NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme volume on elevated range. Price worked lower overnight, giving back the gap up we had to begin the final week of February. At 8:30am the housing starts data came in well-below expectations (-11.2% vs -0.1% consensus) and building permits came in slightly better than expected. As we approach cash open price is hovering inside last Friday’s range, near the highs.

Also on the economic calendar today we have Fed Chairman Jay Powell set to testify before the Senate banking panel at 10am. Consumer confidence data also comes out at 10am. At 11:30am the US Treasury is auctioning off $26 billion worth of 52-week T-bills, then at 1pm $32 billion worth of 7-year T-notes.

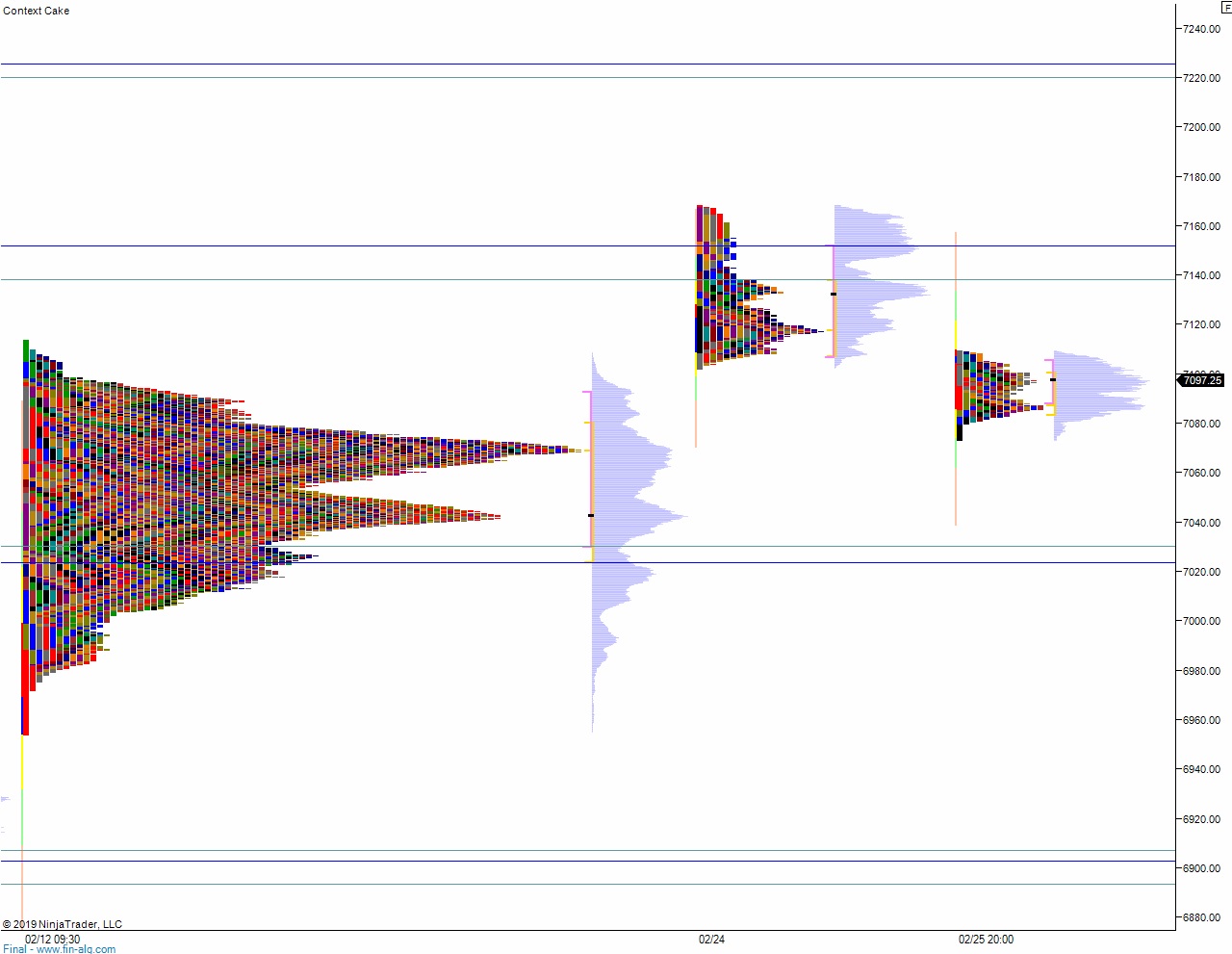

Yesterday we printed a neutral extreme down. The day began with a gap up, putting the market out-of-balance to start the week. We trade up to close the 11/8/18 gap to the tick, briefly going range extension up before the auction failed. Sellers moved us down through the entire daily range. By late afternoon price had rallied back to the daily mid, but it was defended by sellers and we closed out the day on the lows.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7125.75. From here we continue higher, up through overnight high 7129.25. Look for seller up at 7137.75 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 7073.25 to set up a move to target the open gap at 7035.25 before two way trade ensues.

Hypo 3 stronger sellers trade us down to 7023.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: