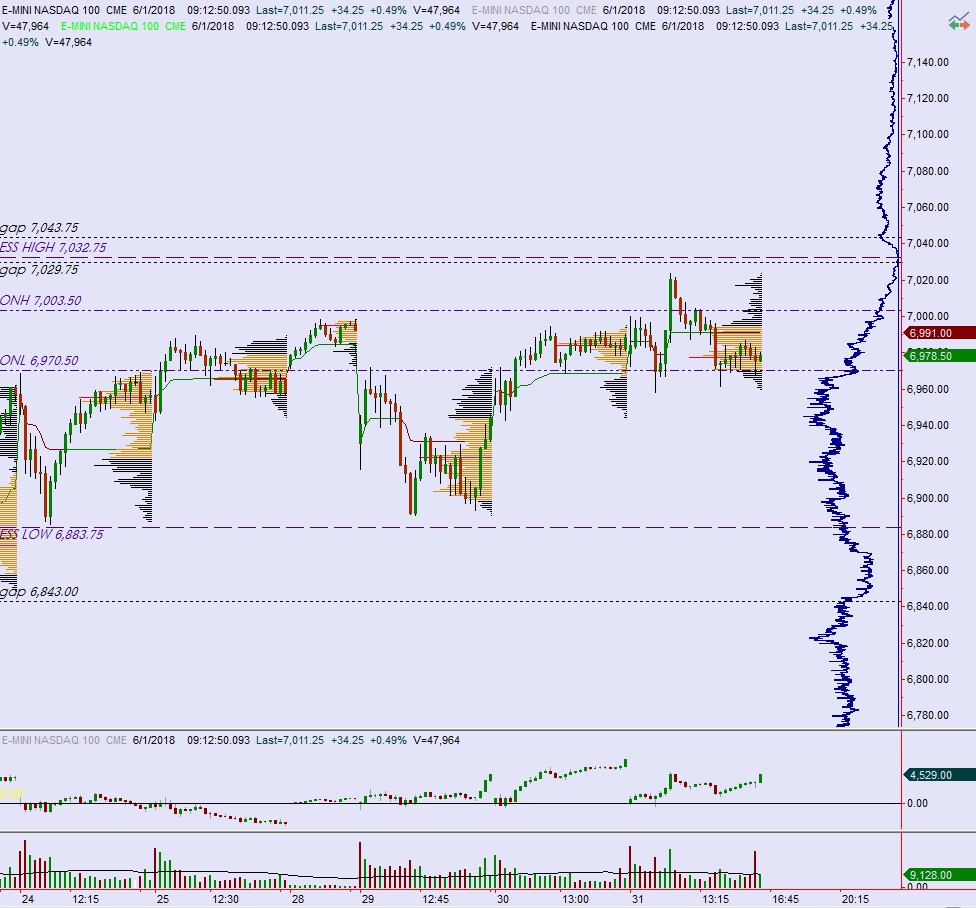

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated volume and range. Price worked higher overnight, slowly and insistently, keeping itself inside of the Thursday range. As we approach cash open price is hovering near the weekly high. At 8:30am non-farm payroll data came out better than expected.

At 10am we have a slew of economic numbers including construction spending, ISM manufacturing, ISM employment, and a few other low impact data points.

Yesterday we printed a neutral day. The day began with with a slight gap down which was filled during the opening chop. Then we worked lower, making a brief range extension down before discovering responsive buyers who traded us up to range extension up, putting us neutral. Then we traded back down into the mean, then below the mean, closing in the lower quadrant.

Neutral.

Heading into today my primary expectation is for sellers to push into the overnight inventory. Look for buyers ahead of the gap fill, around 7000 then a move higher to target 7032.75 before two way trade ensues.

Hypo 2 buyers gap-and-go higher, trading up to 7032.75 then sustaining trade here to set up a move to target 7039 before two way trade ensues.

Hypo 3 sellers work a full gap fill down to 6978.50 setting up a move to take out overnight low 6970.50. Look for buyers down at 6855 and two way trade to ensue.

Levels:

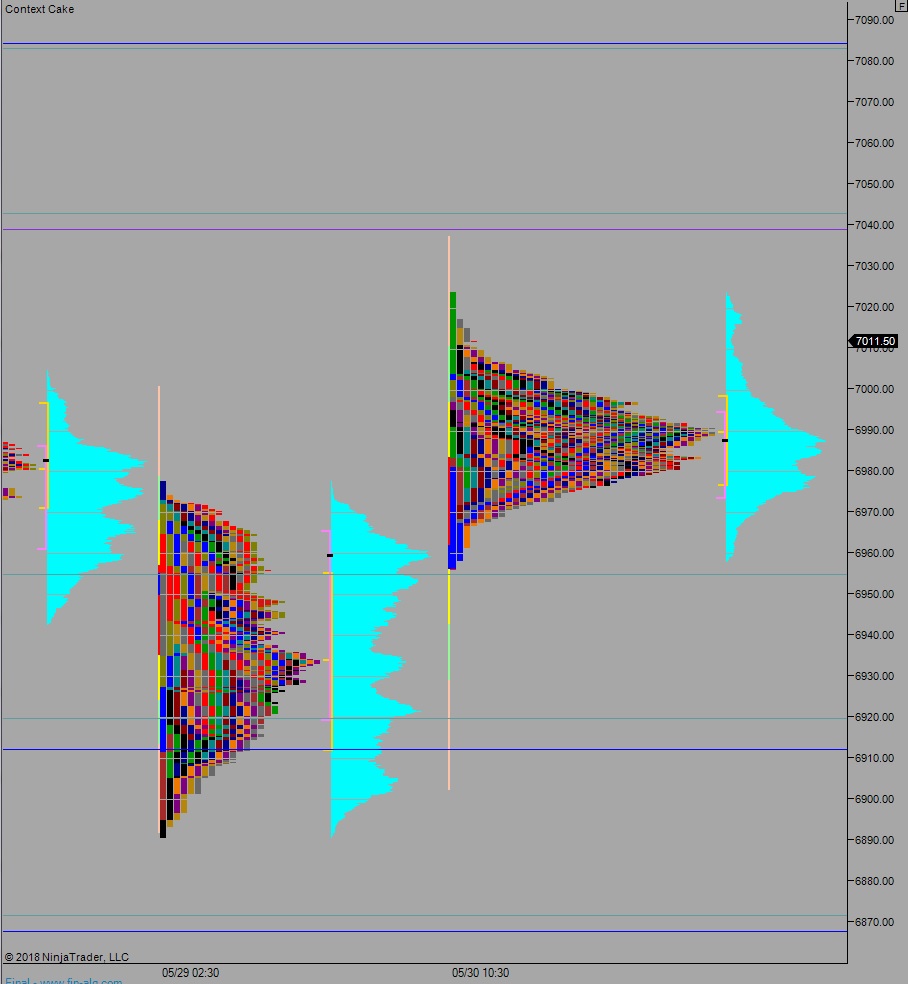

Volume profiles, gaps, and measured moves: