NASDAQ futures are set to gap up after an overnight session featuring elevated range on normal volume. Price continued working lower during the evening, extending the late-day selling from Monday, before finding a strong responsive bid at the upper boundary of lower value and traversing the entirety of yesterday’s range. The rally started around 3am.

On the economic calendar today we have New Home Sales at 10am. This afternoon the U.S. is auctioning off lots of debt. We have the 52-week and 4-week T-Bill auctions at 11:30am and the 2-year note auctions at 1pm. These short duration note auctions will be followed closely by traders as the yield curve starts to flatten.

See Also – Danger: The Yield Curve Is Flattening

Yesterday we printed a normal variation down. Value was attempting to migrate higher in the morning before we settled into balanced, two way trade. Just after yesterday’s T-bill auctions [around 11:30am] sellers became more aggressive. Eventually, by late afternoon they managed to push the market range extension down. NASDAQ futures ended the day at session low.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the overnight gap down to 4352.75. Look for a responsive bid right around these levels and two-way trade to ensue.

Hypo 2 sellers only work the half gap, trading down to about 4362.25 in choppy trade before responsive buyers step in. We then go higher and take out overnight high 4382.25. The auction stalls out just above overnight high, around 4385.50 and two way trade ensues.

Hypo 3 buyers gap-and-go higher. Take out overnight high 4382.25 and sustain trade above 4385.50 early on, setting up a move to test 4397. Look for a probe of the 4400 century mark before two way trade ensues. Stretch target is 4418.

Hypo 4 strong selling, perhaps a drive after the T-bill auctions, fills the overnight gap down to 4352.75 then continues lower to take out overnight low 4341.75. This opens the gates to explore lower value. Target VPOC at 4318.75. Stretch targets to downside are VAL levels at 4311.50 then 4298.50.

Levels:

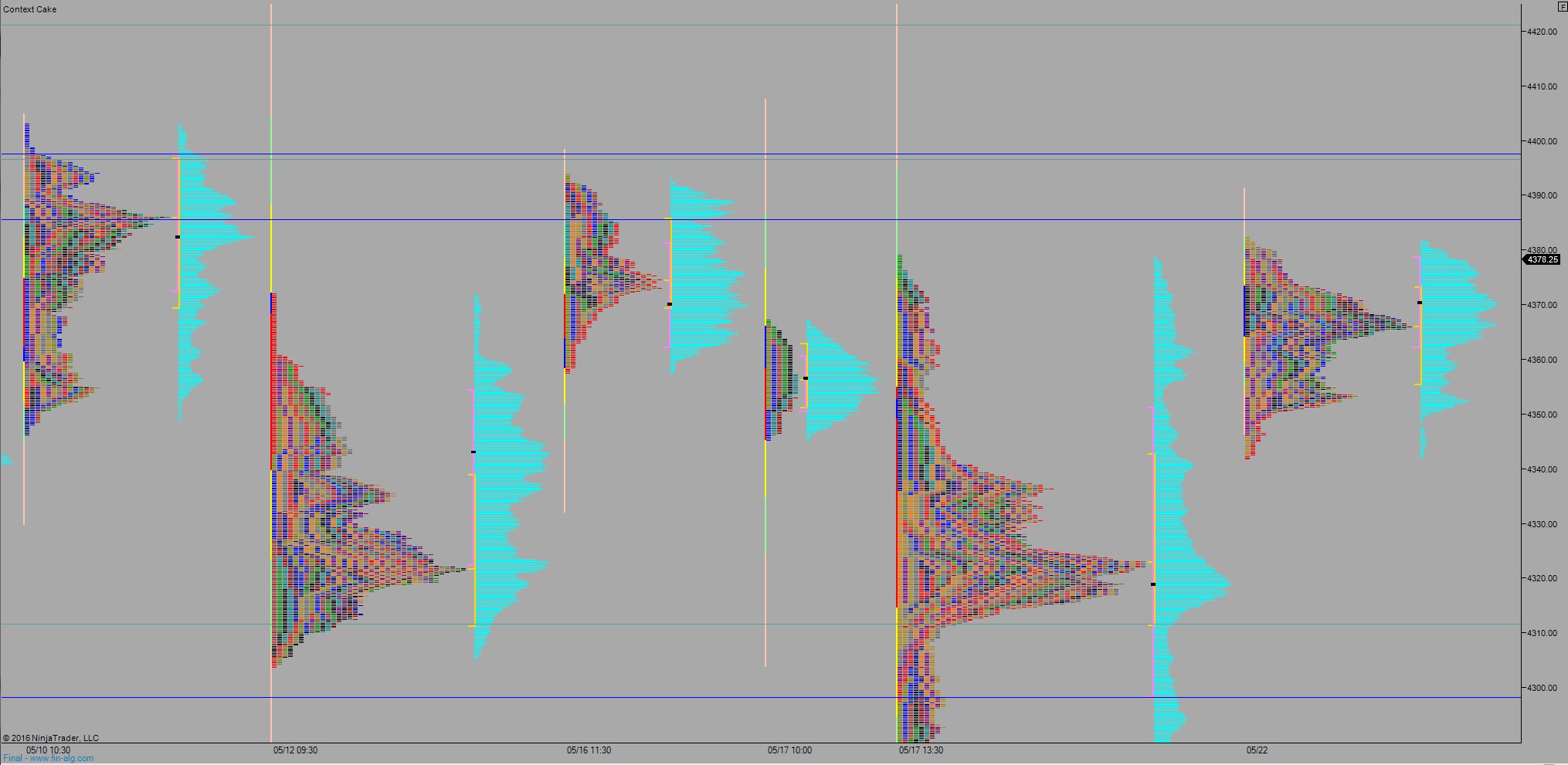

Volume profiles, gaps, and measured moves:

Hypo 3 in full effect right now. YIKES.

This looks a bit like May 20th so far.

I’m interested to see if we can close above the trendline @ 2065

Me too mate. Excellent action

well there’s no arguing with that number. What a show