At the end of the first quarter, a top-down sector analysis was performed, and the best performing sectors were screened using Exodus to narrow the list of potential investment candidates down to something manageable. There’s a video describing the entire process. It is a half hour long and very boring, I suggest you skip it.

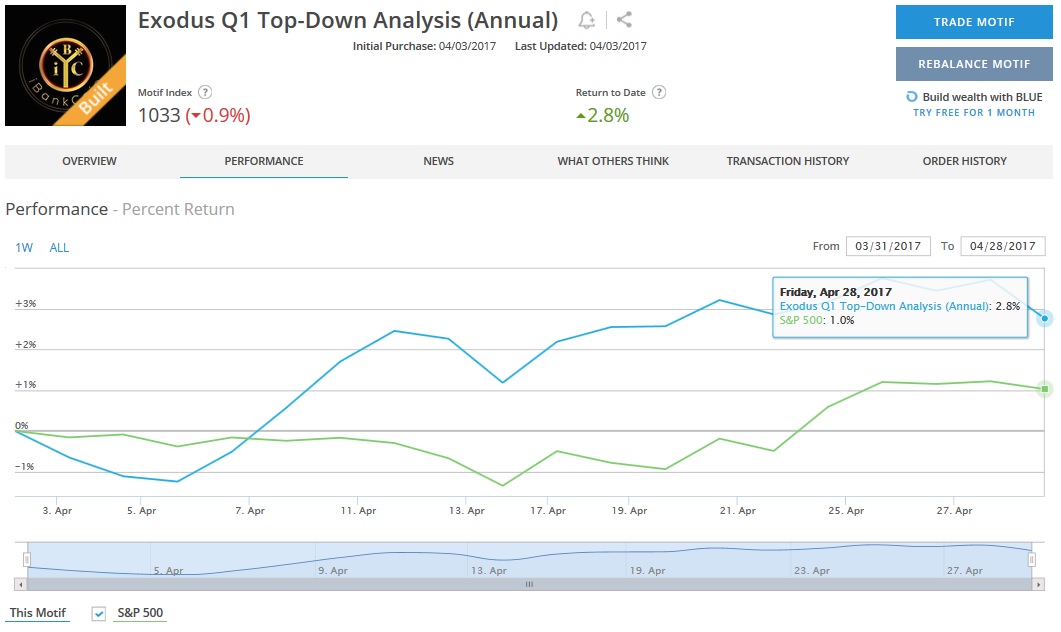

Anyhow, not that it really matters (this portfolio is a 1-year hold, so 1-month performance is irrelevant) but here is the first month’s performance:

There is something to be said about starting on the right foot, not having to play from behind MAYBE, whatever. It hit the ground running. The portfolio turned out 1.8% MOAR returns than the S&P 500. In the industry, they call that alpha.

This is not a sales pitch for our Exodus software, or even a campaign to promote my stock basket. None of that matters. I am sharing this investment approach because of the objectivity it is founded upon. Cold and dead logic—solid foundations for building. Sure, Exodus offers a powerful tool kit for making objective decisions, but there are other ways. You could collect a large data set onto Excel, for example, and run some statistics to isolate quality investments.

When the money goes into these accounts, it is with confidence in the process, liberating you from the distracting/bipolar nature of individual stocks. Sure, you could buy an index ETF and balance it with a bond ETF and a gold ETF and a REIT ETF and bunch of other fee-sucking ETFs.

Or hire a fee-based firm, Mr. Big Bucks.

Or, or…embrace some of the latest disruptive tools like Motif (no affiliation) to take control of your investing. We are entering a period of economic prosperity gentlemen. Are you positioning yourself today for how you want your life to be in the roaring ’20s?

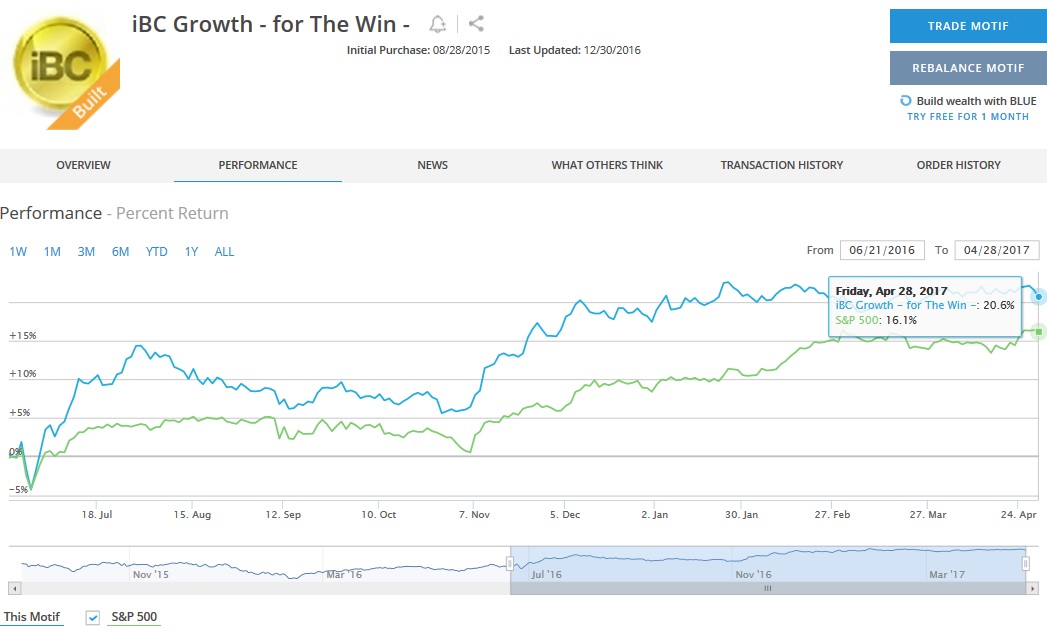

My top-down index compliments the GARP portfolio, Fly’s semiannually adjusted portfolio, quite nicely. GARP is also out performing the S&P. Here is the performance since its June adjustment:

Note: GARP portfolio is members only

Outsourcing my stock picking to The Fly and his time machine allows me to live the fat man’s lifestyle—sashaying around the house in a robe eating hoagies—the best of times.

So far the latest top-down basket is doing well. Will it outperform the S&P 500 for the duration of its holding period?

As always, TBD

If you enjoy the content at iBankCoin, please follow us on Twitter