NASDAQ futures are coming into Monday gap up after an overnight session featuring extreme volume on extreme range. Price shot higher Sunday evening when Globex opened for trade, with price rallying up beyond the Friday midpoint before reversing the entire spike and more throughout the early A.M. hours. As we approach cash open, price is balanced out in the lower quadrant of last Friday’s range.

On the economic calendar today we have Markit composite/manufacturing/service PMI at 9:45am followed by 3- and 6-month T-bill auctions at 11:30am.

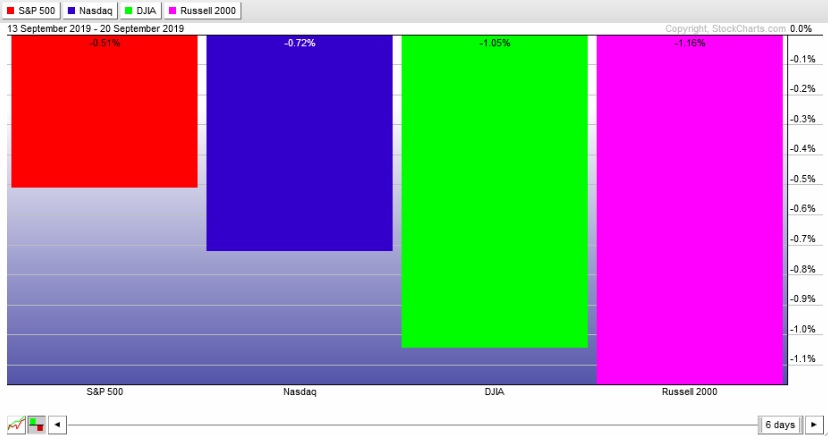

Last week U.S. index prices marked time through the beginning of the week after coming into Monday gap down. Participants appeared to be waiting for the FOMC rate decision Wednesday before taking action. After the rate cut sellers stepped in and drove prices lower before being overrun by strong buying. The strong buying continued into Thursday morning before prices eventually reversed and returned to the lows of Wednesday by the end of the week. The last week performance of the major indices is shown below:

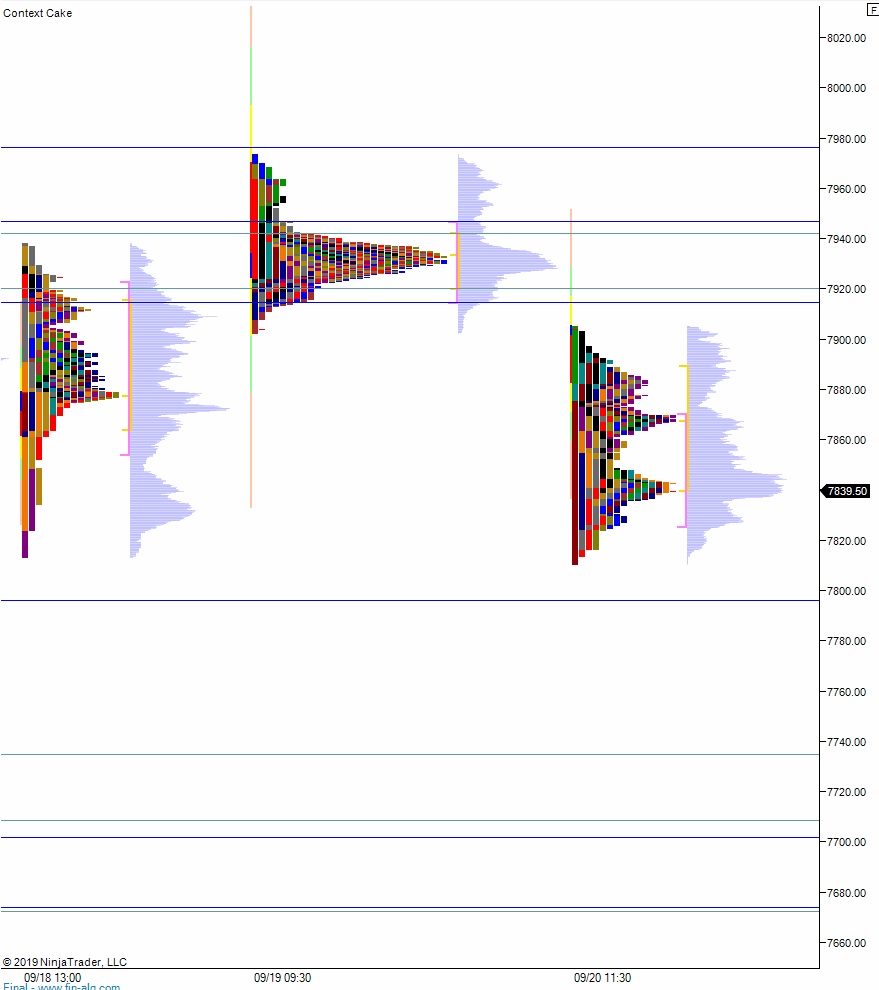

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up to about the midpoint of Thursday’s range which sellers quickly resolved lower. Sellers then took out Thursday’s low and accelerated price down into the post-FOMC spike, trending down below the Wednesday low by a few ticks before discovering a responsive bid. Buyers nearly worked price back up to the daily midpoint before sellers stepped back in and returned price near the lows.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7832. From here we continue lower, down through overnight low 7814. Look for buyers just below the 7800 century mark at 7796 and two way trade to ensue.

Hypo 2 stronger sellers sustain trade below 7796 triggering a liquidation down to 7743.25 before two way trade ensues.

Hypo 3 buyers work up through overnight high 7897.50 and continue higher, up to 7900 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: