low; therefore, the trend was still up as far as I was concerned. However, today bar took out Tuesday low and price action was in the vicinity of the 89xma resistance line.

$AAPL price correction today could as well be a minor and healthy retracement. Nevertheless, I will watch for support on the 38.2% Fib retracement level at $434.75 which also happen to be near the support line from April 11th high.

Take a look at $AAPL daily chart below:

I bought June 7th 455 put option to short $AAPL. I’m betting that $AAPL correction will try to reach $435 support area before bouncing.

If there is going to be a mini-market correction, it may start next Monday and $AAPL will follow the market with it; otherwise, I will sell my put option pronto Monday morning to cut losses if the rally continues on.

My 2 cents.

Comments »