NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range and volume. Price worked higher in a balanced manner, trading up into prices unseen since November 8th. As we approach cash open price is hovering along the 11/08 lows.

On the economic calendar today we have wholesale inventories at 10am, a 6-month T-bill and 2-Year T-note auction at 11:30am, and a 3-month T-bill and 5-year T-note auction at 1pm.

All major earnings announcements have been submitted for Q4. There are several non-impactful companies reporting earnings this week, but they are extremely unlikely to affect the Nasdaq 100.

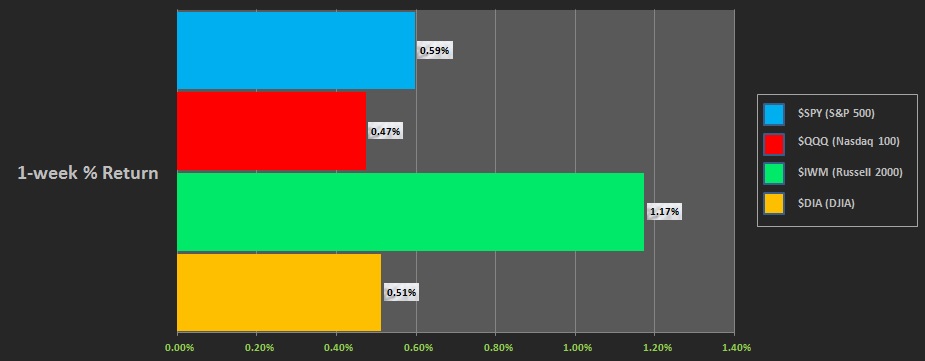

Last week was shortened. We were closed Monday in observation of George Washington’s birthday. Tuesday saw a sharp gap lower that was bought up right at the open. We balanced through Wednesday. The FOMC minutes Wednesday afternoon resulted in a third reaction up. Thursday attempted lower but failed after auctioning through the Tuesday low, and we spent the rest of the week rallying, eventually ending at weekly highs. The Russell had divergent strength, which suggests risk tolerance is increasing. The last week performance of each index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap and push up and away from the Thursday range. Price stalled ahead of the weekly high and reversed much of the daily range, but sellers were unable to press the day into a neutral print. Instead we rallied back up near the day’s high by end-of-session.

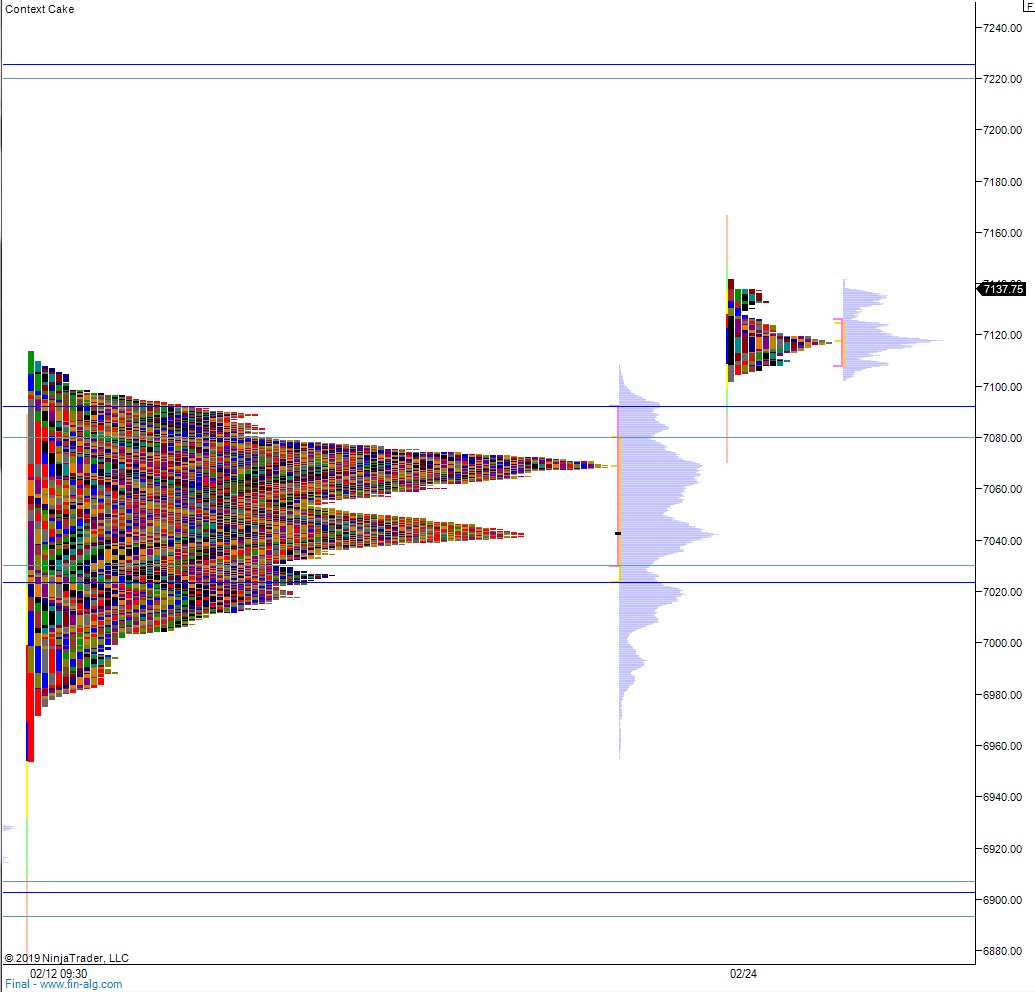

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to close the open gap at 7167.75 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory, working down through overnight low 7102 then closing the weekend gap down to 7088.75 before two way trade ensues.

Hypo 3 stronger sellers drive price down to close the Thursday gap down at 7035.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: