PROGRAMMING NOTE: If you will be in Detroit the week before Thanksgiving, come out to my brief presentation on trading futures Wednesday, November 14th from 6-7:30pm. Here is a link to RSVP for the free event: https://www.meetup.com/Detroit-Investors-Traders-StockTwits-Meetups/events/255982115/

Greetings lads,

Time changed. By the decree of man we fell back an hour. Our leaders can effectively change the time on clocks, but they won’t acknowledge their impact on climate. Whatever. Let’s skip right to making money before I lose the attention of my Simple Jack readers.

On Thursday, October 18th 2018 the predictive ‘mother algo’ inside Exodus flagged oversold. The signal came on the heels of a buy signal that fired on October 4th, so recency bias had the risk of spooking users away from using the information to make money.

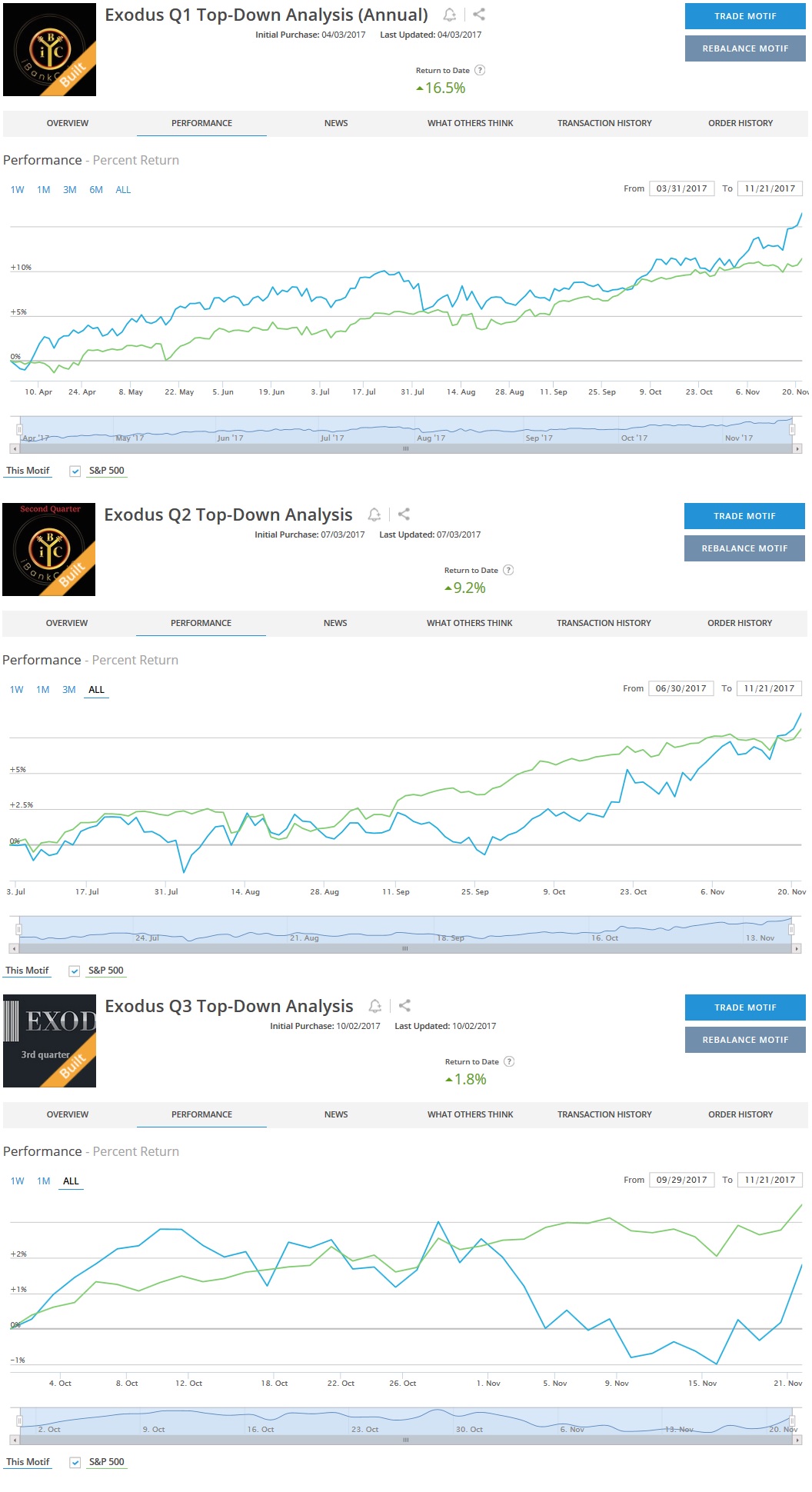

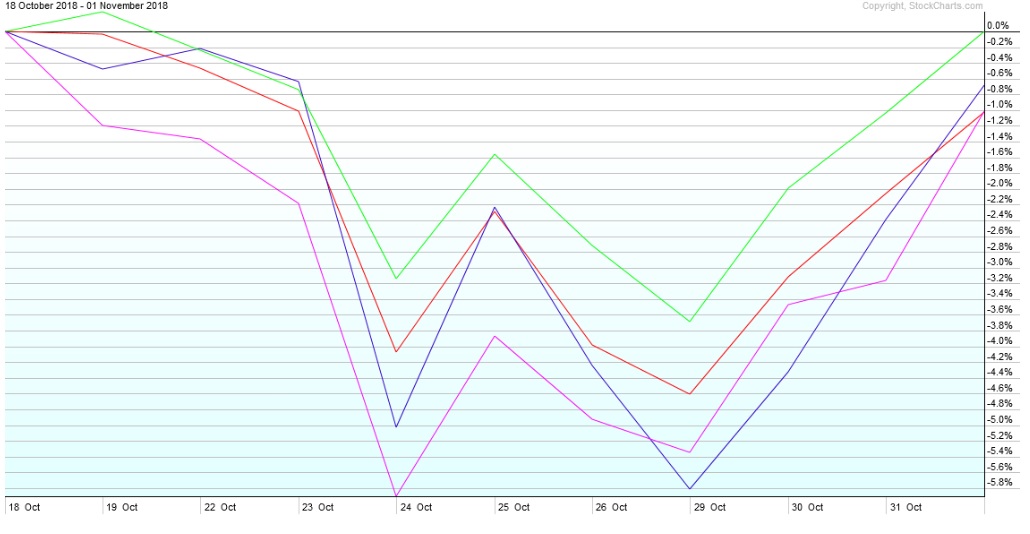

First, here is the performance of every major index during the October 4th cycle:

Next, here is the performance of every major index during the October 18th signal:

You may be looking at those two charts and thinking, “RAUL, you dumb sack of shit, not only do you offend my flat-earther sensibilities, you can’t even read a performance chart and see that your precious Exodus buy signals were losers.”

Which is fair. I did take a proxy position in TQQQ during both cycles, which in both instances generated a 2x loss of the NASDAQ performance shown above. They were losing trades. However, the bullish bias worked to my benefit big time over the same period. Let me explain.

***

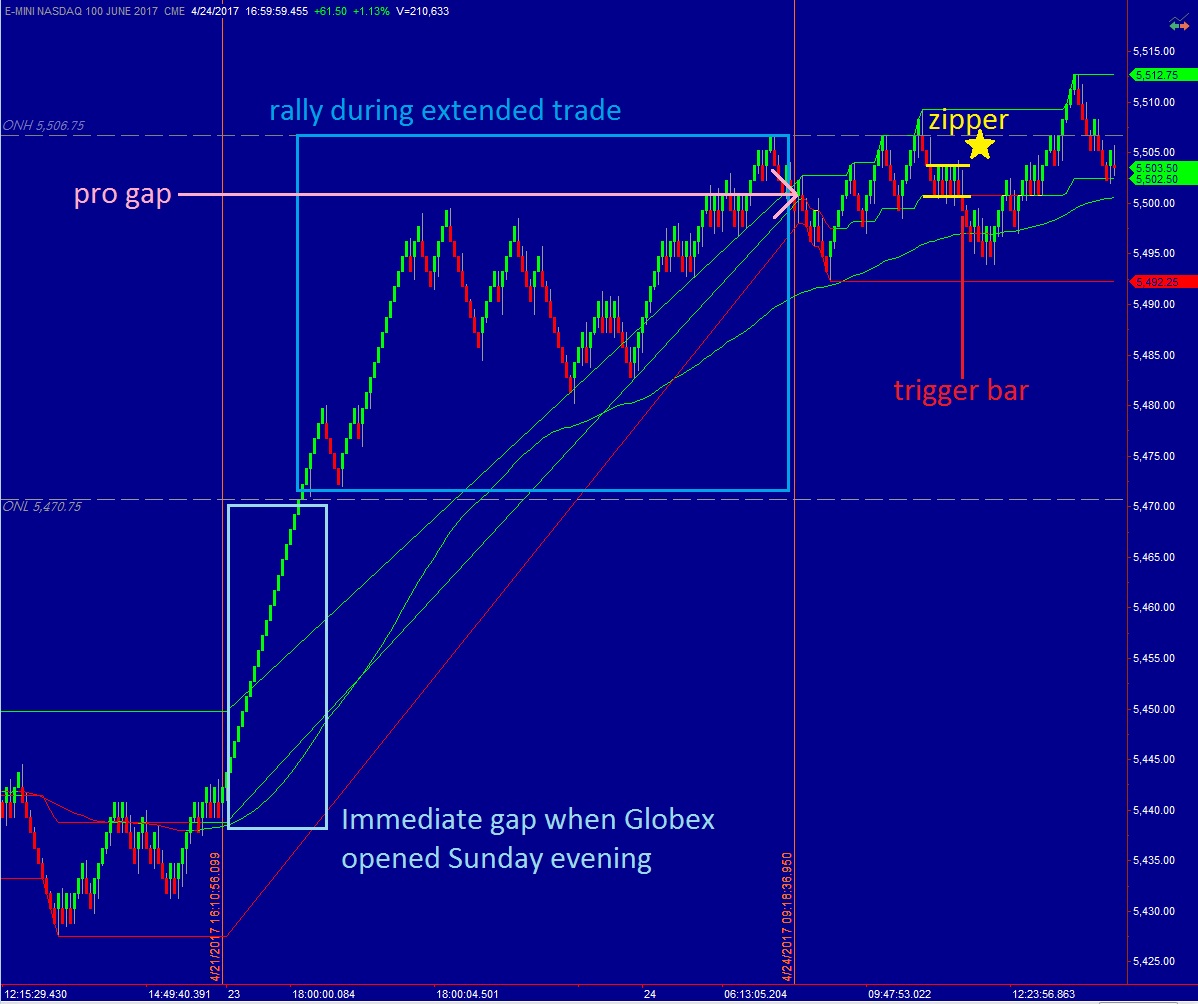

I trade NASDAQ futures. I operate on a different time frame than almost everyone reading this blog. If you wanted to label my trading, I suppose you could call it medium frequency. My average holding period is about six minutes. Average. Sometimes I hold positions for several hours. Especially if I have a directional bias.

Enter the Exodus buy signal. When trading within the confines of an Exodus hybrid oversold cycle I only take long positions, meaning I buy NASDAQ futures with the expectation that I can sell them later in the day at a higher price.

I have specific rules defining my entries. These are setups that I have studied and cultivated over years. They are my craft. I can execute them quickly and cleanly, like an experienced chef chopping an onion. But developing entries is not the purpose of this blog post. This blog post is about EXITS.

So little attention is paid to exiting positions.

When should you exit a position, and why? The answer is in the numbers. The most ratio to track when trading is you expectancy. Here is the expectancy formula, but we won’t deep dive into the math because I don’t want to lose your attention:

Expectancy = (Probability of Win * Average Win) – (Probability of Loss * Average Loss)

For a trading approach to be profitable, the expectancy needs to be greater than zero. To cover the overhead of trading as a business, I like to keep expectancy over 0.30. And overall, when tracking my expectancy, I want to see the arc of my expectancy trending higher.

If you focus on the simple algebra, you can hopefully see (godspeed, Simple Jack) that you have four ways of making your expectancy ratio go up. Here are the ways of increasing your expectancy, in easy-to-digest list form:

- Increase Probability of Win

- Increase Average Win

- Decrease Probability of Loss

- Decrease Average Loss

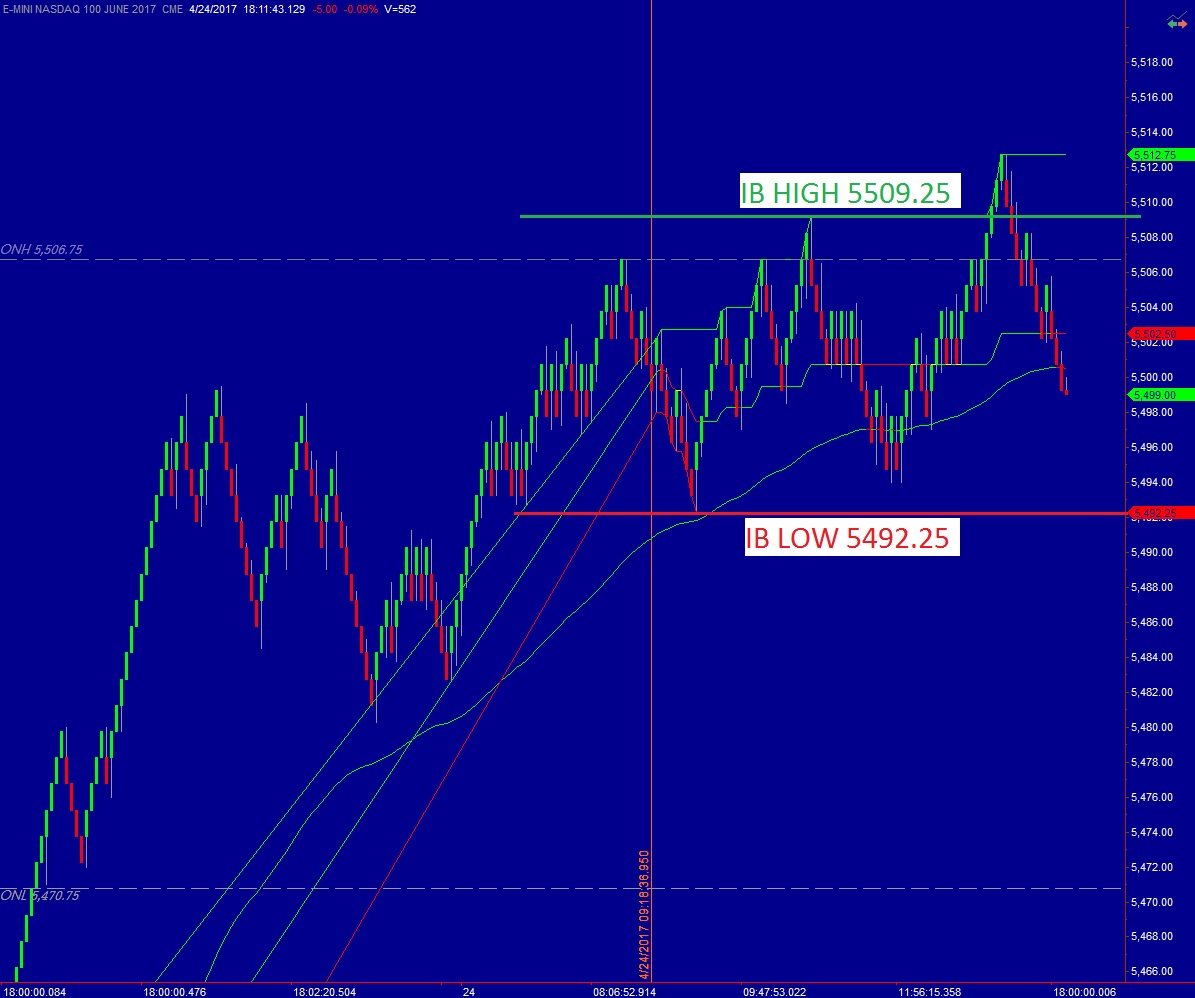

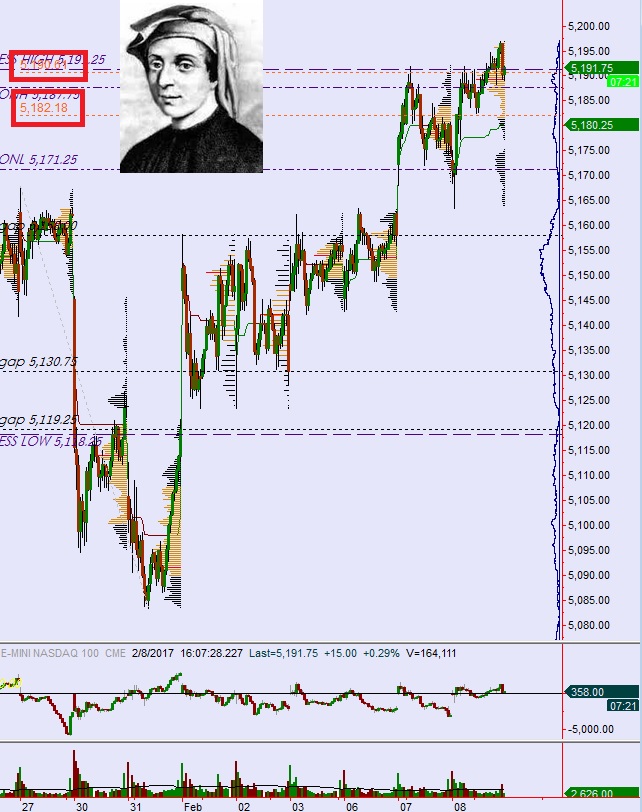

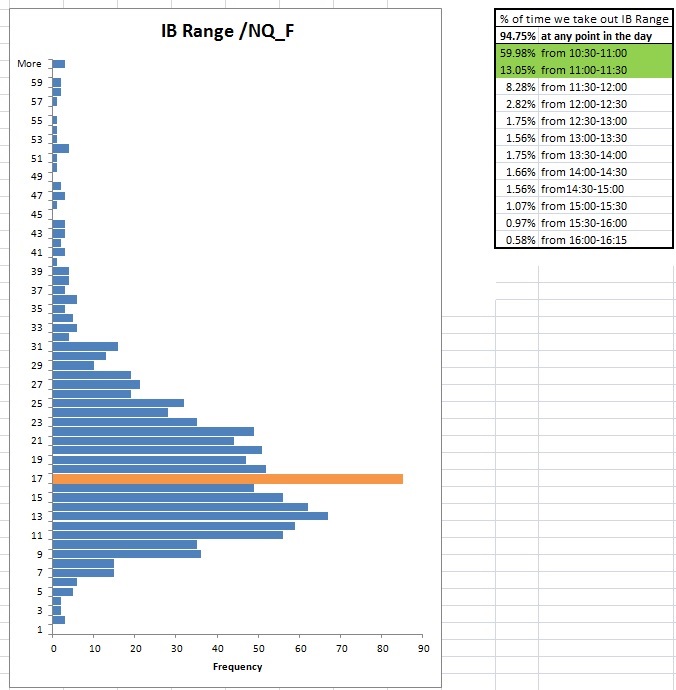

Returning to exits. I need logical reasons to exit a trade—statistics. The first hour of trade after the cash open is called the Initial Balance (IB). Did you know that 94.75% of the time, price breaks beyond the IB range? How do I know? Statistics, damn statistics, and my only true lover—Microsoft Excel, look:

So we know either the high or low of the first hour’s range will break about 95% of the time. But we don’t know whether it will break the IB high or the IB low.

ENTER Exodus, BWAHAHAhAHAHAHAHAH

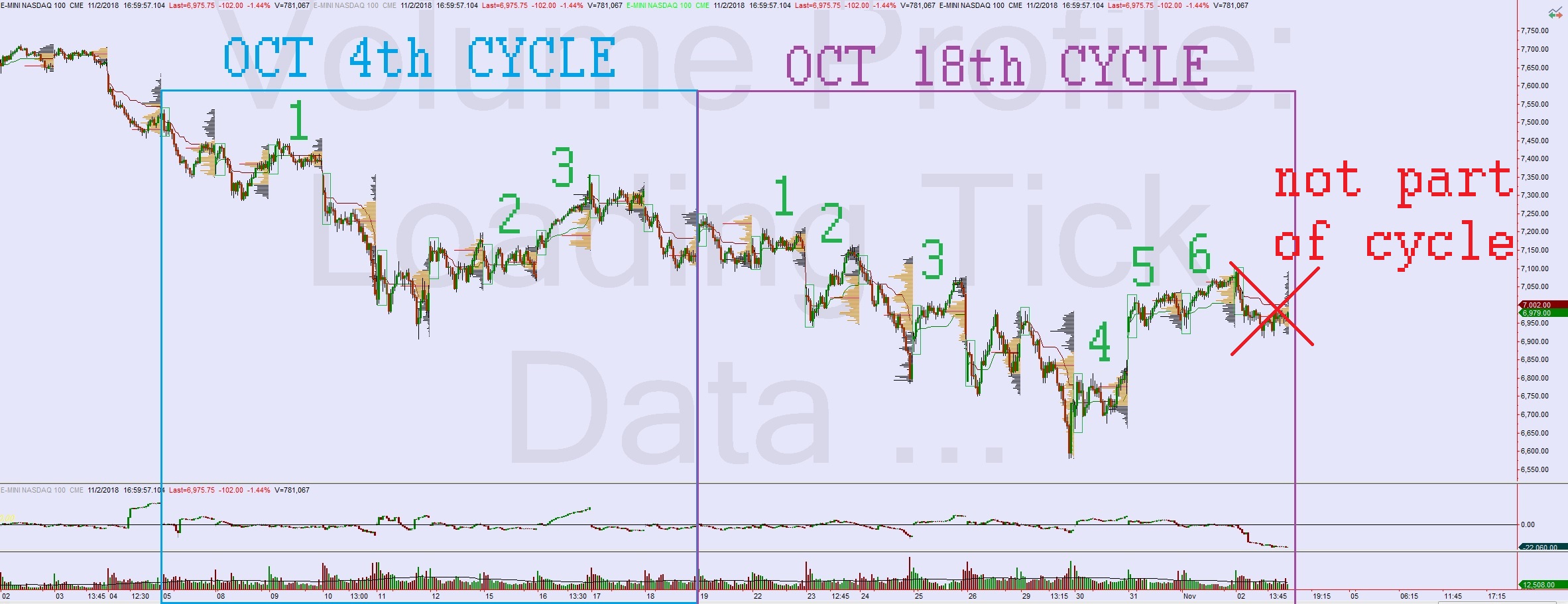

I need to update the study so I can show definitively that Exodus has sharpened my IB trading approach. But let’s go back to the October 4th trading cycle (10/5 – 10/18) and the October 18th cycle (10/19- 11/01).

How many times did we break IB high before IB low during the October 4th trading cycle?

3 out of 10. It was a rough cycle. I was bloodied up pretty badly.

How many times did we break IB high before IB low during the October 18th trading cycle?

6 out of 10. Back in action.

Here they are, in chart form:

When you have the parameters of the initial balance to work with, the closer you are to IB low during an Exodus oversold cycle, the less risk you have to give your trade, and the more REWARD the trades have. The initial balances during October have been BIG. There has ben lots of range to work with.

There is a similar set of statistics that power my overnight high/low approach.

***

Hopefully this short blog post gives you a bit more insight into how I use Exodus/Excel/expectancy to empower my futures trading approach. Ever since I started using IndexModel and Exodus hybrid overbought/oversold signals to force me to only trade one side of the tape, I have seen a dramatic improvement in my expectancy.

It’s funny, I fought like hell to escape the corporate world and all its structure, yet it is structure and discipline that affords me the freedom I desire.

And that is why I produce a Strategy Session inside Exodus even though I do not receive pay for the newsletter. I appreciate the structure The Fly created for me, the accountability to my research that came from other people depending on it. Because it caused me to sharpen my trading edge. For that I am infinitely grateful and will happily give back to our community of iBankCoiners. I don’t care if you hate my geopolitical/environmental views, I know we are all here with the explicit intent of extracting fiat dollars from the global financial complex. These are my ravenous people.

Working through these cycles, one after another, is how I make my way through the world, no one’s master, no one’s slave. Right now I have no cycle to work with. That means I will only be scalping the price levels revealed during the morning trading reports and only when I feel like it. Tight risk, quick 8-9 point scalps.

Neutral until otherwise noted.

Exodus members, the 207th edition of Strategy Session is live, go check it out! Be sure to take a look at Section IV, I like the story semiconductors are telling.

Comments »