Not in the stock market. Stocklabs is flagging bullish and only the old gods, Janet Yellen or Walmart can do anything to hinder the rally. It is the mayhem of progress I’m referring to as we race to put corn into the ground before the moon goes full. Ten days.

Corn lads, sweet corn and lots of it. I’m working with five different heirloom varieties, one purported to yield tasty sweet corn in 65 days. One ear per stalk, stalks 5-to-7 feet tall. Said corn will be converted into doge as I and others toil to help daddy Elon realize his vision of one currency to rule them all — a joke coin — a hustle — the hustle IS alive.

I work so heckin’ dang good hard you have no idea. Toiling. All the little bones in my wrists and forearms click and wiggle when I sit down and commit to the mouse and keyboard because most of the time they wield shovels and wheeled barrows and hoses and knives and saws — tools — I’m a man not some video game junkie — I jack it with both hands. Work while you can an old man told me.

When I’m an old boomer I need everything done built. Then I can sit around taking psychedelics and meditating and writing stories.

I reckon I’ve got at least 50 good years left in me for speculating, as long as I can keep my brain sharp. As for building, toiling, developing the infrastructure to be a fully independent food producer high up here in the progressive north, I prolly have about 10 years left on this decaying sack of flesh I inhabit.

My bones wiggle and creak. My entire suspension system from the rooter to the tooter is already flashing a check engine light on the proverbial dashboard of the central nervous system.

I work like a machine. Steady. Long duration sessions 14 sometimes 16 hours without breaks. Fueled by cheap lager, del taco bean goo and reefer. I toil like this despite warnings from Hermann Hesse and Thea von Harbou.

I love seeing a person move with purpose. This nice Asian man at Home Depot last week helped me load some OSB into EL BURRO BLANCO. He was jogging around the parking lot. He had a little ear piece in and was on a call talking about handling some business. He was like a grown up version of ‘Data’ from The Goonies. I’m usually the only one bouncing around, relentlessly dominating tasks. It was nice to see someone else moving with some purpose.

The fat american can only move with purpose when they’re in their penis-compensation-mobiles, hurrying across the motorways and for what? They look miserable. Hurrying to their next serving of meat.

People in Detroit often wonder aloud, “why do so many chaldeans have so much money?” Because they’ll put three generations, sisters and cousins in one 4,500 square foot house and concentrate their resources. The Italians used to do this too, but they’re drifting into the Americanized way of solitude and mediocrity.

Chaldeans stick together and you look at all the businesses they own after only being in this country one maybe two generations, and it makes you realize just how mysterious the fat american is. Your clan has been here for how many hundred years? Yet live in a house owned by a fucking banker? And a picked-up truck you borrow for 600 fiat american a month.

My clan has been in America for only about 50 years and look at us? We’re thriving. Coping land deals. Eight lots at a time. Immigrant hustle will win nine times out of ten especially in the shadow economy. The land is there. We buy. We fix it to grow corn. We’re the captains now. Go cheer for your college basketball team, stupid american, we will toil and toil and TOIL.

That’s about alls I have in me today in terms of Sunday sentiment.

Raul Santos, May 14th 2021

And now the 338th edition of Strategy Session. Enjoy.

Stocklabs Strategy Session: 05/17/21 – 05/21/21

I. Executive Summary

Raul’s bias score 3.20, neutral. Steady rally into Tuesday morning, then look for Walmart earnings to dictate direction until Wednesday afternoon, then watch for the third reaction to FOMC minutes to dictate direction into the second half of the week.

II. RECAP OF THE ACTION

Trend down Monday across the board. Continuation selling through Wednesday. Snapback rally Thursday and into the weekend, accentuated by a trend up Friday.

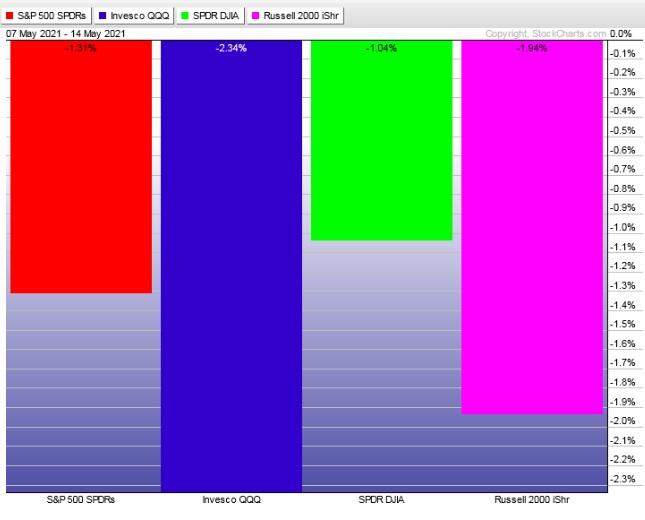

The last week performance of each major index is shown below:

Rotational Report:

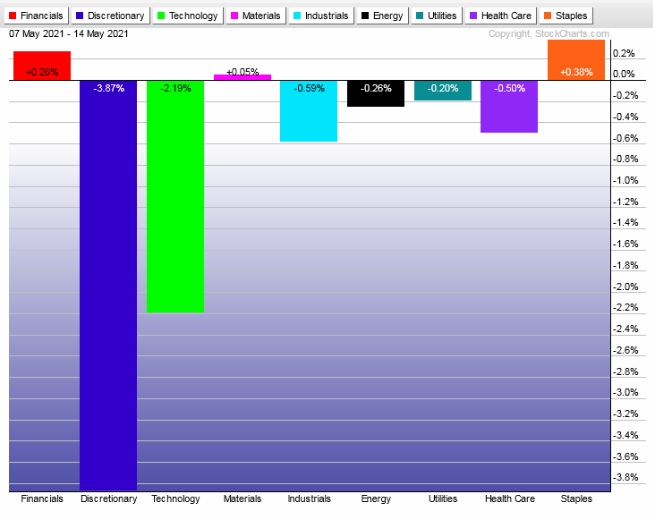

Tech and Discretionary rotated away from. Staples and Financials relative strength.

slightly bearish

For the week, the performance of each sector can be seen below:

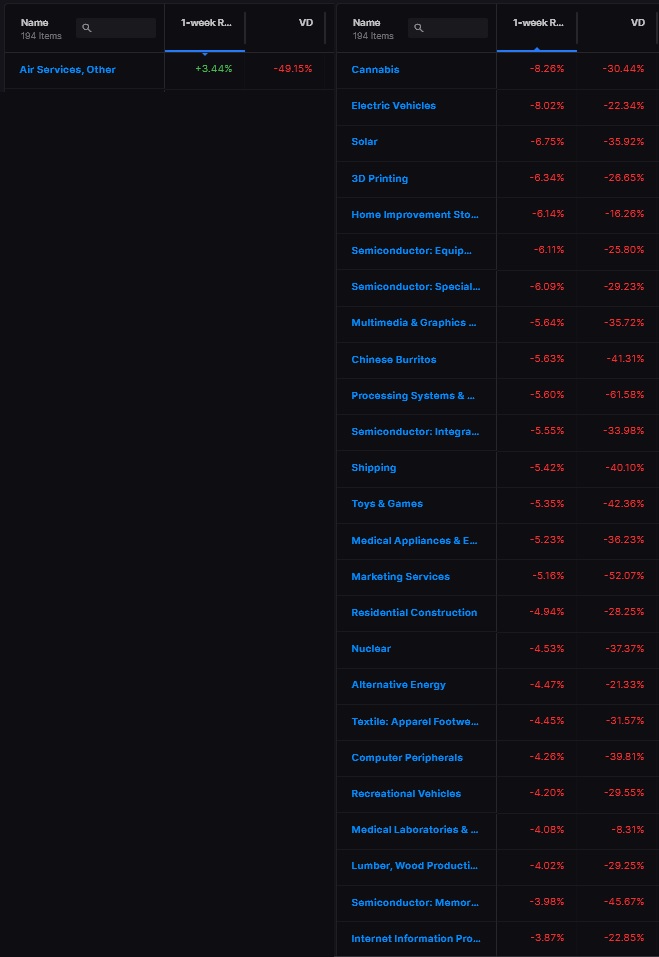

Concentrated Money Flows:

Money flows negatively but not in an extreme manner. There were some key semiconductor industry groups on the negative side of the ledger.

Volume delta remains pinned negative and median return was about -130 basis points.

Money flows are slightly bearish.

Here are this week’s results:

III. Stocklabs ACADEMY

Counting cycles

See last week’s Strategy Session. It references a 6-month oversold cycle that ended May 4th. That same day Stocklabs went oversold on the 6-month again. This is where one must decide how they count cycles and which ones count and which ones don’t.

Because if we decide that a signal happening on the tenth day is an active signal, then we are 8 days into a different oversold cycle.

However, the way I count these signals is that it runs through that tenth day and a new signal would only be active the following session.

That puts us into a position where The Wednesday May 12th oversold signal is active. Otherwise, it would not be since it occurred in the middle of the May 4th signal.

It does not matter which method we choose, only that we stick to it. Otherwise when everything is moving and our emotions are maybe clouding our judgment we are more likely to commit an error.

Of note, the May 12th oversold signal triggered on both the six and twelve month ago. I am going with it.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Steady rally into Tuesday morning, then look for Walmart earnings to dictate direction until Wednesday afternoon, then watch for the third reaction to FOMC minutes to dictate direction into the second half of the week.

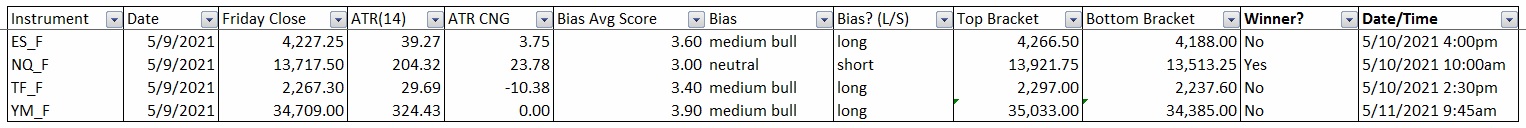

Bias Book:

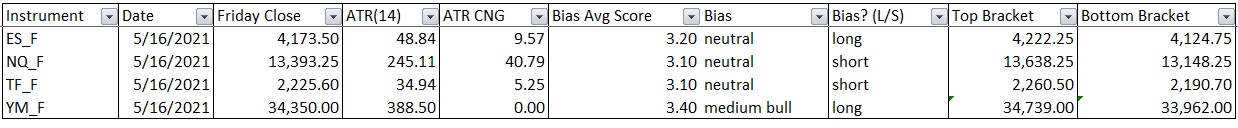

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

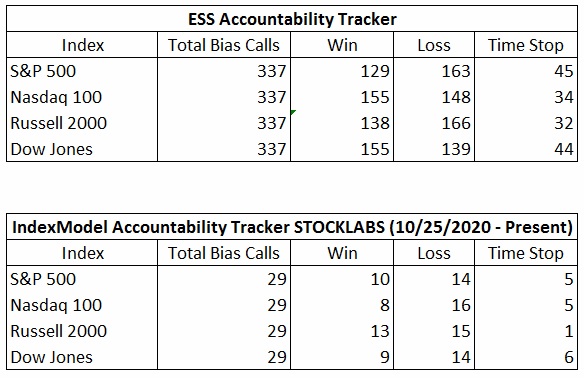

Bias Book Performance [11/17/2014-Present]:

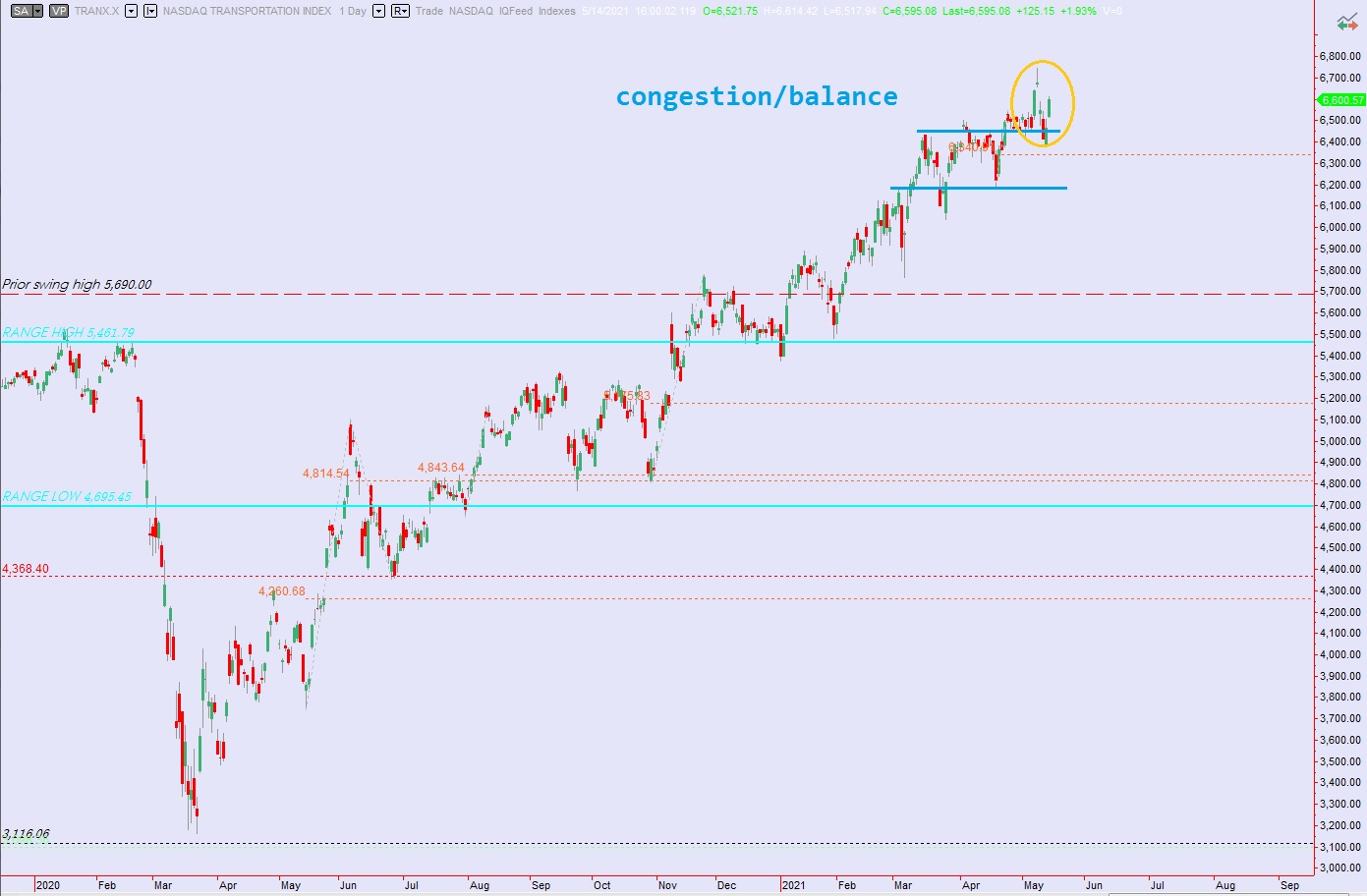

Balance and congestion

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports saw an uptick in volatility along the highs here, making the picture heading into next week appear to be balance. Balance along these highs is not bearish.

See below:

Semiconductors are also congested and appear to be in a healthy, time-based correction, balanced along the highs.

See below:

V. Stocklabs Hybrid Oversold

On Wednesday, May 12th Stocklabs flagged oversold on the 6- and 12-month algorithms. These bullish cycles run through end-of-day May 26th. Here is the performance of each major index so far:

VI. INDEX MODEL

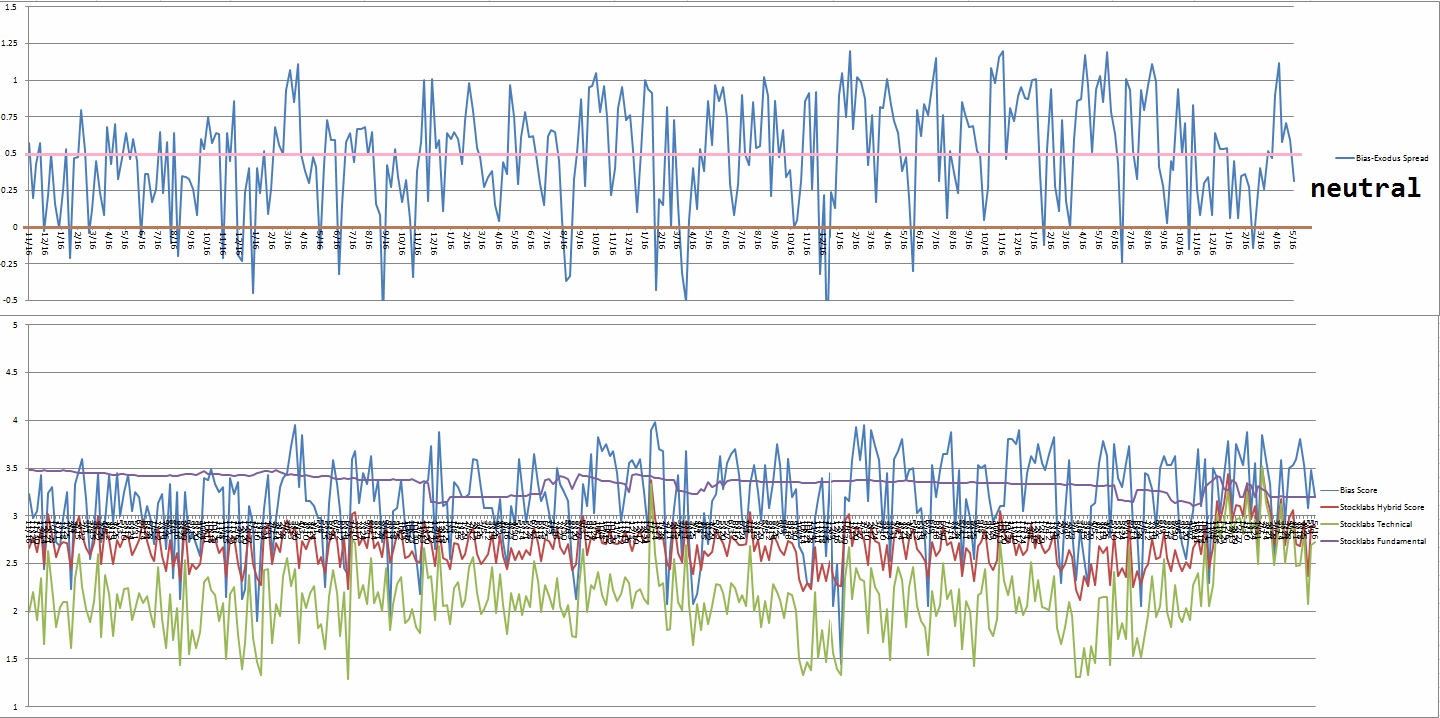

Bias model is neutral after being e(RCS) bullish last week and RCS bearish two weeks prior

We had a Bunker Buster eleven weeks ago.

Neutral means no bias.

Here is the current spread:

VII. QUOTE OF THE WEEK:

“Commit to your business. Believe in it more than anyone else.” Sam Walton

Trade simple, guard your emotional capital

If you enjoy the content at iBankCoin, please follow us on Twitter

Keep ’em coming, Raul.

I really appreciate it.

Love the Chaldean reference; you only know if you’re from the metro Detroit area