“Love the discipline you know, and let it support you. Entrust everything willingly to the gods, and then make your way though life–no one’s master and no one’s slave” – Marcus Aurelius

It has been almost 3 years since I escaped the oppressive bonds of corporate mediocrity, but I remember how we would all clamor around our cubicle quarters about this time of year. We were all giddy to hold our soup bowl up and accept a second cup of broth from management. Then we would go into the HR system and adjust our federal withholding exemption so Uncle Sam wouldn’t take half of it from our W-2 paycheck. Gone are the days of waiting in line at the soup bowl whilst The Company was enriched by the billions. Now I am liberated, and ironically enough, it requires rules and discipline to live free.

I have to trade a rule-based mechanism, and I need to execute it consistently. That means no more whimsical frills; this is a no BS game and BS bitches come and fade every.single.month. I would rather lay sewer pipes then be re-caged into a cube. But I am smart–you’re smart too–so I find ways to get my cheese and bread, no one’s master, no one’s slave.

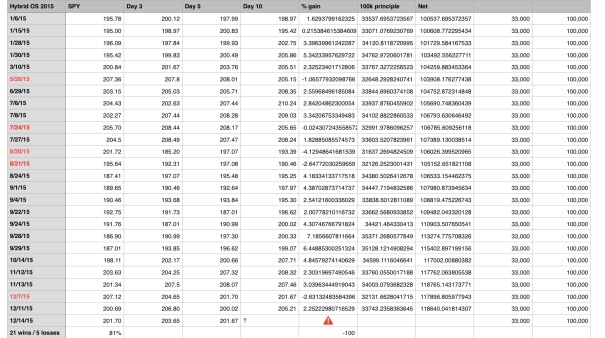

Trading consistently means having an objective method of entering a trade. Imagine if you could score over 4000 stocks, another 1000 ETFs, interest rates, commodity prices, and currency behavior instantly. Then imagine concentrating all of that information and building a trade idea from it. That is the high-level means by which we generate the Exodus Hybrid score. It’s comprehensive and simple at the same time. I love a simple discipline because when everything is moving fast you know how to execute. Here is a hypothetical study, had you taken every signal the software generated this year:

I just closed out my triple leverage Russell 2000 long, aka Tina, aka TNA, for the win (aka FTW). The trade was good for about 10% and of the ‘position’ variety. Not quite a swing trade, not quite a day trade. The gain serves as a nice year-end bonus for yours truly–a bonus I earned whilst barreling down the steepest and deepest mountains of central California. Not, mind you, whist hunching over a computer terminal in a 10-story corporate complex. My fate is entrusted to no one but the gods. This is how I make my way through life.

GOD WILLING, I will have another three years of the good life. If not, that’s fine too. All I need to do is plan and execute, over and over, diligently confronting the facts, and piling on one good decision after another. It takes discipline and rules to live free, but you get to write the rule book. That’s big.

Comments »