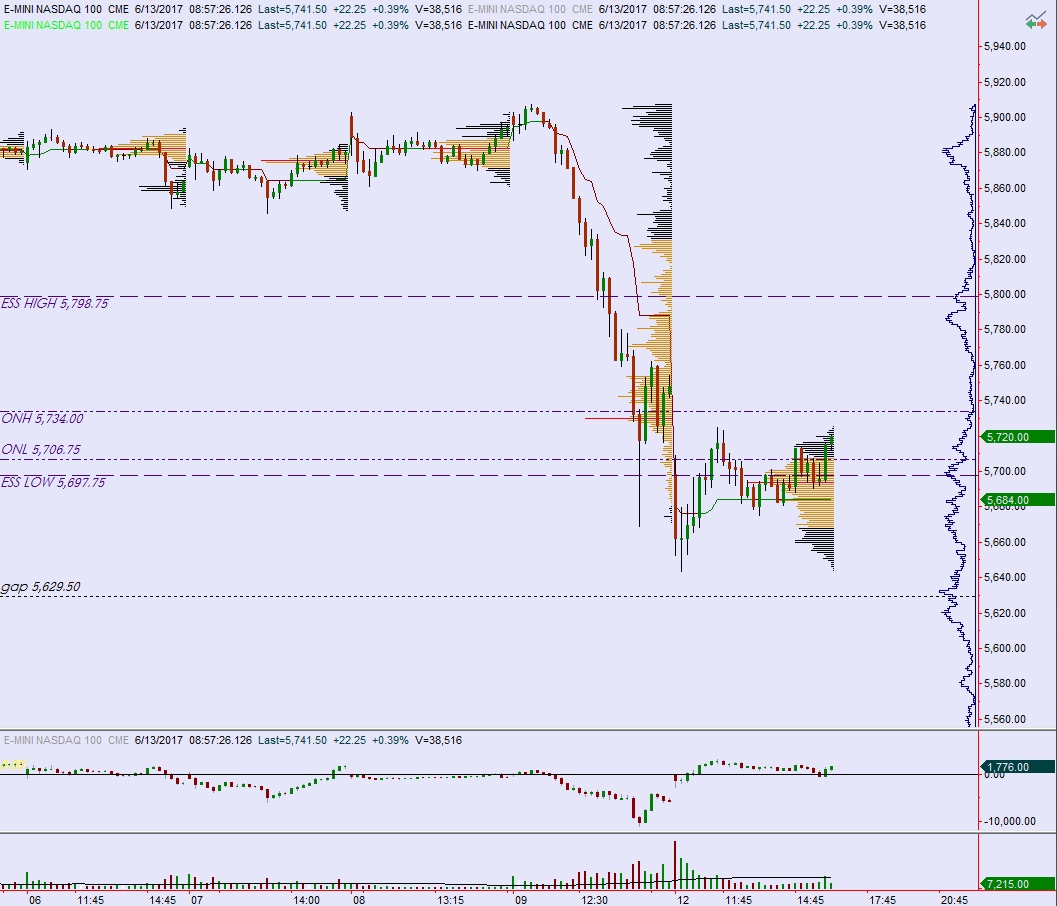

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, slow and steady, hardly taking any time to trade sideways or lower.

The economic calendar is dead. Like you probably do not need to trade today. There’s a 4-week T-bill auction at 11:30am and a 3o-year bond auction at 1pm.

That is it, and everyone will likely at some point today start marking time ahead of Wednesday afternoon’s FOMC decision.

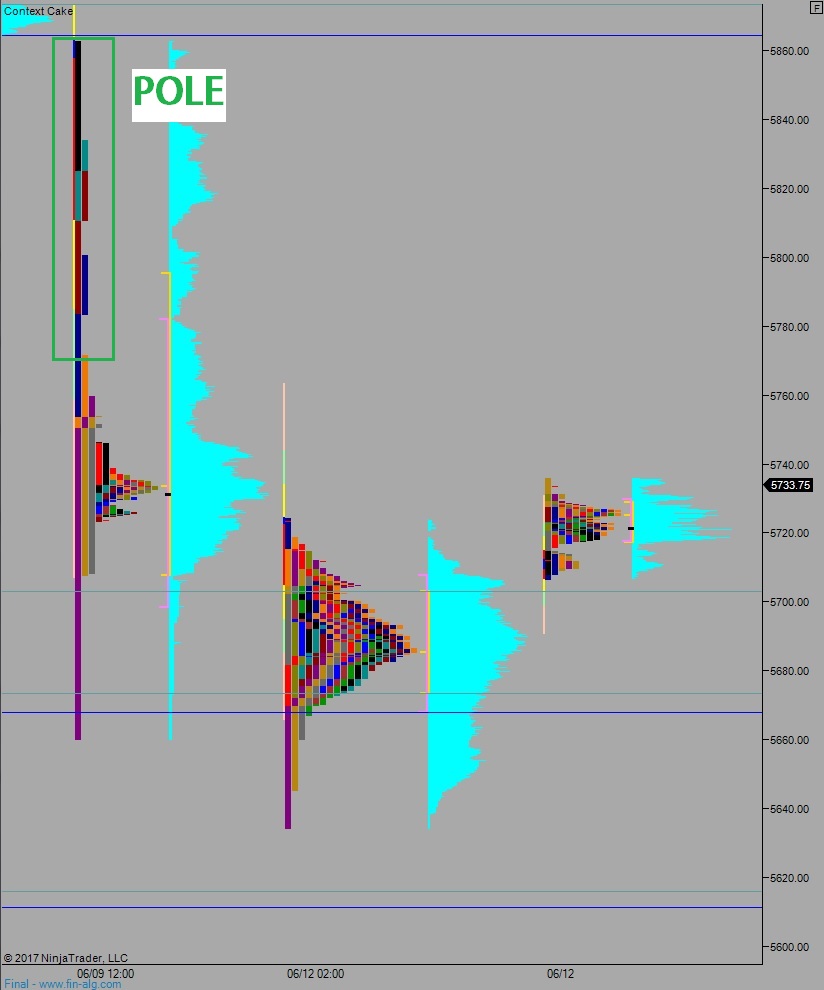

However, there is the potential for a pole climb, which is a way of describing a steady ascent up a thin and slippery surface (believe it or not). In this case, the ‘surface’ is how our market profile is currently printed. You can see what is being described as a pole on the colorful chart at the bottom of this blog entry.

Yesterday we printed a normal variation up. People woke up freaked out. All their fears about the tech sector had come to life and the NASDAQ was careening lower again, for a second day. Price closed a gap left behind around 5/19, went a touch lower, then found a responsive bid. We spent the rest of the day auctioning higher. Buyers struggled to regain the low-end of balance formed Friday afternoon.

Heading into today my primary expectation is for buyers to gap-and-go higher. Price works up to 5760 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 5720. They continue lower, down through overnight low 5706.75. Look for a bid around 5700 and two way trade to ensue.

Hypo 3 pole climb. Price sustains above 5760 triggering an uninterrupted move up to 5800 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: