Whoever made the decision to schedule Memorial Day here was on to something. The placement of this much needed rest is divine. I spent the weekend decorating the graves of my losing trades. Most trades receive a solemn salute for their service. For others, I stopped and observed for what seemed like hours, with deep introspective of the events that led to the loss.

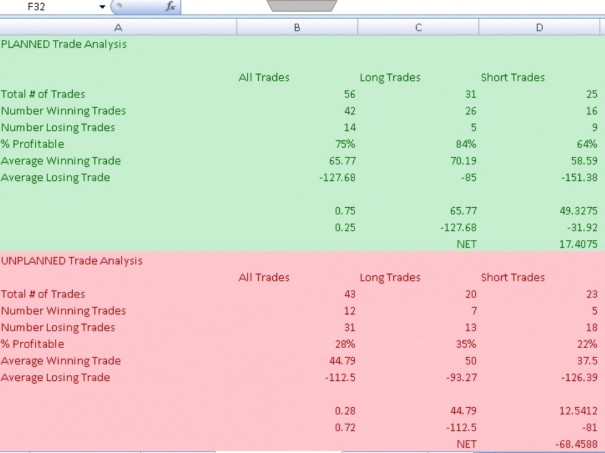

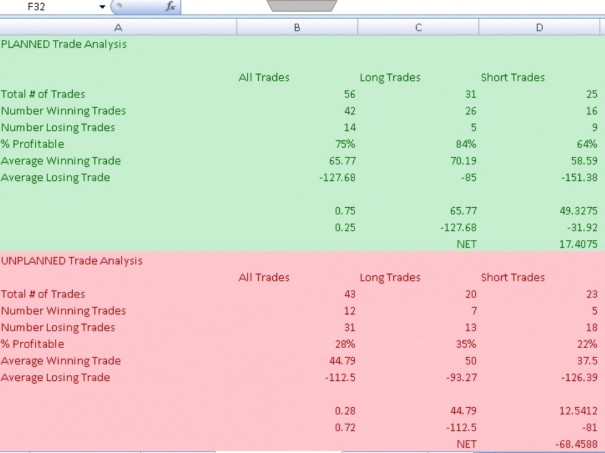

I reviewed every trade taken in the S&P this month. If only ironically but perhaps like a little galactic wink, there have been 99 trades. A blanket of inpatients was strewn over the field. And from the review a glaring bit of clarity emerged. I must stick to my plan. I have two data sets, one with trades taken according to my plan and the rest.

Check check it out:

Pretty good numbers on the planned trades. Something to build on, no doubt. But the thing is, I really like my unplanned trades, even though the numbers suggest I should NEVER trade anything outside my plan. So I hardcoded a nuance into The Plan which lets me have my cake and eat it too. The rule is inspired by the feedback I received from you guys and I appreciate your thoughts. Kudos gentleman, behold! Literary logic to protect my ass:

I will only trade other pictures (like profile support/resistance) if I’ve earned risk capital and with a ‘one round elimination’ format meaning trades can only continue to be taken if the prior trade was correct.

To break it down, I have to only trade my plan until I’ve earned profits. If at that point I really need to take an unplanned look, I have one shot to do so. Not two, or three like Friday. I always build risk into my trades and must be willing to forfeit 1/2 my daily gains if the unplanned trade is wrong. If it’s a winner, and I want to take another, the same rule applies.

Planned trades can be taken any time. Even after a failed unplanned trade. Make sense? If you hate it let me know.

I’ve gone over 100s of charts and screens and bloggers’ picks and have a few hot looks going into the week should the market bounce or even flatline. I’m a stalker long on MSPD, LSI, SNDK, NANO, and UTEK.

Get excited.

Comments »