Nasdaq is trading lower premarket on a balanced structure and normal range and volume. ADP Employment change came in a bit lower than expected at 8:15am and prices saw little reaction to the news.

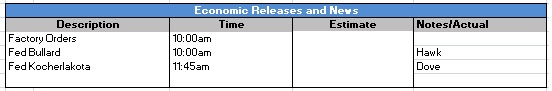

On deck we have ISM Non-Manufacturing at 10am, Crude-distillate inventories at 10:30am, and Fed’s Mester is talking at 12:45pm.

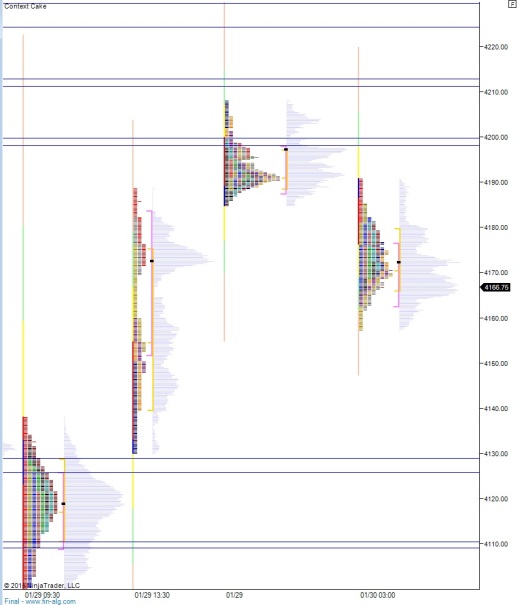

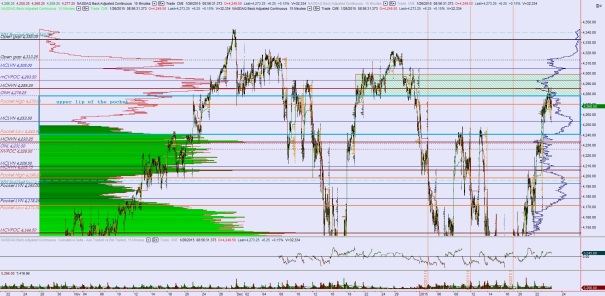

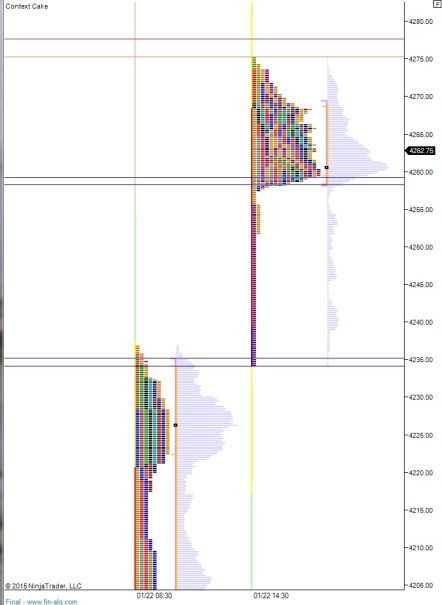

Yesterday the market went gap up after a strong bounce of the lows Monday only to see some early selling. Sellers pushed to test the afternoon rally and found responsive buyers who took us all the way though the initial balance to put a neutral. Buyers then sustained their strength into the close resulting in a neutral extreme print. This day-type is a high conviction day type for buyers.

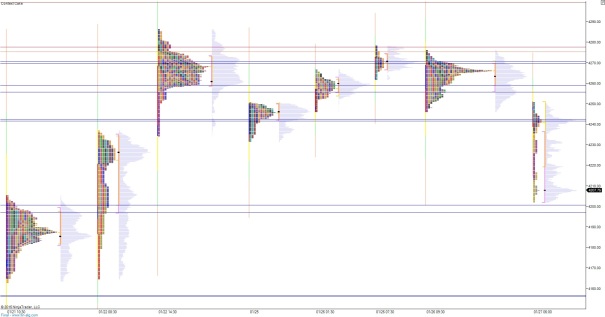

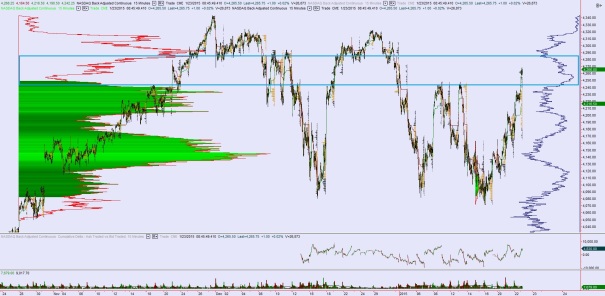

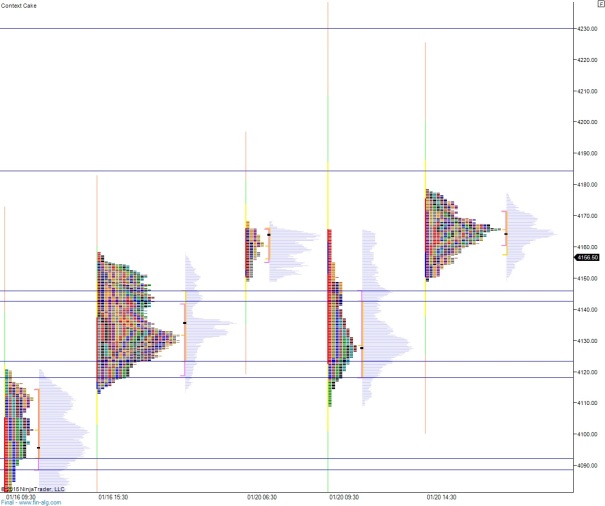

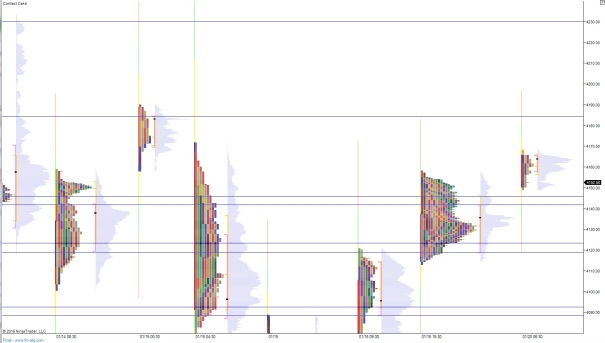

Intermediate term, we are trading at the top end of a six-day range after a big gap down last week. This balance structure is inside an even larger balance structure dating back to late October. Compression-inside-compression.

Heading into today, my primary expectation is for sellers to try and push lower early on and test the LVN at 4189. Here I will look for responsive buyers who work toward closing the overnight gap up to 4215.25. Stretch target is a move up into the above gap and a targeting of the MCHVN at 4233.25.

Hypo 2 is sellers push through the LVN at 4189 and test through the pocket and down to the 6-day mCVPOC at 4178.75. If buyers are not found here then a continued move lower to test yesterday’s low 4166 and a revision to the October MCVPOC down at 4144.50.

Hypo 3 is buyers press up and close the gap to 4215.25 and push above 4233.25 to sustain a drive up to close the gap to 4269.25.

These levels are highlighted on the following volume profile chart:

Comments »