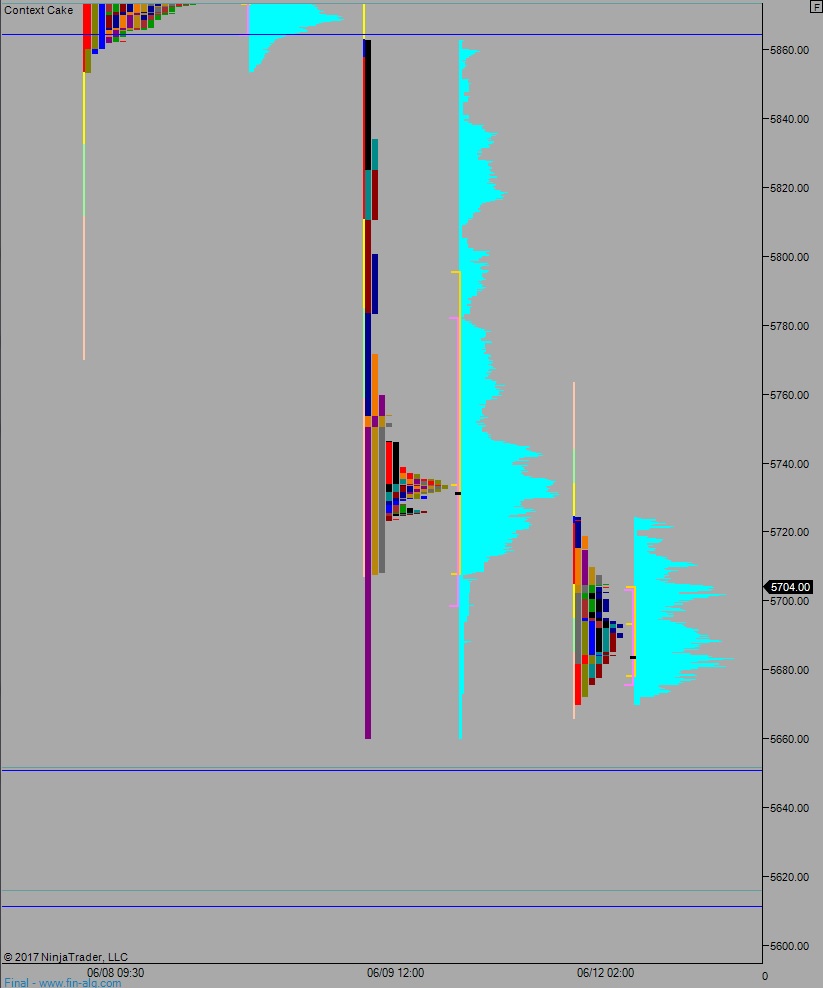

NASDAQ futures are coming into the week with a pro gap down after an overnight session featuring extreme range and volume. Price worked lower, starting around midnight, trading down near last Friday’s low before settling into two-way trade.

The economic calendar is light today. Mostly Treasury auctions, see below:

- 11am, 6-month T-bill, $33bln

- 11:30am, 3-year Note, $24bln

- 12pm, 3-mont T-bill, $39bln

- 1pm, 10-year Note, $20bln

We also have a monthly budget statement at 2pm.

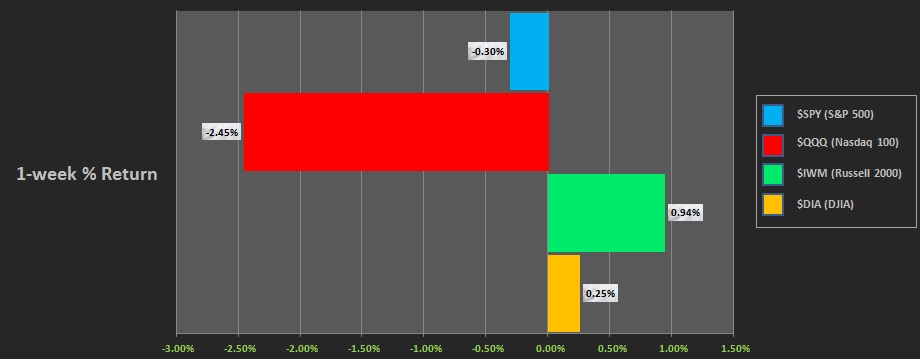

Last week major indices worked sideways until Friday. On Friday a heavy wave of selling pushed through the market, hitting the NASDAQ particularly hard. Last week’s performance of each major U.S. index is shown below:

On Friday the NASDAQ printed a trend down. Price pushed down to levels not seen since late-May before a sharp responsive bid came into the market. We did not trend the entire day, but a significant portion of the day was spent trending lower.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5748.25 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, down through overnight low 5670 and continue lower, down to 5651.50 before two way trade ensues.

Hypo 3 stronger sellers press down to 5615.50 before two way trade ensues.

Hypo 4 strong buyers ‘pole climb’ up to 5800 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: