When that fourth bunker buster hit on June 12th I had to drudge some funds out of an old LLC to once again buy the dip. I’ve been a dip buyoor the whole way down baby. That’s the difference between me, a grandiose style delusional disordered verses you, the paranoid cable news watcher.

I am cursed with future vision, and I bare this cross with as much humility as possible but at the same time I stare at patches of dirt and imagine all-glass buildings rising into the sky.

When the cement crews show up I say hello and inspect their hole. Constantly learning as much as possible from my cousins the latinos. Good honest folks doing hardt work. Some smarter than others.

The amish are my homies. I like their beards and they like mine. We both like accumulating land and making it produce corn and tobacco.

City centers are the lifeblood of culture and unfortunately we have to keep the rural kooks afraid to come near by giving off the appearance of chaos and crime.

It sucks but the alternative is a bunch of militia freaks, with their tiny cocks and compensatory pickup trucks clogging the roadways with their gay honking meetups.

It’s time to buidl lads and if that hasn’t become abundantly clear yet, what with the toxic wokes and the derranged assult rifle owners, a spectrum of lunacy with two insufferable poles, idk what will stoke yous into action.

The global financial complex is a tool. A set of data representing the interaction of humans worldwide. Humans who, for our intent and purposes are more data blips than souls. Because we have to maintain a strict adherence to the system otherwise the fucking citadel will make to kill our moneys. In this manner we make our way through these financial arenas, extracting as many fiat american dollars as efficiently as possible because those fuckers aren’t going to finance our buildings.

Nope. They only finance w-2 chooches who bring home a steady bi-weekly compensation in return for FUCK YOU you’re tethered to these meetings about meetings 40-60 hours per week.

Good lucking buidling whilst corporate overlords have you chained to a cubicle. Chooched. To the highest degree.

Model wants more pump. The earnings calendar is light. Non-farm payroll is the only data on the docket. And we have a nice clean start to the second month of Q3. Love it when the calendar is very nice and clean with the first being a Monday.

Okay for now,

Raul Santos, July 31st 2022

PS – thank you Jeff Bezos, thank you Google, thank you Microsft. Mark, please do better.

And now the 395th strategy session.

Stocklabs Strategy Session: 08/01/22 – 08/05/22

I. Executive Summary

Raul’s bias score 3.85, neutral*. Buyers continue to explore higher prices during a week-long rally. Then look for non-farm payroll data Friday morning to dictate direction into the weekend.

* extreme Rose Colored Sunglasses e[RCS] bullish bias triggered, see Section V.

II. RECAP OF THE ACTION

Sideways-to-slightly lower through Tuesday morning. Then a strong rally throughout the rest of the week.

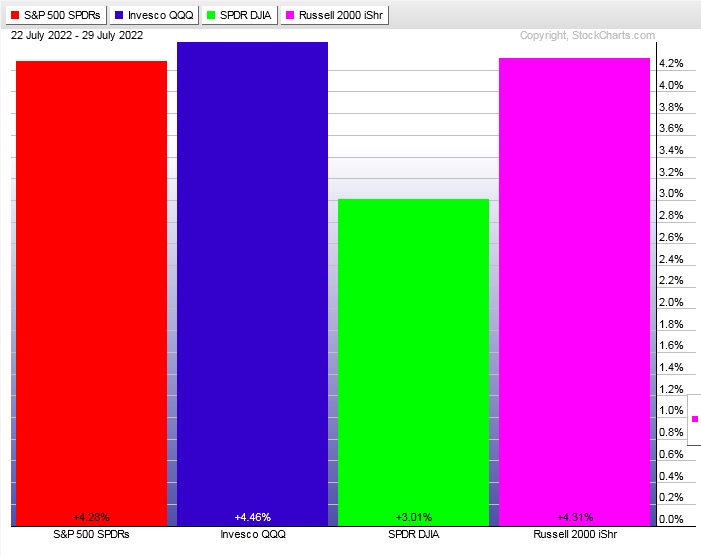

The last week performance of each major index is shown below:

Rotational Report:

Second consecutive week of strong buying rotations. Stronger than last report.

bullish

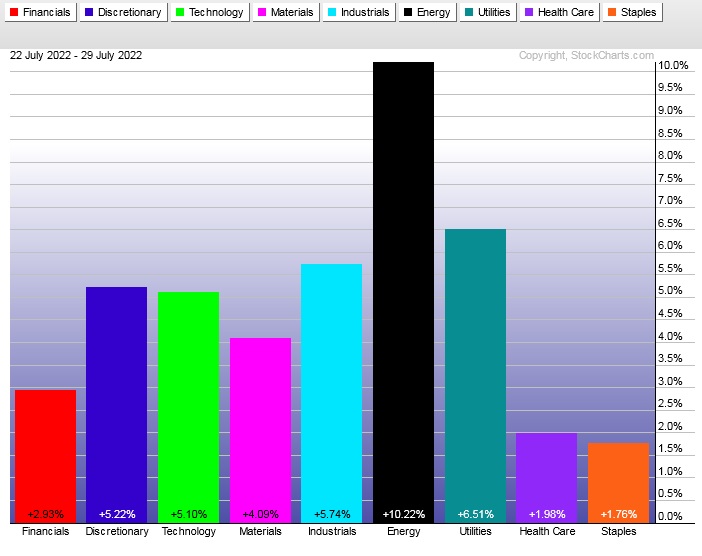

For the week, the performance of each sector can be seen below:

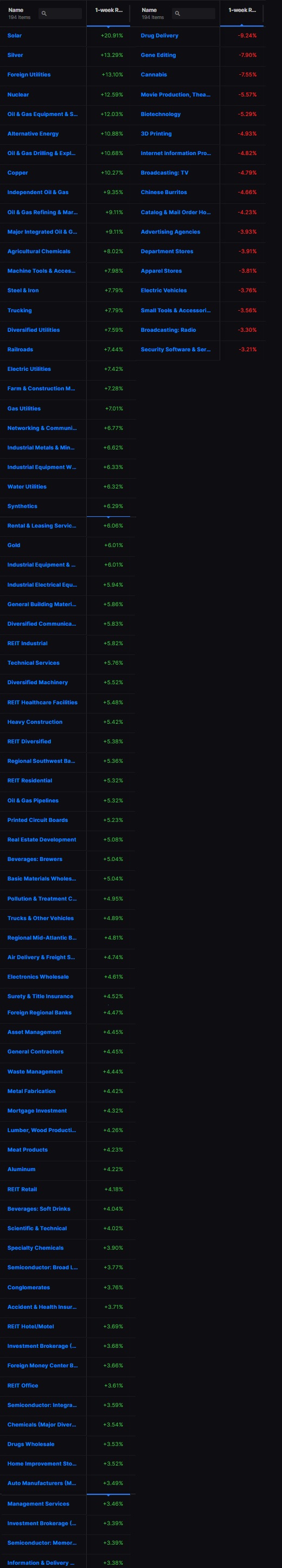

Concentrated Money Flows:

Second consecutive week of a major buyside skew in the money flows.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Signals uncross, all signs point to higher

New month starts cleanly on Monday. Minimal earnings/economic data on the docket. IndexModel and Stocklabs in bullish cycles. Rotations, money flow and contextual charts all point to higher.

Press risk.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Buyers continue to explore higher prices during a week-long rally. Then look for non-farm payroll data Friday morning to dictate direction into the weekend.

Bias Book:

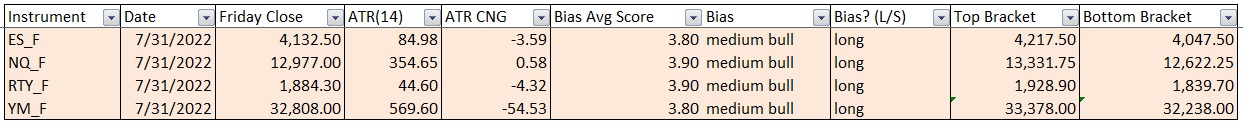

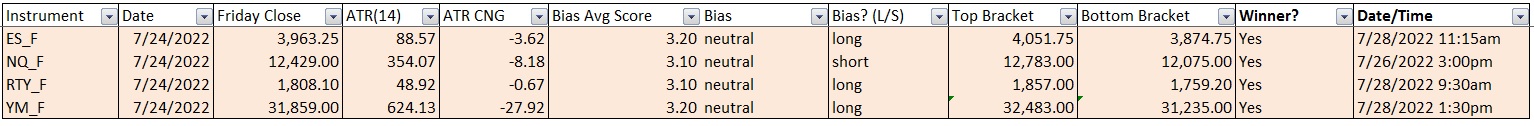

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

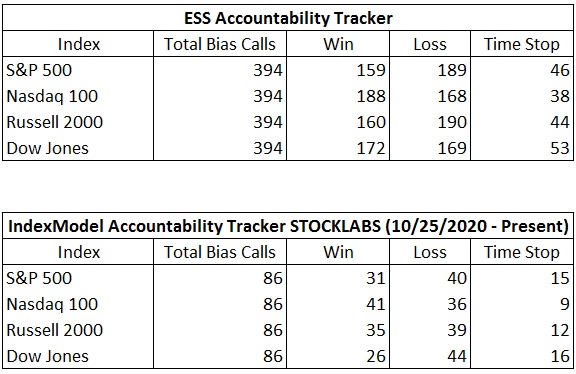

Bias Book Performance [11/17/2014-Present]:

Support held and now it looks like time to probe higher

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

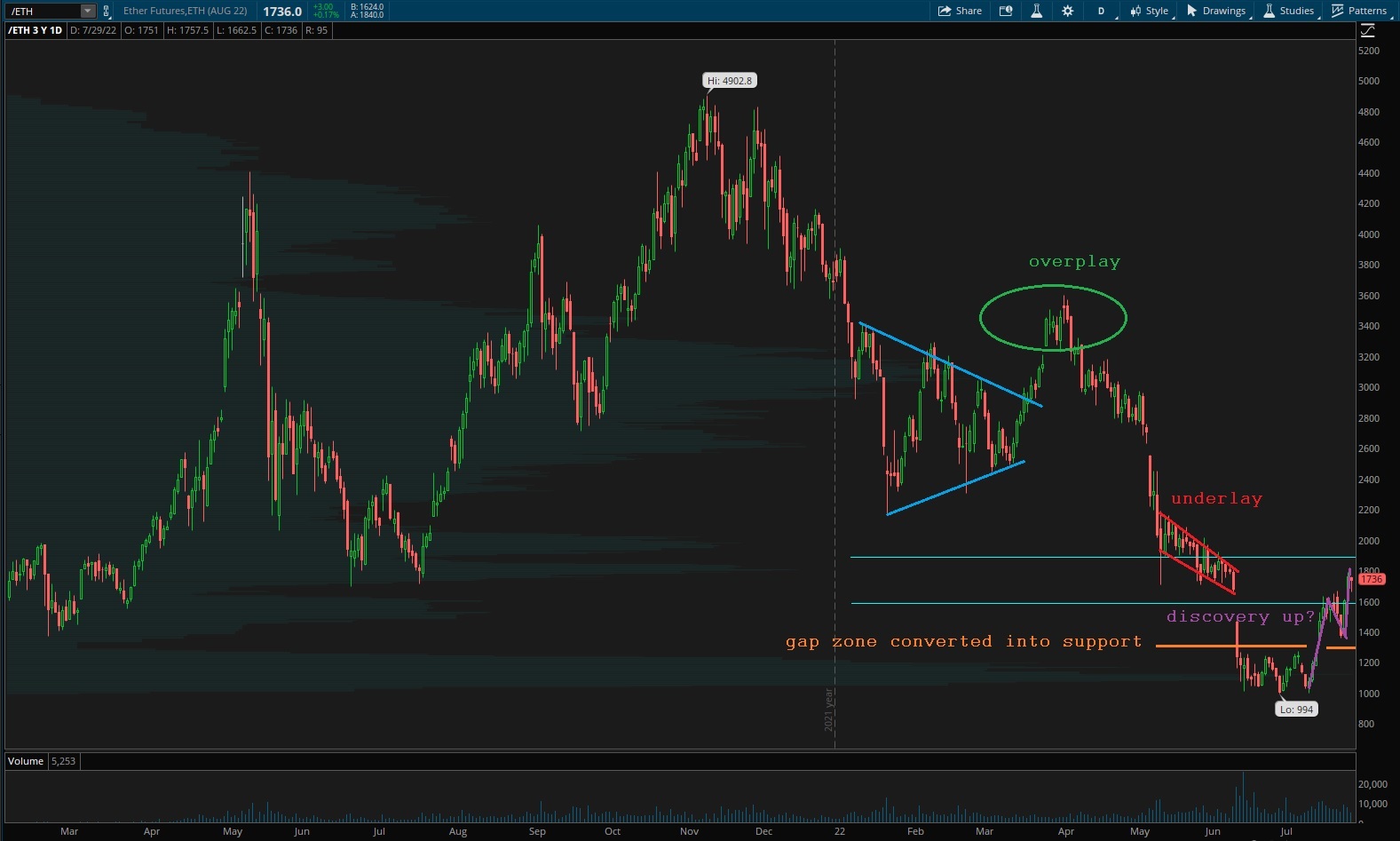

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

The weak low held on Transports for now. This charts discovery up has been more explosive than semiconductors or ether. Next matter of business appears to be testing a bit higher to see if the prior swing highs are defended by sellers.

See below:

Semiconductors exited an aged discovery down phase after closing an old gap (marking the bottom) by switching directly into discovery up. Until a strong seller emerges to restore balance, this chart appears to be seeking higher prices.

Ether found support a bit higher than expected in last week’s report and is now discovering higher prices. This new commodity has nearly doubled in price in one month.

V. INDEX MODEL

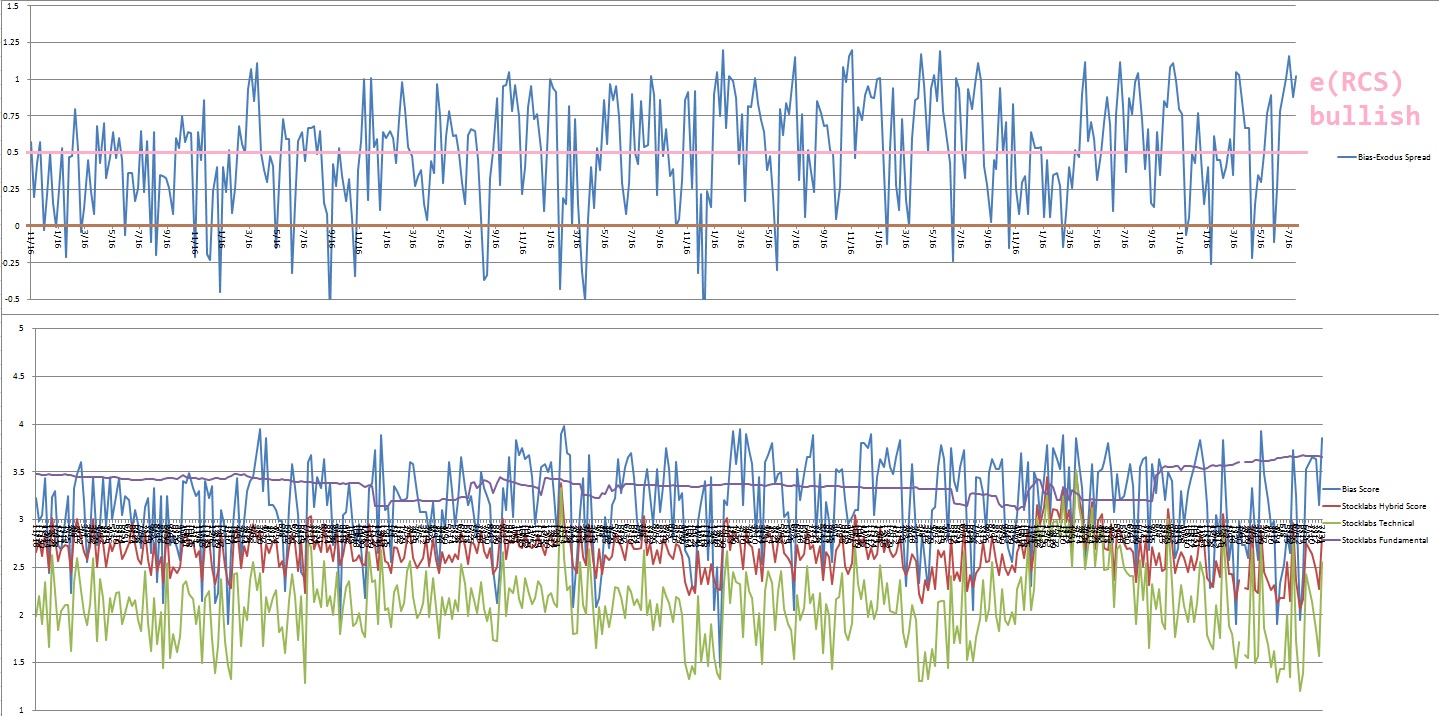

Bias model is extreme Rose Colored Sunglasses bullish after being RCS bearish last week. Prior to that signal it was e[RCS] bullish for two weeks.

I’ve noticed that four e[RCS] readings in tight succession tend to suggest a rally is maturing.

There were four Bunker Busters in recent history — six weeks back, thirteen weeks ago, twenty-six reports back and a third thirty-four reports back.

Here is the current spread:

VI. Six Month Hybrid Overbought

On Tuesday, July 19th Stocklabs signaled hybrid overbought on the six month algo. This signal has bullish statistics. The cycle runs through Tuesday, August 2nd end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“Patience is not simply the ability to wait – it’s how we behave while we’re waiting.” – Joyce Meyer

Trade simple, trust the process

If you enjoy the content at iBankCoin, please follow us on Twitter