NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price was balanced until about 8am EST when the market began a steady campaign higher. As we approach cash open, price is hovering along an area that served as support late last week before ultimately breaking on Monday.

On the economic calendar today we have a 4-week T-bill auction at 11:30am.

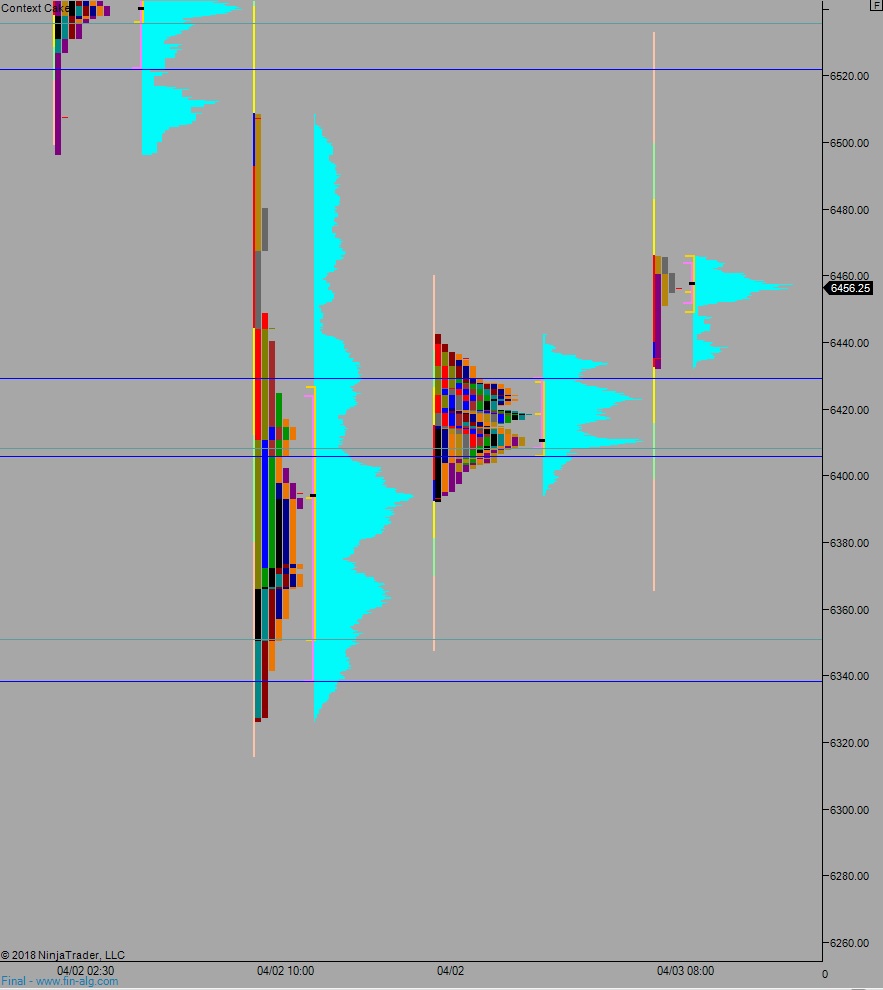

Yesterday we printed a double distribution trend down. The week began gap down and buyers quickly spiked higher on the open, stalling one-tick below the Friday gap 6570.50, but in the parlance of 40 point rotations, close enough to consider it a gap fill. Then sellers stepped in hard, and we were trend down all morning. The secondary rotation lower after New York lunch made new lows, probing down into prices unseen since February 9th when we made a swing low. Responsive bidders were found ahead of the lows and two way trade ensued.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade a half gap down to 6429. Here we see buyers step in and work up through overnight high 6464.75 setting up a move to target 6500 before two way trade ensues.

Hypo 2 stronger sellers work a full gap fill down to 6394.75 before two way trade ensues.

Hypo 3 buyers gap-and-go higher, sustaining trade above 6500 setting up a move to target 6522.

Levels:

Volume profiles, gaps, and measured moves: