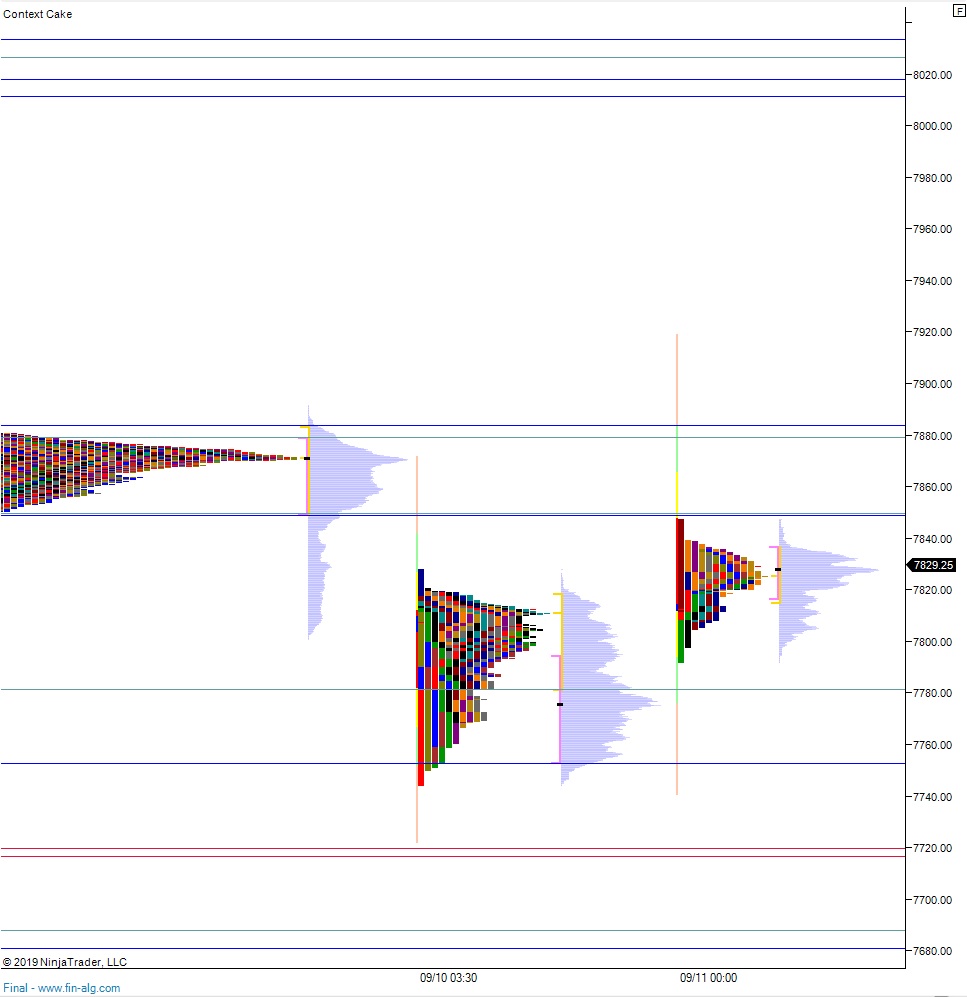

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, tradig up above the Monday midpoint before settling into balance. As we approach cash open, price is hovering above Tuesday’s range.

On the economic calendar today we have crude oil inventories at 10:30am followed by a 10-year note auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap down and drive lower. Sellers drove price down to a new two-day low, probing into the top-side of a multi-week range that price broke away from last Thursday after President Donald Trump tweeted something positive regarding tariff talks between U.S. and China, saying they would resume in October. Buyers stepped in ahead of the rally point and began working price higher, eventually reclaiming the midpoint by New York lunch and rallying up and away from it to go range extension up. A retracement to the mid was defended by buyers who eventually ramped price back to the daily high near end-of-day.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7847.50. Look for sellers just above at 7849.25 and two way trade to ensue.

Hypo 2 sellers press into the overnight inventory and close the gap down to 7815.50. From here we continue lower, down through overnight low 7786.50. Look for buyers down at 7800 and two way trade to ensue.

Hypo 3 stronger buyers sustain trade above 7850 setting up a move to tag 7879 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: