NASDAQ futures are coming into Tuesday gap down after an overnight session featuring normal range and normal volume. An uncommon sight over the last few months, to see such normal metrics. Price was balanced overnight, probing below the Monday cash low but overall remaining in the holding patter that began around noon Monday.

On the economic calendar today we have construction spending at 10am, ISM employment/manufacturing data at 10am, and a 4-week T-bill auction at 11:30am.

After the bell, the largest public company in the world, Apple, is set to report earnings.

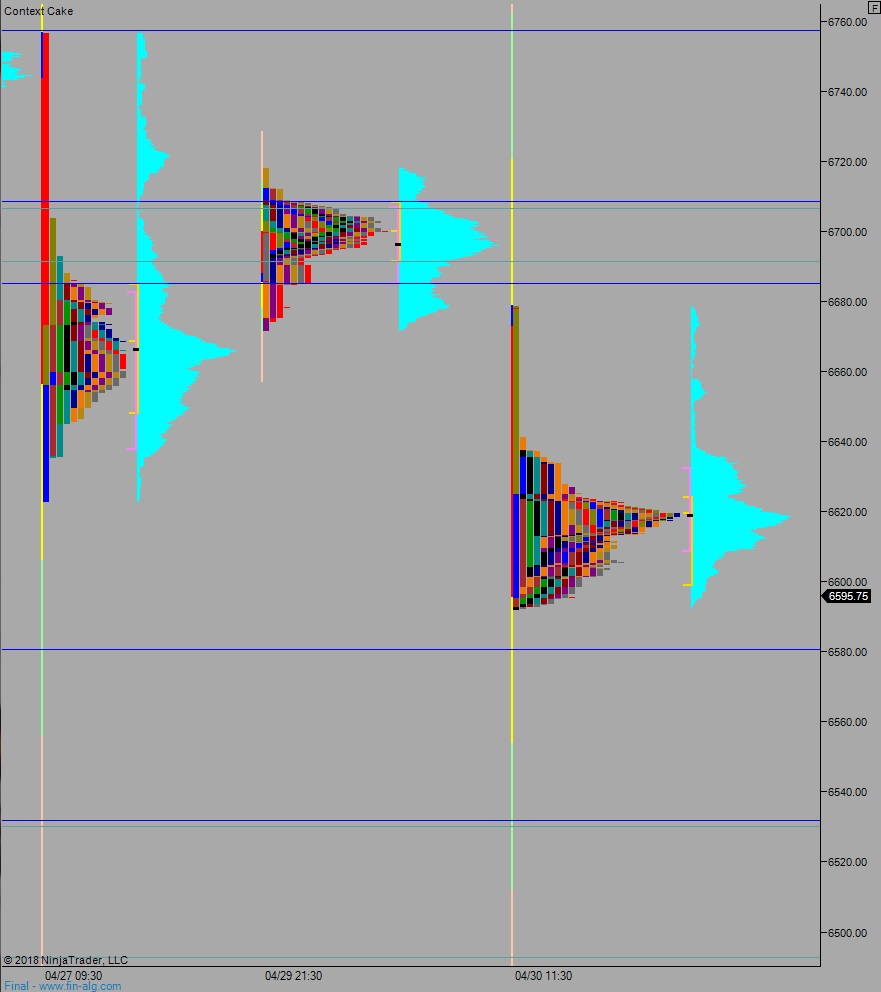

Yesterday we printed a normal variation down. It was shaped like a lowercase letter-b, which suggests a long liquidation took place without sellers ever becoming truly initiative. This short-term phenomenon often occurs near the end of a move, and unless sellers continue pressing into the tape, remaining short becomes a precarious endeavor.

Heading into today my primary expectation is for sellers to gap-and-go lower, down to 6580.75 before we pause and wait to hear Apple earnings.

Hypo 2 buyers work into the overnight inventory and close the gap up to 6612.75 then continue higher, up to 6660 before two way trade ensues ahead of Apple earnings.

Hypo 3 stronger sellers become initiative and work down and close the gap at 6554.75 that we left behind on from last Wednesday. Look for buyers at 6545 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

Nice call on the 80 level. What piqued your intrest there? Thin profile below?

So Apple beat expectations, which was unexpected given the bearish tone of analysts. I thought that they would miss on earnings (but was still long based on the fact that they are still a gigantic cash-making machine).

AAPL will obviously drive stock indexes up in the near term, due to its sheer size. However, we’ve seen earning spikes in AMZN and NFLX get faded over the next few days. Of course, these stocks are bloated so APPL may have more resilience. What are your thought on how this relates to the “sell in May” thesis from Sunday?

i’m back,

have another coin to introduce, much bigger returns this time since it just released and way cheap, way cheap, fractions of pennies. yet this project has the back of deeep players. I will pick up some tomorrow and tell yall about the coin. yall be impressed cause its not flamer shit. this project has fucking purpose beyond you and me, bout the future and shit like that. pick up some ETH so you can make some quick buys. this aint no fucking pumper, its a holdr for annual intercourse of 1000x-10000x.

get that eth ready cause i annouce coin pair soon….!

heres a hint,

remember gnutella? think of it as bulding a new interweb and saying fuck you to the corporates/banks/gov

this is bigger than www

its the next www

unlike the majority of shitcoins, that leave a disclaimer about how the coins they releases hold no intrisect value and can never be redeemed for money…

this new project does the opposite!

states its value is real, you own it, it redeems value as payment,

the network grows, you make more,

everybody eats bread