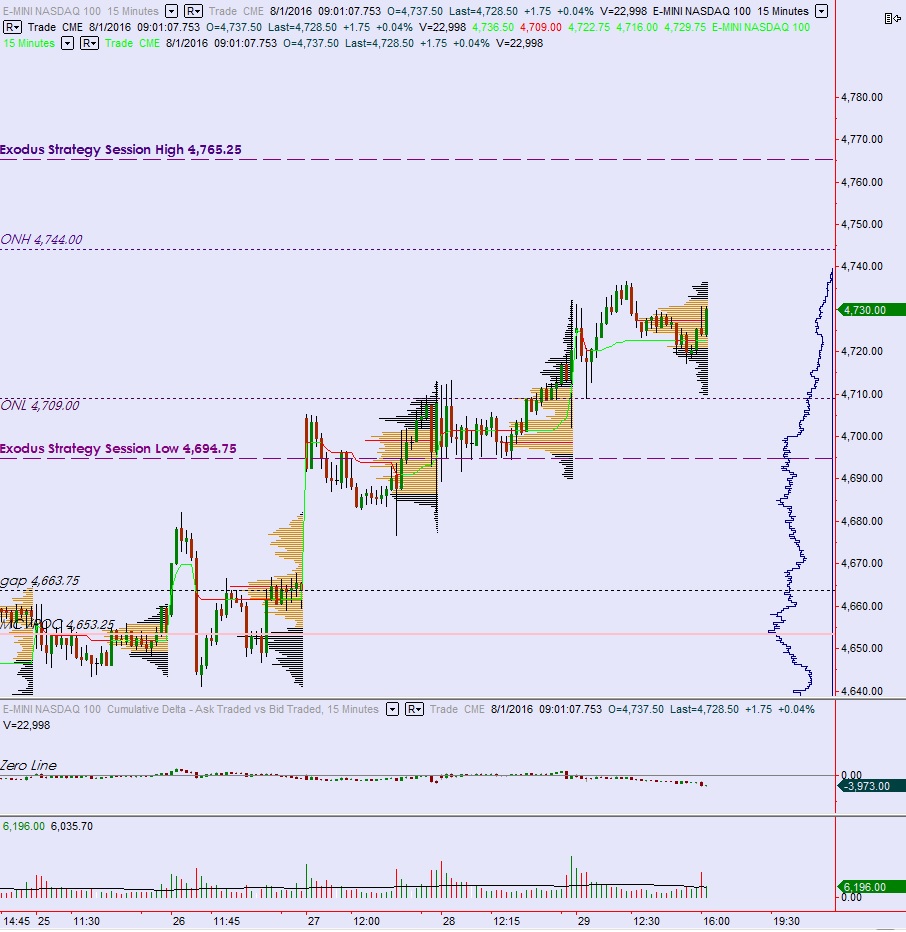

NASDAQ futures are coming into August flat after an overnight session featuring normal range and volume. Price worked lower overnight and formed a double low, weak low, vs Friday’s low before pushing higher and making a new swing high. Just above swing high sellers were found and two way trade ensued.

On the economic calendar today we have ISM-Manufacturing at 10am, a 3- and 6-month T-bill auction at 11:30am.

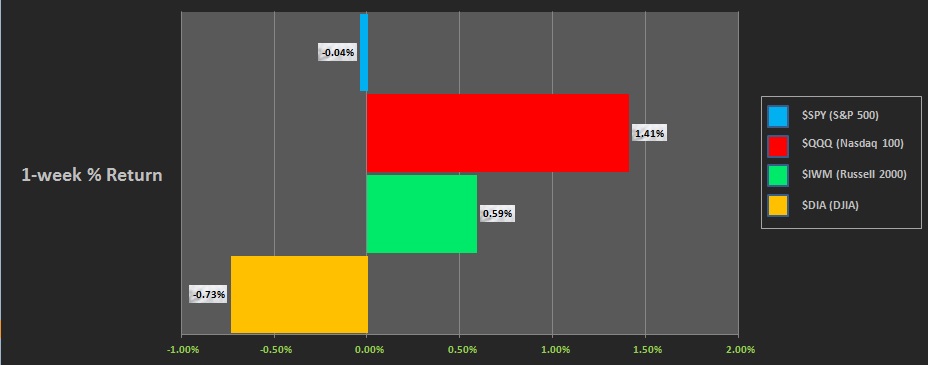

Last week the NASDAQ worked higher while the S&P stayed flat and the Dow worked slowly lower. The Russell managed to print out a small gain. The following chart lists the performance of each major index last week:

Last Friday we printed a normal variation up on the NASDAQ. After opening gap up, sellers worked the gap fill and found a strong responsive bid ahead of the 4700 century mark. Price went range extension up before selling into two-way balance. A slight ramp occurred during settlement.

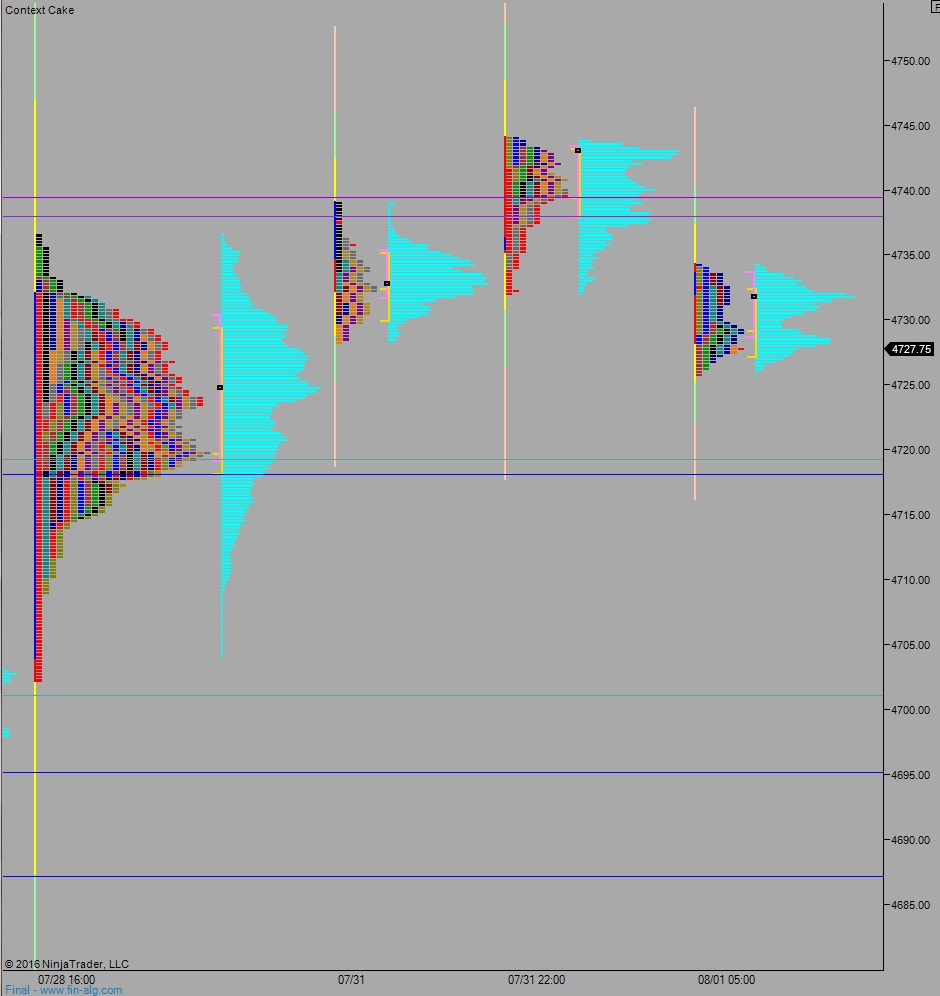

Heading into today my primary expectation is for sellers to work into the overnight inventory. Look for buyers around 4719.25. Buyers struggle to reclaim 4730 and sellers become initiative at take out overnight low (weak low) 4709. Look for responsive buyers around the 4700 century mark and two way trade to ensue.

Hypo 2 buyer work up to 4738 and find sellers. From here we auction down to 4719.25 before two way trade ensues.

Hypo 3 buyers push up through 4738 and the take out overnight high 4744 and continue exploring higher prices. Measured move target is 4765.25.

Levels:

Volume profiles, gaps, and measured moves: