NASDAQ futures are coming into Wednesday flat after an overnight session featuring normal range and volume. Price held Tuesday range overnight but also managed to form a double/weak high at 5353.75. At 7am MBA Mortgage data was released.

Also on the economic docket today we have Existing Home sales at 10am, the US Treasury is auctioning off $13B worth of 2-year floating rate notes, then at 1pm they’ll auction $34B worth of 5-year notes.

At 2pm the FOMC Minutes will be released from the February 1st meeting. Traders down at the CME are currently pricing in a 17.7% chance of a rate hike when the Fed next meets on March 15th.

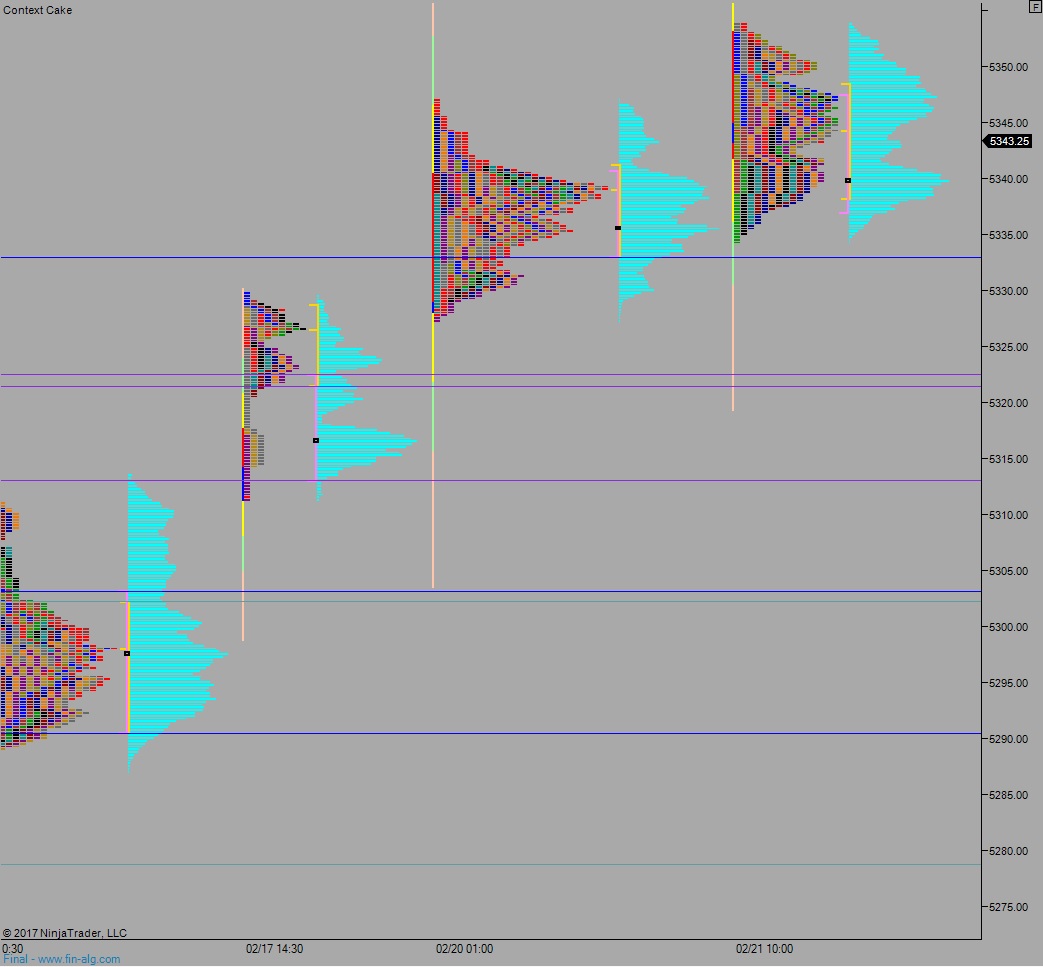

Yesterday we printed a normal variation up. The gap down to start the holiday shortened week was greeted with buying. Buyers pressed to new all-time highs before price retraced down through the daily mid. We churned through the NYC lunch then ramped higher at end-of-day.

Heading into today my primary expectation is for price to work up through overnight high/weak high 5353.75 to tag measured move target 5358.25 before two way trade ensues.

Hypo 2 sellers press down through overnight low 5337.25 and tag 5333 before two way trade ensues.

Hypo 3 stronger sellers press down and close the weekly gap down at 5325.25. Look for buyers just below at 5322.50.

Levels:

Volume profiles, gaps, and measured moves: