Keeping The Balance

Overnight was fairly quiet in the Composite futures where the main feature was a rotation higher in the early hours, around 4 am. The pulse higher was effective in erasing a slow and balanced drift lower, but it also put the market into overbought territory on the very short term. Early on, perhaps even premarket, my expectation is for sellers to work price lower a bit before we see an attempt at another rotation higher.

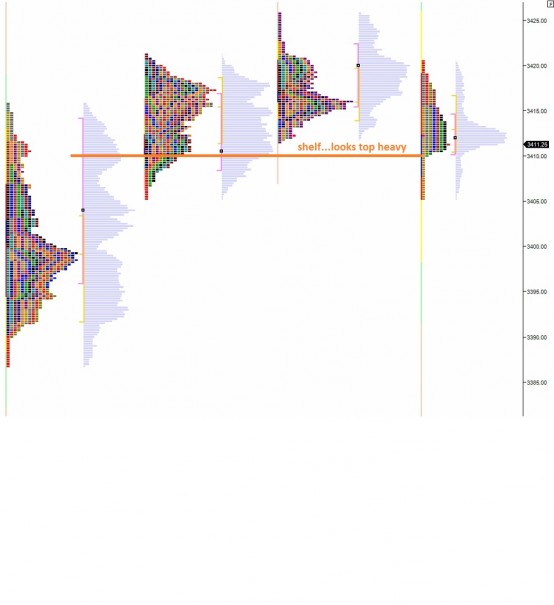

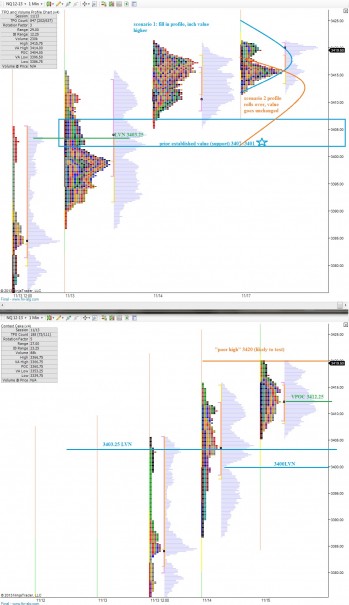

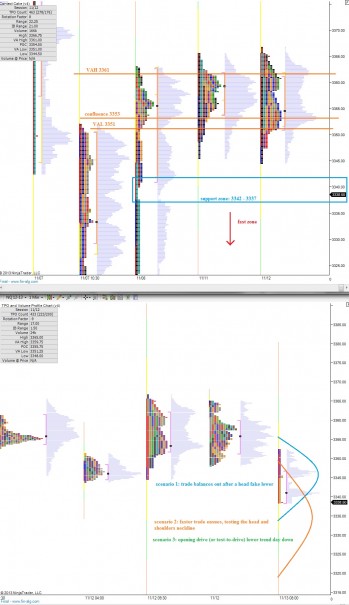

I have envisioned two scenarios for today, both which expect value to be built upon our existing and fragmented profile structure. Should we press beyond these envisioned profiles and accept price beyond their range that would be an early cue this week that sentiment has shifted.

You can see my vision along with levels to monitor on the following market profile charts:

Comments »Exploring Temporary Phenomena

Yesterday’s profile was interesting to watch develop because if one had not clearly identified the opening drive-type action from the buyers, they may have hypothesized the action was only a temporary phenomenon known as a short squeeze. Value was slowly migrating lower all week and we came into the morning with a sharp gap lower which suggested something overnight had changed the market’s dynamic. When the second leg higher erupted at high noon, it signaled a fresh batch of initiating buyers had stepped in and put fresh money to work.

In short, a squeeze may have been the spark, but an authentic accumulation occurred throughout the rest of the day.

Trend days are considered risk-free entry point in Market Profile theory which suggests that buying any time during a trend day will allow you to exit at higher prices, eventually. The “eventually” is one of the greatest qualities of market profile I have come to learn. They are not a very effective timing tool. Instead, they are fantastic for framing a day, estimating range, and locating key event points in the tape. Timing is best achieved with the bar charts.

I’m going to keep our attention on the /NQ because I am actively trading it and most of my stocks are nestled in its electronic bosoms.

Weakness crept into the overnight session, whether it was profit taking or short sellers is not material, it was sell flow. The action was able to recapture the upper quadrant of the second leg higher in the index, which is the area I envision us spending our day. Best case scenario for the longs is a consolidation along the upper quadrant of the trend distribution.

Should the selling pick up and press us below 3382.75, this would suggest a significant sentiment shift, and would merit caution before initiating any new long exposure.

I have highlighted this level, as well as drawn out a few scenarios on the following market profile charts:

Comments »Afternoon Structure Report

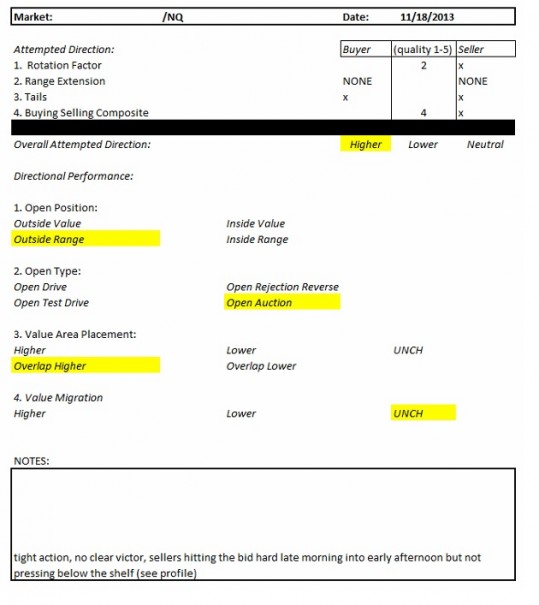

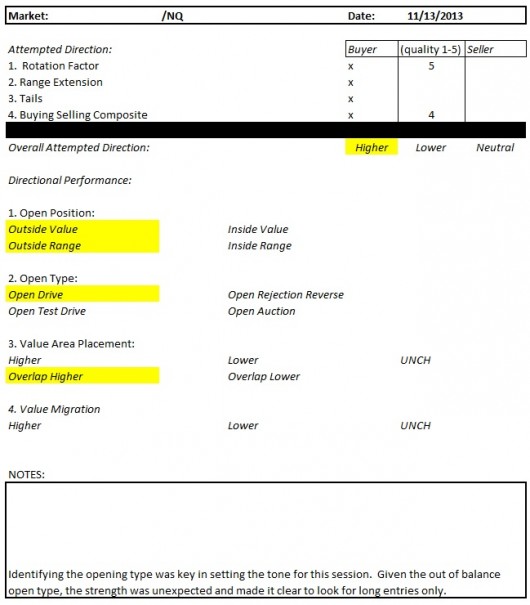

I am testing out a new form, a template mostly from the Mind Over Markets book. Let me know your thoughts:

Comments »Turning Our Attention To The Head

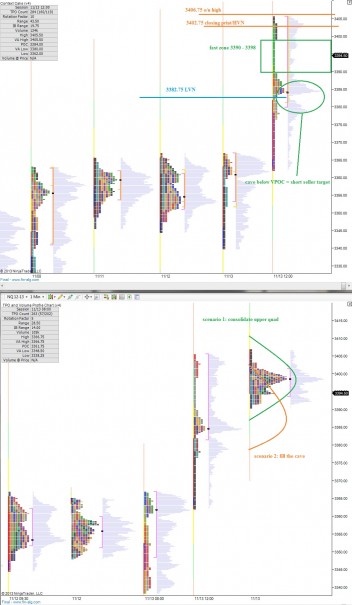

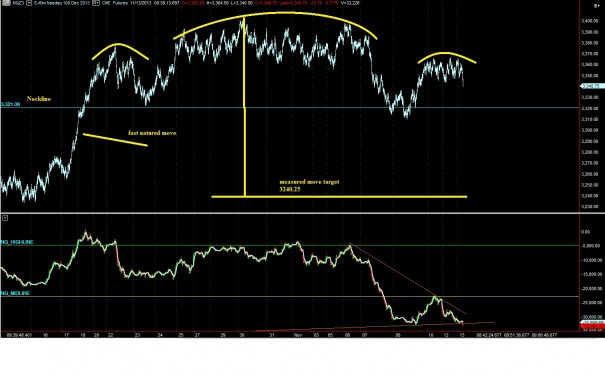

Two big rotations lower overnight have taken prices much lower in both the NASDAQ composite and the S&P futures. Today’s market profile analysis will focus on the /NQ, the electronic mini futures contract which tracks the NASDAQ composite.

The reason for turning focus away from the S&P is because I perceive the current structure of the NASDAQ important here.

First, observe the following bar chart, dating back to 10/16, we are close to printing a head and shoulders topping pattern. Price is in the top window pane:

Trade has been bracketed since opening Sunday evening and we should monitor the bracket extremes to determine if the market is coming out of balance. Much like the behavior at the edge of a low volume cave, price can penetrate a bracket extreme without breaking the level.

Looking at the overnight action, we can clearly see sellers establishing control overnight which has pressed us out of yesterday’s value area and range. This tells us something overnight changed the perception of the market. The risk today is elevated, as is the reward on an intraday basis.

It will be important to monitor the open type. Early on my expectation is for buyers to react to these lower prices. However, we are in “pro gap” territory currently, with price on the S&P trading 10 handles away from yesterday’s close. This makes filling the gap a more challenging endeavor, one where someone certainly should not just buy the opening print and wait for the gap to fill.

I have highlighted the support levels I will be keying off of today in the NASDAQ as well as a envisioned a few scenarios on the following market profile charts:

Comments »Better Suited for Robots

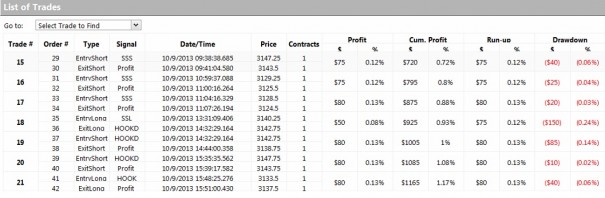

The index futures are trading all over the place, and I find myself trading well in the morning only to give back my gains come the afternoon. I brought Elroi over to the /NQ with me this week because I need to keep my eye on the jackass in case he does something stupid—which he does from time to time because my coding skills are a bit…meh.

My algo loved today and had its best day ever. However I sullied all of my morning discretionary profits and much of Elroi’s algorithmic profits by flip flopping in the chop. 80% of my trading errors occur when the market churns. My exponential moving averages converge, my Keltner channel goes sideways, and price chops at like 1000 miles per hour. And I go, “shorts have this, SELL SHORT on the breakdown. OH FUCK it’s a fake out, COVER, here come the longs, FUCKIN’ BUY’EM UP, SLAAAMMMMM, back down.” I used to do this a good 4 or five times before I snapped out of my insanity. Now it takes two bad trades for me to realize I am a jackass and sit on my hands.

The problem is the market did that to me twice this afternoon. Lol, I am leaving that sentence because it speaks volumes to my mistake. The market did nothing to me, I only did these things to myself. I review these conditions all the times. I know to stay away. In the morning, I do. In the afternoon I loosen my focus a bit. I will go through my trades and verify this tendency but I smell a “no afternoon” rule brewing up.

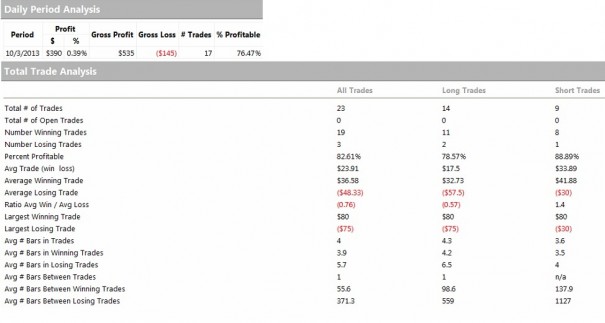

Here are Elroi’s trades:

Comments »Raising Cash is Hard These Days

Sunday night Raul was brooding harder than Ryan Gosling in a New York City taxi cab. The futures were lit aflame and it seemed almost certain I was due for an ole timey courrrection. And it would make sense, because I am sashaying around these markets with impunity lately. It is always a matter of when, not if, the market will sniff me out and drop a grand piano on my head.

Hey it happens—I won’t lie to you…truth serum is a perk of being anonymous.

But the grim reaper didn’t visit me this morning. Instead a little bit of the Miley Cyrus trickled through the veins of the market and I had a green day (no dookie).

The morning flowed, and after going on a seven trade winning streak in the /NQ_F I thought it respectful to make a sacrifice to the stock gods—so I sold off some RVLT over 4.

Don’t get up in arms now. There is no need to revolt at this action. RVLT ballooned last week to become almost 20% of my portfolio. And I took that low floater into the weekend because I knew the move had more junk in the trunk. When it fizzled today, I took off my bottom shares, the shares I bought down in the depths of hell, and booked them for over a 30% profit.

RVLT still remains my largest position but I did not want to start getting emotional over here so I took it to a size where I can stop pulling up the chart and a size I would consider riding though earnings. Great company or not, you are a jackass to have 20% of your risk existence on an earning’s call.

It wasn’t long before I had a new home for the cash. I piled it onto ONVO, making the position my third largest behind only RVLT and CREE.

ONVO 3d prints organs which is a total mind blow. The chart is forming a tight consolidation which will blow shit up when it breaks. My trade reviews show me I need big size on ASAP, so I can get my fat scale off while everyone else is still on the chase like I did AMBA last week. Being up 6% on my ½ entry, it seemed imminent to buy more.

In short, the port is green, the /NQ trades more at my speed, and everything on the news is fake.

Congratulations to Howard Lindzon and the entire Stocktwits team for getting a CNBC’s John Melloy to take the reigns as CEO. This is a huge blow to the financial news industry and no doubt speaks volumes to the decaying value at CNBC and the exponentially growing value of getting your news directly from traders.

Successful businesses aren’t the result of some magic voodoo. They are the result of good decisions diligently executed one after another. When presented with the right information, it does not take a genius to make good decisions. Any of you would choose correctly given the best information. And it is the people doing the work, day in and out, people like us folks on iBankCoin and Twitter, who know the business the best. Not some stud on the teevee.

The investor class is realizing this, slowly. Remember, when you venture to the internet for knowledge due diligence is paramount. Follow “experts” for months and hold them accountable. Don’t just follow some cowboy into a field of algo turrets.

And always demand more, more, MOAR!R

Comments »A Good Week to Be Bullish LEDs

I was able to advance my portfolio by seventeen percent to start the month pressing my high water mark while the market consolidated/traded lower. As the month continues, the risk continues. This is a risky environment and stock picking continues to be paramount.

I love open water swimming. It is explorative by nature and makes me feel small. Perhaps I feel the same enjoyment trading in the futures. And although I enjoyed swimming in the /ES these last 6 months, the /NQ has a much better feel. /ES is like catching the shore pounding waves in Huntington Beach California where /NQ is like the warm rollers down in Costa Rica.

We will however continue profiling the /ES as it bakes the finest contextual cake in town.

Tesla came out and defended his technology like a true gentlemen after the bell today. Much like Henry Ford would stop and repair any broken down Model T’s he passed, Musk came to the modern day rescue, producing a detailed report on the event.

I do not know any CEOs who are behaving as fantastic as this guy.

I like my book of stocks and I only wish I wasn’t sidelined on ADHD. Everything else about this week was perfect.

LEDs will continue to be a disruptive tech. Keep your eyes peeled for them and do not hesitate to report your findings to Raul. Better yet, use your AMBA cameras to gather intelligence.

Signing off,

Raul

Comments »I Am The Lizard King

I can do anything.

We sure do cover the /ES_F often over here on the Raul blog, discussing its…implications, if you will. Building the contextual cake helps me to identify abnormalities, flinches, and hand tips by the big money. The E-mini S&P is the most liquid financial instrument in the world. It makes sense to pay attention to it.

But trading it has become a slow and painful grind. It is like going years without a dish washer even though you love to cook. You get by, but your soul dies a little every day.

I needed some change (No Obama) so I traded the /NQ. I like the NQ…peep today’s stats:

Thoughts:

- today had a large range

- /NQ is thinner

- smaller contract size suits my size a bit nicer

- I trade lots of Nasdaq and Russell stocks so I may be concentrating my eggs

- It offers more trading opportunities (at least lately)

/ES has been brain numbing, while I go ‘big pimpin’ on these wiry stocks. Speaking of which, my book was up a percent today. That is a result of stock prowess and hanging out with traders much more seasoned then me. Mainly my gains today were a result of being on the right end of a technology revolution. So while sour bastards get their kicks shorting Tesla, which is fine, I am embracing the future and finding opportunities to invest in it.

In short: CREE and RVLT what what?

I started buying ONVO too, right about at these levels. You can’t keep me out of this name. When my pickled organs give out I want robots around to print new ones. Seems like a no brainer at five fifty. I consider it an investment in myself.

I sold YGE. It felt like when I sold VIPS yesterday…too soon-ish. However, dwelling on these thoughts prohibits the mind from seeking opportunity elsewhere. I sold RBCN too, for a loss, because it sort of just fell out after mainlining hot money. I do not want to be around when the Apple WWDC crowd goes running for the doors, should they do so.

ADHD is a ticker which by design frustrates me, ripping higher like a freshman jacked up on Mountain Dew and Ripped Fuel. Ah high school…when ephedra was still legal. I have wanted a long on this one for a few weeks but my attention keeps darting away from it. Instead I want to Snapchat and play ping pong in the futures.

I do not really love the way we are setting up into the weekend. The market looks like the headless horseman. Sentiment sucks but the crowd isn’t always wrong. I have concentrated by book down to the following positions listed largest to smallest:

RVLT, CREE, USO, LO, BALT, AMBA, FB, ONVO, F, IMMR, MJNA, O

That jackass MJNA stock can burn up and go to zero for all I care. What a garbage stock. I am -20% on that field play. I thought about cutting O about 100 times, but I figure keep it and collect the yield. My basis is a tad below here.

Everything else I hold close to chest. As a matter of fact, I need more CREE and RVLT but I am exercising patience. Together the stocks represent almost 30% of my risk capital.

I will let Q4 play out a bit before getting more risk into those two names. In the mean time I can increase my LED exposure via VECO, RBCN, GTAT, OESX, and LYTS.

Comments »