NASDAQ future are starting the week gap up after an overnight session featuring normal volume on elevated range. Price was balanced overnight, trotting along inside of last Friday’s range. At 8:30am personal consumption data came out in-line with expectations.

Also on the economic agenda today we have Chicago purchasing manager at 9:45am, pending home sales at 10am, and both a 3- and 6-month T-bill auction at 11:30am.

Last week was choppy. Sellers stepped in late Monday morning and became initiative into Tuesday, trending markets lower. They pressed into the open Wednesday and discovered a strong responsive bid ahead of major tech earnings, earnings which ultimately served to propel the NASDAQ higher into Thursday and Friday morning. Then Friday morning sellers stepped in again before we balanced early Friday and traded sideways into the weekend.

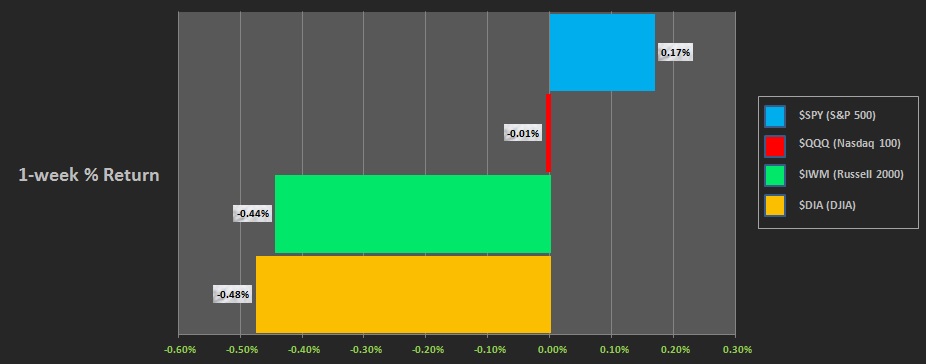

The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began gap up, likely in part from tech earnings that came out Thursday evening. Sellers stepped in and worked the market lower for much of the morning before we balanced and traded sideways into the weekend.

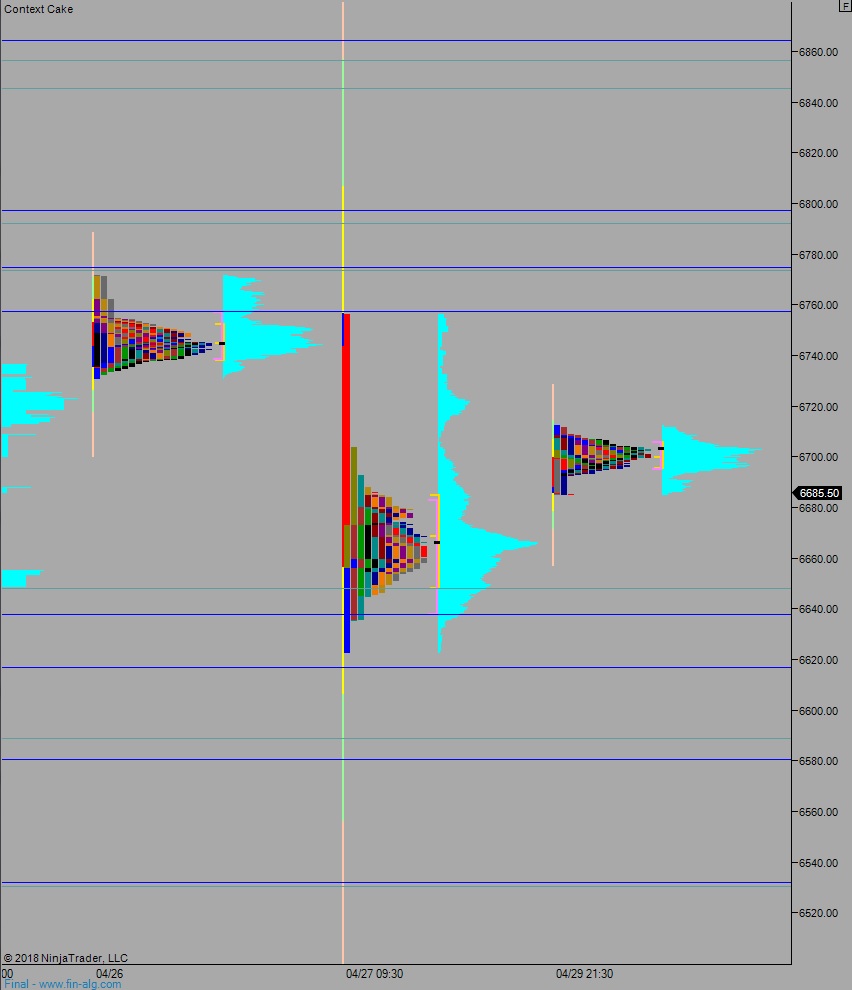

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6668.50. From here we continue lower, down through overnight low 6660.50. Look for buyers down at 6648 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 6712.50 setting up a move to target 6757 before two way trade ensues, effectively negating last Friday’s conviction seller.

Hypo 3 stronger sellers sustain trade below 6640 setting up a move to target 6617.25.

Levels:

Volume profiles, gaps, and measured moves: