Totally cliche right? To proclaim Sapiens to be a meaningful book? Kinda sucks but, the book just really makes clear how to invest.

Now I may be just a humble NASDAQ futures trader and prolific but unpopular blogger/fintwitter-er, but several years back I read that pop-culture book and it changed the way I invest. Folks sometimes ask me what book I recommend on investing, and I say Sapiens every time. The writing in that book laid the ground for the investing style I’ve come to call “faith-based investing”.

Drinking the koolaid is what made people into bitcoin millionaires. HODL! The battle cry of seemingly insane investors, right?

The big shot professionals with their serious haircuts can’t help but snicker at the concentrated bet investors who go all in on one or a few ideas. What could go wrong? They sarcastically ask.

They don’t have big enough huevos.

The concentrated long term bet on any financial instrument is a threat to their professional existence. The people of financial services make a living prying into the personal life of others then making really average investments in really average ways that produce really average returns.

Which is fine if you already have money.

Most of us don’t.

If you’re someone who wasn’t born rich and you want any hope of becoming truly wealthy then you have to make concentrated long term bets.

I strongly recommend making your biggest bets on yourself. On places where your efforts have an effect on the outcome. These require less faith in others and more in yourself.

I know that when I buy land I can work that land. You cannot take away my willingness to work. Only the gods can. I will turn a seemingly useless patch of dirt into a fucking goldmine. But I am cut from a different cloth then most of you. I am built like mountain goat. I am strong on plow and there is immigrant blood in my and it boils hot and make me want to kill.

So I channel all that energy into land development and have total confidence in my ability to strike the stone until wine flows.

Then I go and seek bigger humans than me and invest in them. I invest in people and put my faith in people. People like Elon Musk, JACK DORSEY.

Faith is what lets me sit through the big drawdowns. Just like the Christians can pray to their god when the going gets tough, I can rest assured that I have invested with the brightest humans in the world and that allows me to wait until the tide turns.

The right stuff to invest. The willingness to think and fast and wait. That is all you need. Throw a bit of faith on top and you have the recipe for big gains.

Listen man, make average investments expect average returns. Do something different, expect different results.

That’s all I have to say about investing.

Raul Santos, December 20th 2020

And now the 317th editon of Strategy Session:

I. Executive Summary

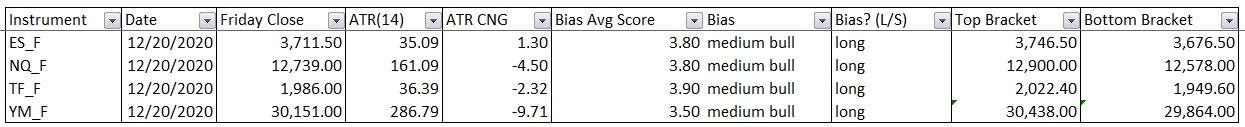

Raul’s bias score 3.75, medium bull. Buyers hold price steady along the highs during the holiday shortened week.

**U.S. markets will close early Thursday (11:15pm ET) in observation of Christmas Eve and remain closed Friday in observation of Christmas Day.

II. RECAP OF THE ACTION

Strong rally early Monday, carried through the week. Selling Friday gave back some of the Wednesday/Thursday gains before strong ramp into the weekly close reclaimed much of the gains.

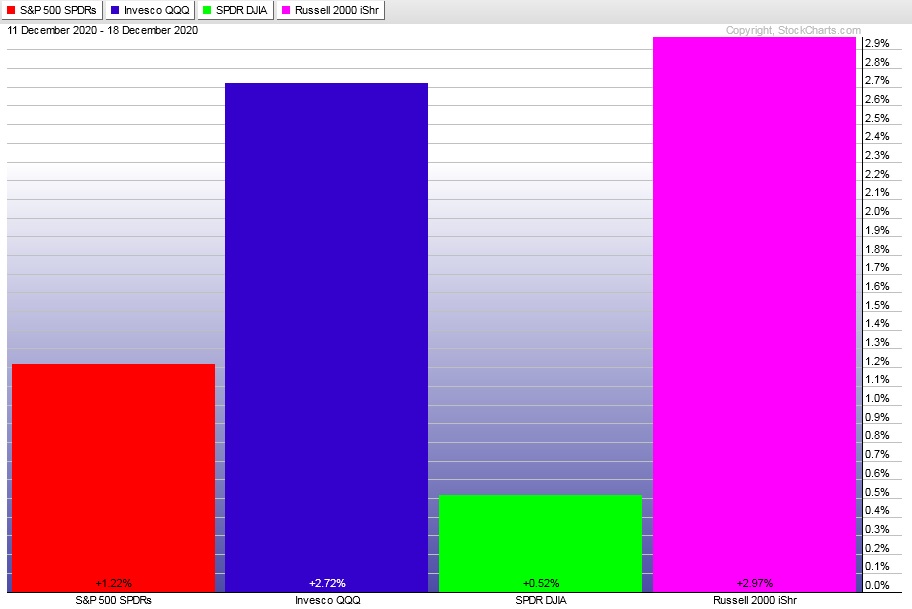

The last week performance of each major index is shown below:

Rotational Report:

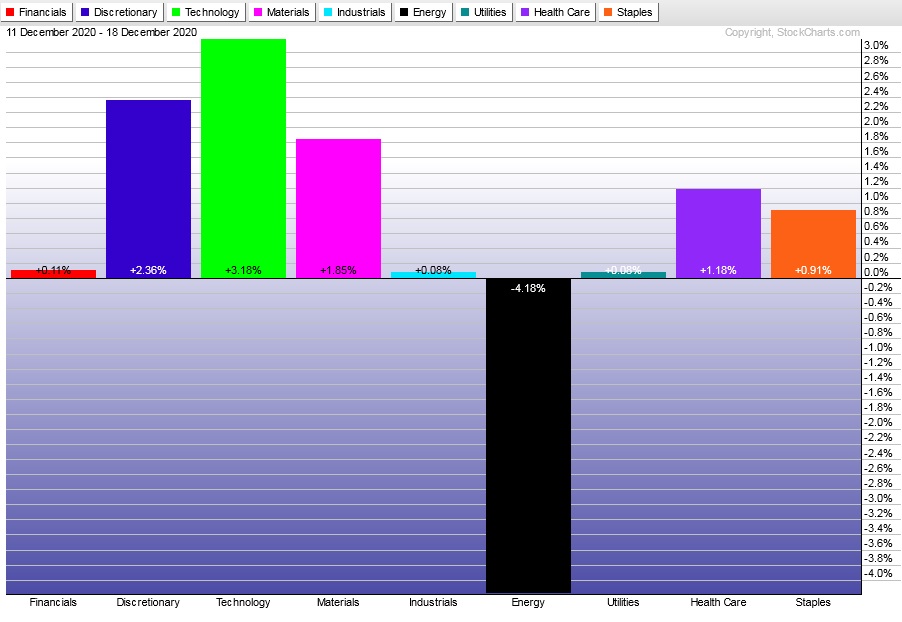

Energy still on its own planet. Tech and discretionary way out in front.

Bullish

For the week, the performance of each sector can be seen below:

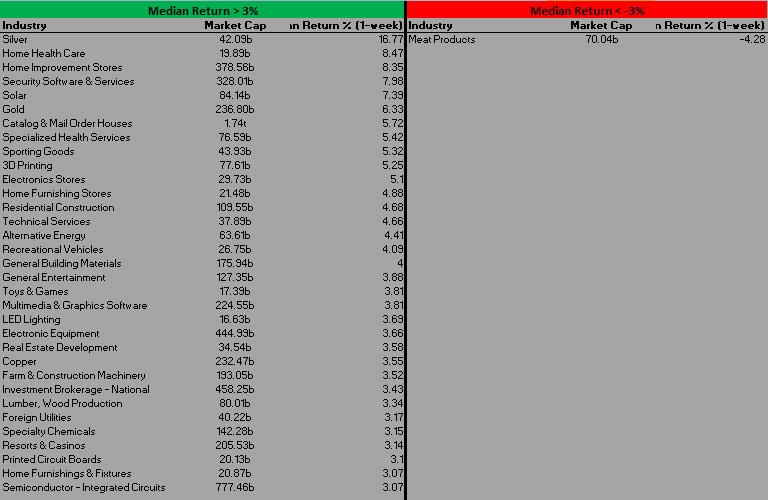

Concentrated Money Flows:

Industry flows skew back to bullish after being neutral last week.

Here are this week’s results:

III. Stocklabs ACADEMY

Stocks go up

An interesting observation—from the Intelligence page on Stocklabs. Setting the back test period to ten years and observing the real time data on the current hybrid score, the market has been higher 71.2% of the time over the ten day period.

The statistics from the real time scoring consistently show higher probabilities of prices being higher over a wide range of algorithmic scores.

Something to think about. Consistently engaging the broad market to the short-side is a low probability bet over multiple day holds.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Buyers hold price steady along the highs during the holiday shortened week.

Bias Book:

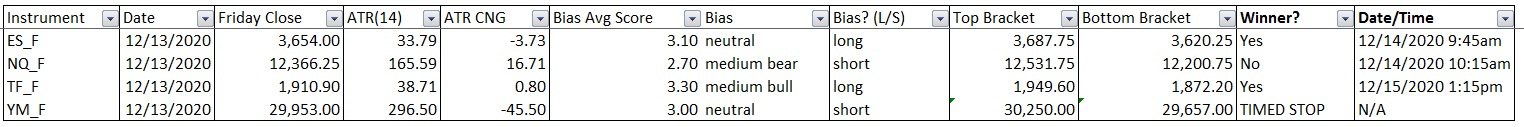

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

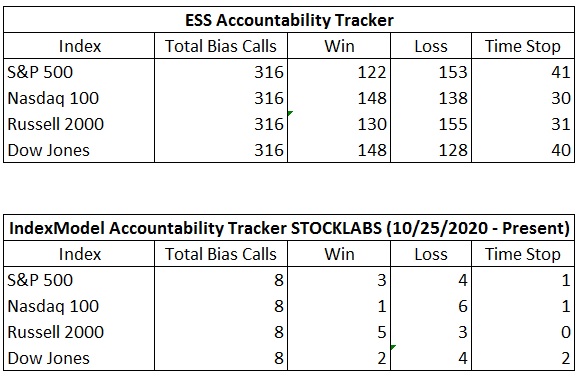

Bias Book Performance [11/17/2014-Present]:

Semiconductors keep going up, Transports could still fail

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports are sticking around the highs, which makes the failed auction less and less likely. However, one cannot help but see the ascending flag set up, which often times sets up a leg lower. The failed auction picture is still in play and this is a critical contextual component to keep in mind heading into year end.

See below:

Semiconductors negated anything seemingly sketchy last week. Now they simply look like a chart going higher.

See below:

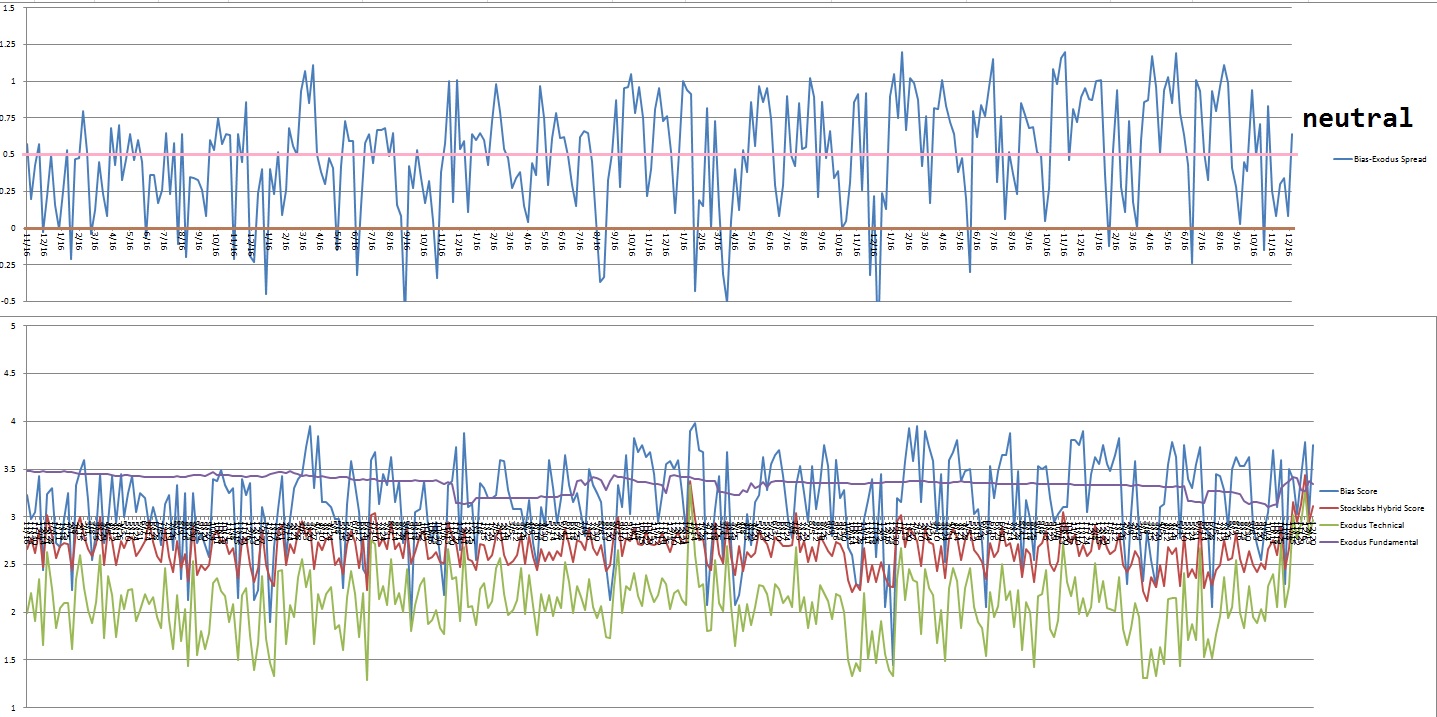

V. INDEX MODEL

Bias model is neutral for a sixth consecutive week. No bias.

VI. Stocklabs HYBRID OVERBOUGHT (COMPLETE)

On Friday, December 4th Stocklabs signaled hybrid overbought. This is a bullish cycle that runs through Friday December 18th, end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“No winter lasts forever; no spring skips its turn.” – Hal Borland

Trade simple, savor the moments as they come

If you enjoy the content at iBankCoin, please follow us on Twitter