NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price worked up through Wednesday’s high briefly before settling into balanced trade inside yesterday’s range. At 8:30am Initial/Continuing jobless claims data came out mixed and the Philadelphia Fed reading was in line with expectations.

Also on the economic calendar today we have Leading Indicators at 10am and a 5-Year TIPS Reopening auction at 1pm.

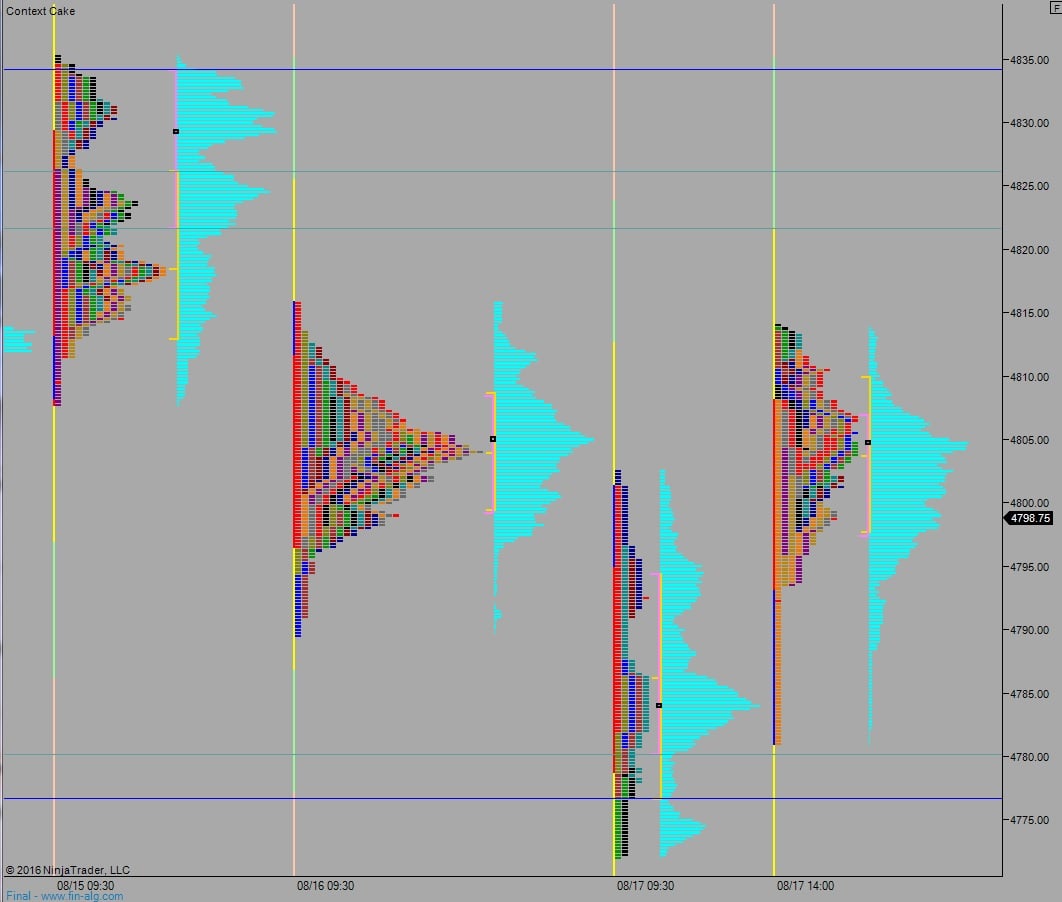

Yesterday we formed a neutral extreme up. Sellers were active on the open for a second consecutive day, aggressively driving price lower early on. Then, briefly, they managed to extend price lower before finding a strong responsive bid before the FOMC minutes.

The bid pushed up through the day’s entire range, putting the market neutral. Then FOMC minutes hit, third reaction yielded the buy signal, and we rallied through end of day, closing near the high making Wednesday a neutral extreme day-type.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4803.50. Sellers show up here and work price down through overnight low 4793.50. A test of the excess low just below overnight low brings in a bid and two-way trade ensues.

Hypo 2 buyers close overnight gap up to 4803.50 then work through overnight high 4814 setting up a move to close the open gap up at 4822.75 before two way trade ensues.

Hypo 3 strong selling pushes down into the single prints below 4793.50 setting up a liquidation move to target 4780 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: