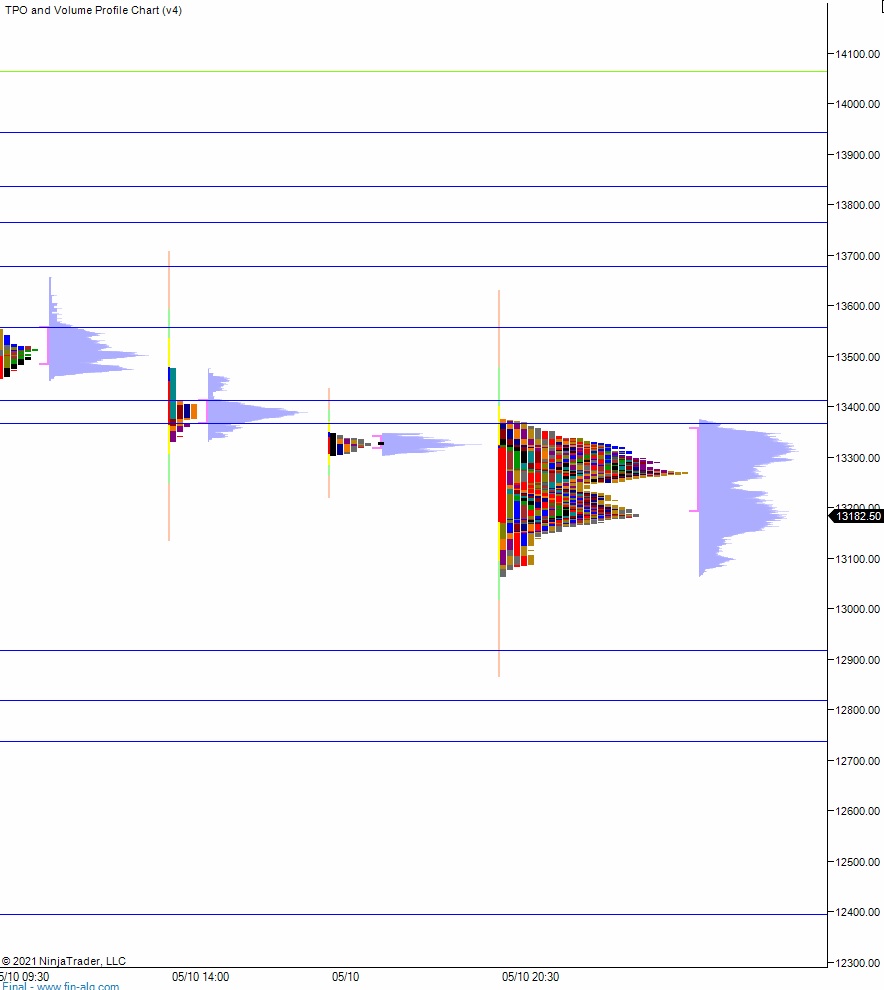

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the top side of Tuesday’s midpoint until 8:30am when CPI data came out higher than expected, introducing a wave of selling that nearly took out the Tuesday low. Since then we have been chopping in the lower quadrant of Tuesday range and that is where price is as we approach cash open.

Also on the economic calendar today we have crude oil inventories at 10:30am, 10-year note auctions at 1pm and a Treasury Statement at 2pm.

Yesterday we printed double distribution trend up. The day began with a gap down into levels unseen since March 31. A brief probe lower at the open managed to close the 03/31 gap before buyers stepped in and drove price higher. Said buyers pushed price higher for the first 30 minutes, then we had a sharp move back to the daily mid, buyers defended and this set up a gap fill. Price then chopped along the Monday low for the rest of the session.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,317.50 before two way trade ensues.

Hypo 2 stronger buyers trade up to Monday naked VPOC 13,500 before two way trade ensues.

Hypo 3 sellers take out overnight low 13,091 setting up a run to 13,000.

Levels:

Volume profiles, gaps and measured moves: