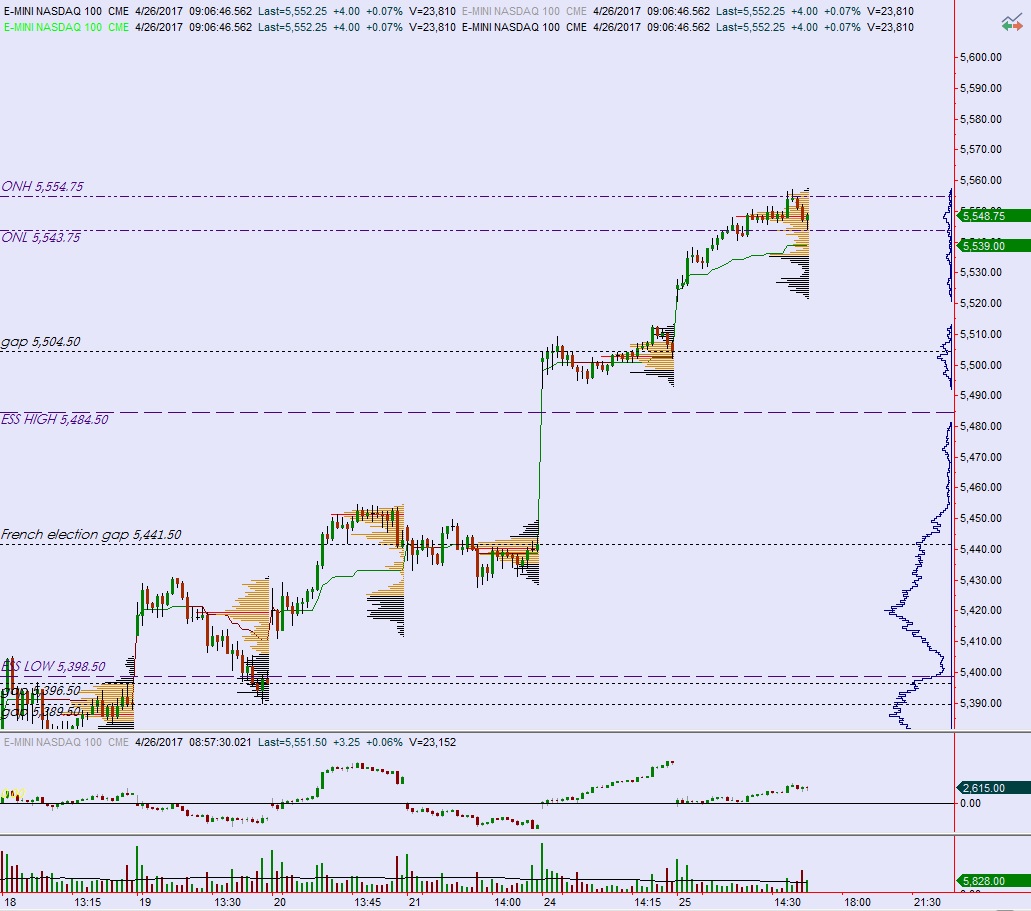

NASDAQ futures are flat heading into Wednesday after an overnight session featuring normal range and volume. Trade was balanced overnight, holding inside the upper quadrant of Tuesday’s range. At 7am MBA mortgage applications came out better than last week.

Also on the economic docket today we have crude oil inventory at 10:30am, a 2-year floating rate note auction at 11:30am, and a 5-year note auction at 1pm.

Yesterday we printed a double distribution trend up. Price opened gap up and ran higher nearly the entire day, exploring the open-air of all-time highs.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 5548.75 then continue lower, down through overnight low 5543.75. Look for buyers down around 5530.50 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 5554.75 then test up above all-time high mark 5557.25 and continue exploring higher prices.

Hypo 3 strong sellers trigger a liquidation down to 5511.25 before two way trade ensues.

Levels:

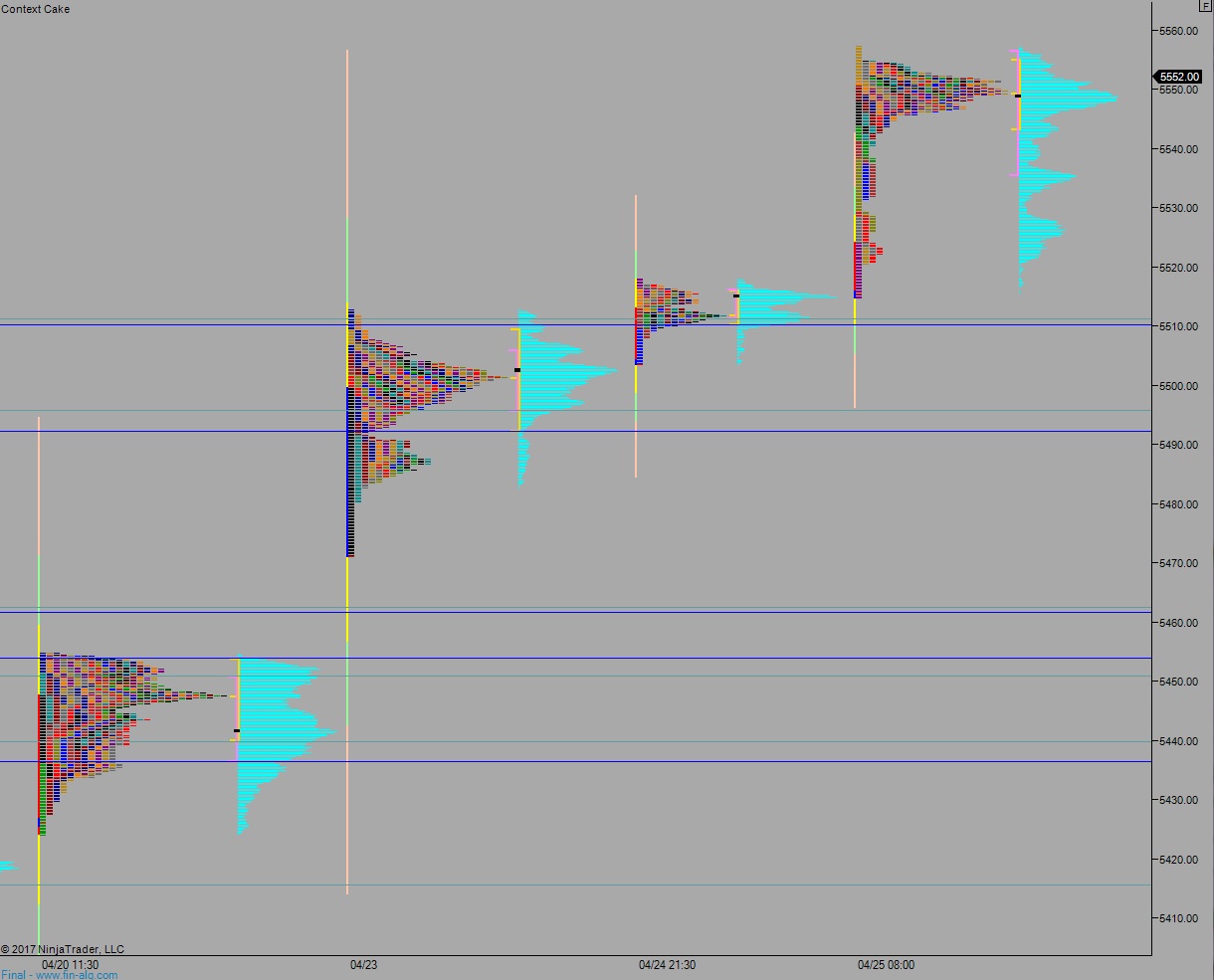

Volume profiles, gaps, and measured moves:

I guess what I was trying to say and ask in my comment yesterday is this:

“0.2% Of Nasdaq Companies Accounted For 45% Of Its Recent Gains”

https://tinyurl.com/lz8tqeb

In essence, to play Nasdaq, all one could do is load-up on five names and ride the market.

Pretty much. But I play both sides, simply trading the futures contract, which gives me access to more leverage and has more order flow visibility, for now. Soon I will have ability to see order flow on some of the big NAS stocks, not yet though.

I am skeptical of trading when entire market can move with a just a few names. Historically (last 10 years) projected into the long-run, I don’t see many able to outperform the average market returns – except lucky gamblers. Not even large 2/20 hedge funds can do better than average. Usually worse.