Greetings lads, floods coming.

And in the meantime any diligent human who has studied the squirrels knows how important it is to gather supplies ahead of the winter. The winter is when the weak perish and the hearty procreate.

Some humans are much better at gathering supplies than others. When it seems like not as many dollars are being funneled into the stock market rally, people read that as bearish. It really does not matter. There is still enough participation.

It blows my mind when people talk about pensions. Defined benefits. They are dead and gone. A relic from an era of men who could not be held responsible to gather enough supplies before they become useless–enough supplies to last them through their useless years.

Nowadays, you can augment your brief existence here on earth with robots. This is how you live very old and happy without a pension. In the old days, they just enslaved people. Quite evil.

But being a benevolent robot overlord is not evil. It is natural and healthy and much better than paying money every week into a bastard pension run by some pencil dick in Boston.

Have you guys seen bitcoin by the way? It is nearly $6,000 fiat American dollars to buy one coin. I love the “governments are gunna shut them coins down” argument, because it truly is the most moronic. It demonstrates a complete lack of understanding. Bitcoin is decentralized. There is nothing to shut down. It is, indestructible. Brilliant.

See you fuckers at $100k.

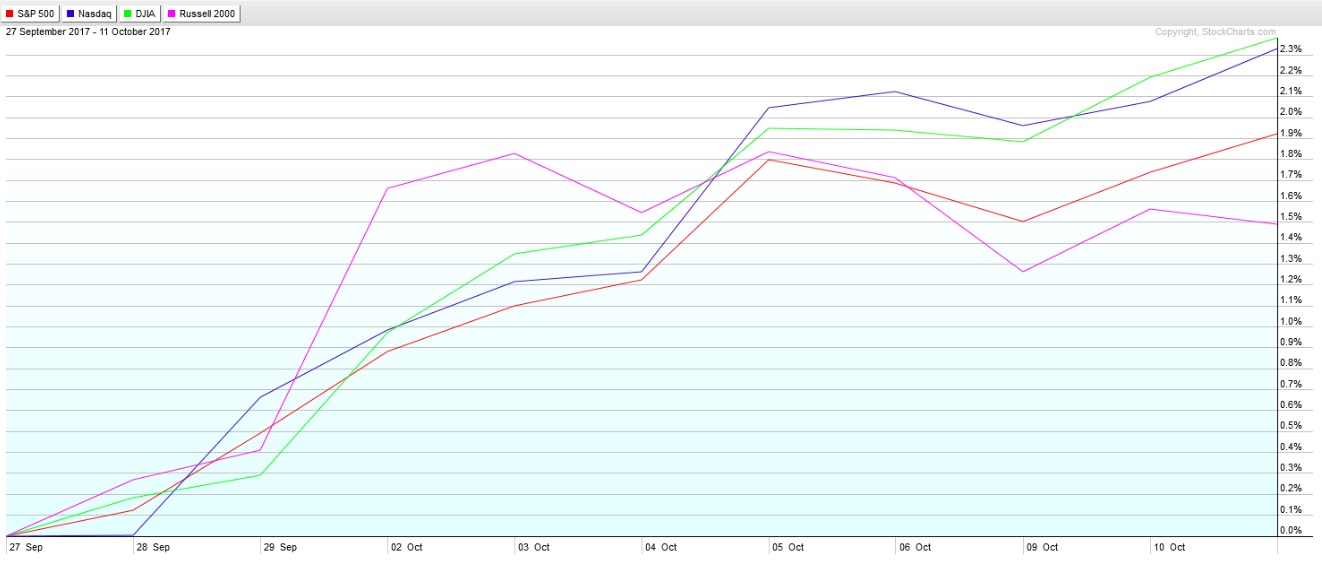

Moving on. The models inside Exodus caught a 2% rally across the board recently. During our one-on-one phone calls I always tell members, “If you can get out of your own way mentally, and just trade the 36-month hybrid overbought/oversold cycles, you will pay for your membership 10x over.” I hope they listen. Look at this quantitative excellence:

As for next week, the model I build, which seeks to predict (somewhat) the nature of the auction over the next five trading days, it is looking for a calm ascent higher. Nothing robust. This was the same call last week. Will it be dead-eye dick accurate two weeks in a row?

As always, TBD.

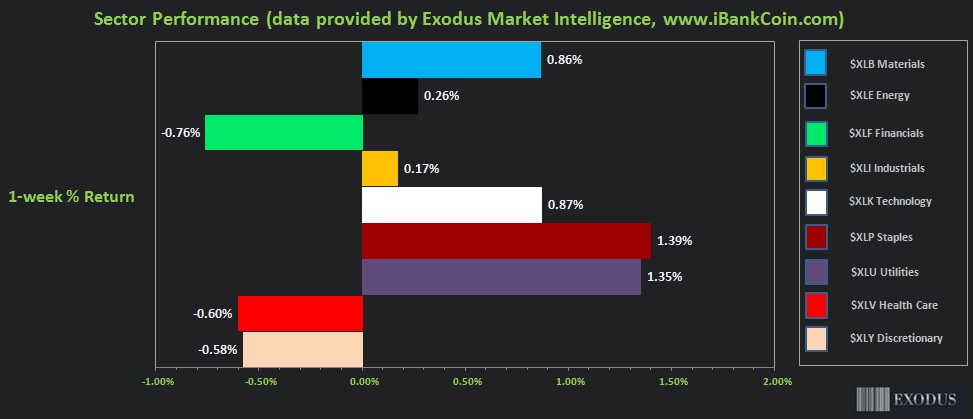

One caveat, a feather in the proverbial bearcap, if you will, comes in the form of last week’s sector rotations which skewed towards Utilities and Staples. In fact, my best performing stock so far in Q4 is $CWT. These rotations speak of risk aversion:

I will be in the bush this upcoming week. I have been in the city for far too long. I am beginning to consider making to kill some of the locals townsfolk out of sheer boredom. Therefore, as soon as I complete this letter to you, the loyal reader, I am hopping in the transient express and making my way to the north shore of Lake Superior. Lake Superior is the largest freshwater lake by area in the world. To think, it is only 5 hours away and I have hardly explored its upper regions…shameful.

NO LONGER.

In summary, volume on exchanges is sufficient to support a rally. Pensions are dead. 401ks robo feed fiat dollars into the S&P 500. Robot over-lording is good, tricking hippies into building you a farm for free is bad. If you are missing out on the bitcoin rally, shame on you. Tell your kids you are missing out on the greatest video game rally ever. Models are bullish.

And I will be deep in nature, so the townsfolk are safe.

Exodus members: the 152nd edition of Strategy Session is live, go check it out!

If you enjoy the content at iBankCoin, please follow us on Twitter

should we all just switch to trading cryptos since indexes no longer have any semblance of capitalistic fair & free markets?

The overnight gap fill on nq has been $$ for the last like 3 months

I do not Advocate trading cryptocurrencies only to buy them and never sell them