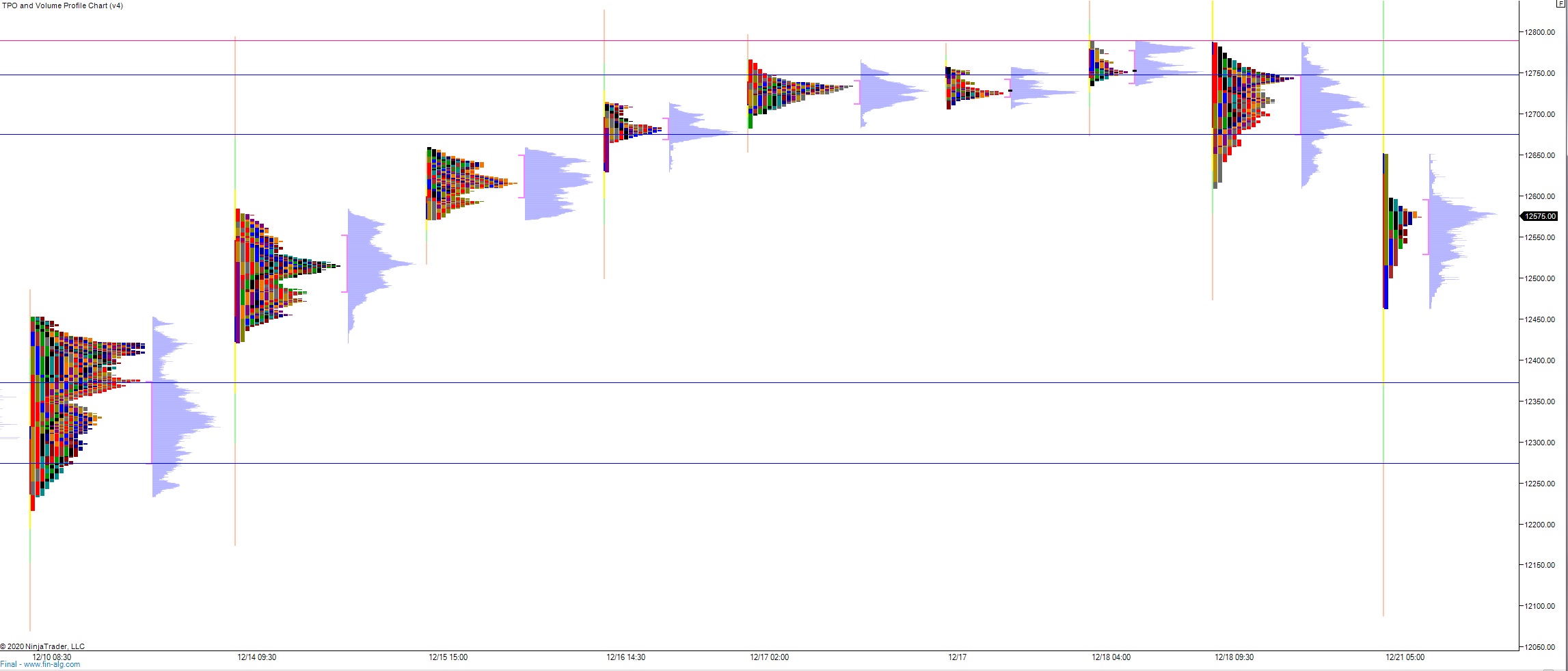

NASDAQ futures are coming into Christmas week down a quick -140 after an overnight session featuring extreme range and volume. price was balanced overnight until about 4:30am New York. From 4:30am until about 6am price drove lower, rotating unidirectional down to the open gap left behind last Monday afternoon. Since then price has bounced off the lows, and as we approach cash open price is hovering in the lower quadrant of last Wednesday’s range.

On the economic calendar today we have 3 and 6-month T-bill auctions at 11:30am followed by a 20-year note auction at 1pm.

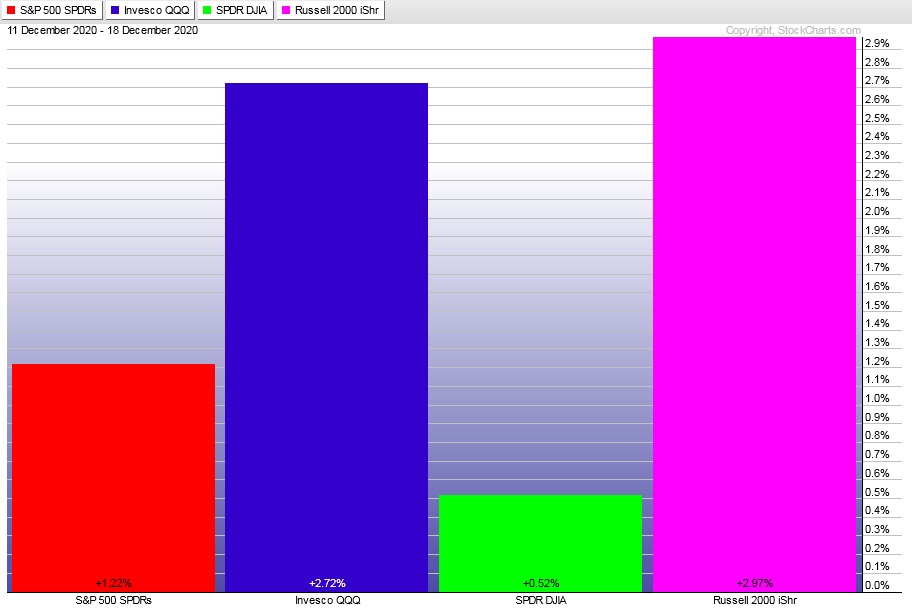

Last week featured a strong rally early Monday that carried price higher throughout the week. Selling Friday gave back some of the Wednesday/Thursday gains before strong ramp into the weekend close reclaimed much of the gains. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap up and poke higher, making a new all-time high before sellers stepped in and closed the overnight gap then continued their campaign lower, down through the Thursday low. Then we spent New York lunch checking back to the daily midpoint (which sellers defended) setting a second leg lower. This second leg worked price down through the Wednesday VPOC. Then, late in the session, right around the Wednesday midpoint, a strong ramp took hold, ramping price back up above the midpoint and closing the day out in the upper quad of range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 12,675.25 before two way trade ensues.

Hypo 2 stronger buyers work a full gap fill up to 12,739. Look for sellers up at 12,747.75 and for two way trade to ensue.

Hypo 3 sellers gap-and-go, trading down through overnight low 12,463.50 on their way to tagging 12,400. Look for buyers down at 12,372.25 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: