NASDAQ futures are coming into Monday gap up after an overnight session featuring extreme range and volume. Price worked lower overnight, taking out Friday’s low and trading down into the 11/22 range before rallying 120 points. As we approach cash open price is hovering in the lower quadrant of Friday’s trend down.

On the economic calendar today we have JOLTS jobs openings at 10am, followed by a 3- and 6-month T-bill auction at 11:30am.

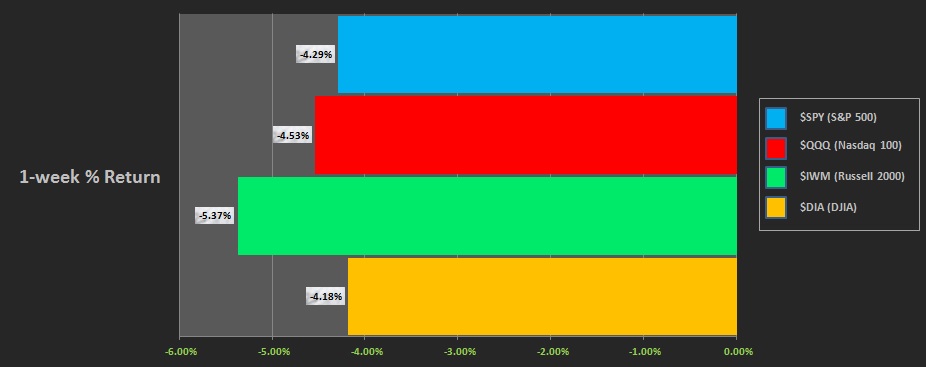

Last week was unique. It began with a pro gap up then chop. Tuesday began with a small gap down that buyers were unable to fill. This resulted in a trend down Tuesday. Wednesday the markets were closed in observation of President G.H.W. Bush’s death. Thursday markets re-open with a pro gap down that is bought up through most of the day. Friday said buying is erased as another round of selling/liquidation blows through, closing out on low-of-week. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend down. The day began with a slight gap down that buyers resolved before the selling resumed. Selling then lasted all day, trending lower right up until closing bell, talking us into the weekend on weekly lows.

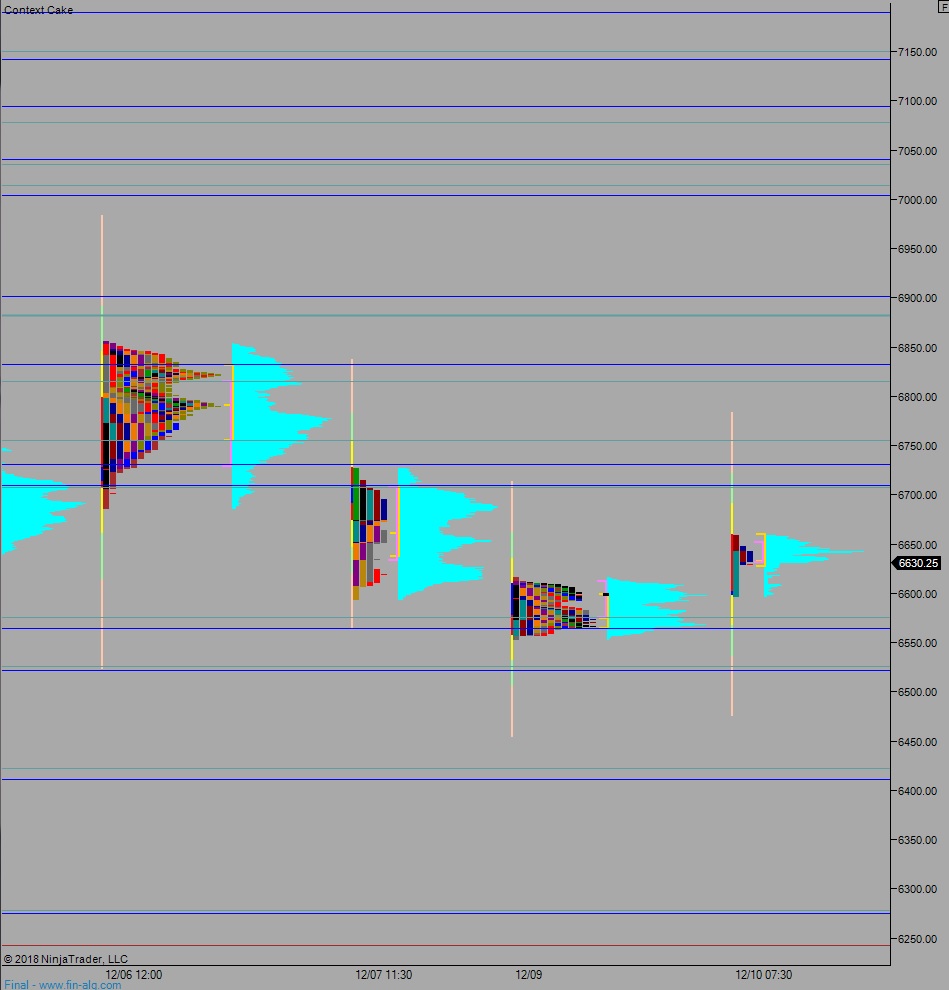

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6620.50. From here we continue lower, down through overnight low 6554 to tag the open gap down at 6530.50. Look for buyers down at 6526.75 and two way trade to ensue.

Hypo 2 stronger sellers continue the liquidation and we trade down to 6454.75 before two way trade ensues.

Hypo 3 buyers step in ahead of 6600 setting up a move to take out overnight high 6660. Look for sellers up at 6709 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: