The market is being dismantled despite the bullish fund flows often in play when a new month starts on a Monday. The downward price action marks a decisive victory for my index model, a working strategy inside the Exodus Strategy Session.

Rose Colored Sunglasses [RCS] triggered its first 2016 short signal on Sunday, and its cold stats were paired with a bit of contextual mojo to formulate my predictions heading into the week. This post is not bringing your attention to this victory so I can pat myself on the back, but instead to demonstrate that the market continues to be methodical and compliant with auction theory–the only viable theory for consistently approaching this market with poise and objectivity.

What is the market likely to do from here? Well the NASDAQ is trying to lead lower, but the other indices aren’t cooperating. This is a classic Option Addict risk divergence. Heck, I bet he is considering a long /NQ trade any minute now, if I had to guess.

I will not participate in such trades. Instead I will wait for tomorrow when I will be in the smog infested air surrounding L.A. If at that time I see fit to procure equity exposure, I will do so via the QQQs.

In the meantime, chalk up another win for the good guys.

Want to see more? Here’s an expert from last Sunday’s Exodus Strategy Session:

Bias Model: Rose Colored Sunglasses Short Bias

After two weeks of neutrality, the model has a short bias heading into the new month. I am hesitant to initiate new shorts, especially early in the week, due to the seasonality of a new month starting on Monday. However, by Wednesday I will be looking for a potential position short into the end of the week.

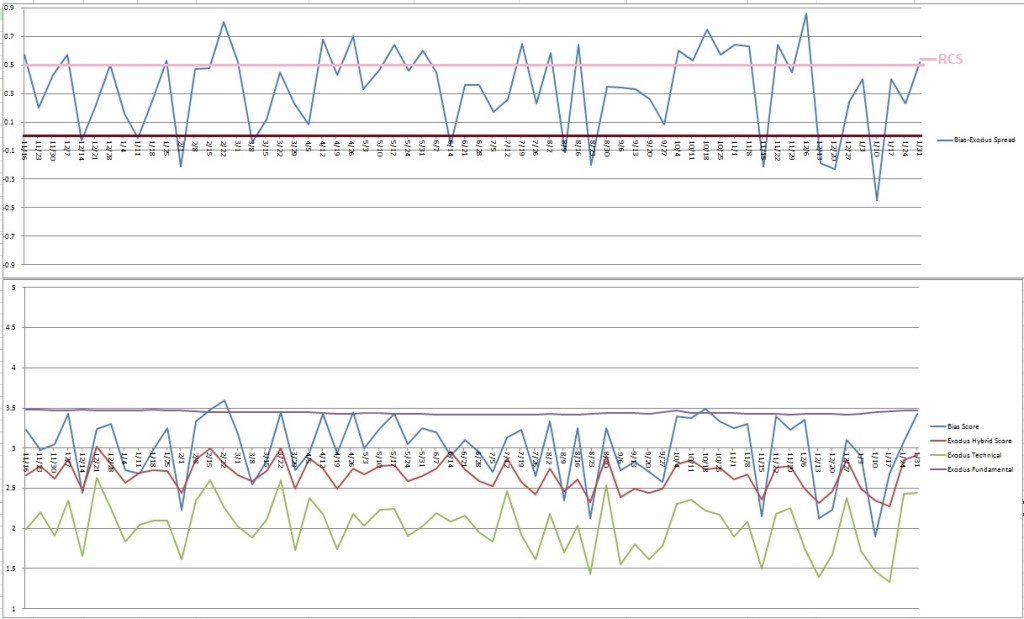

Here is the current spread:

Want even MOAR? Here is the ‘Thesis for The Week’ from Sunday’s Strategy Session, an executive summary for those too busy to read the entire report:

Buyers continue working higher Monday based off last Fridays strength. A gap up Wednesday is reversed and we spend the rest of the week trading lower with the Non-farm Payroll data Friday accelerating the selling into early Friday before the week finishes with quiet, two-way balanced trade.

If you enjoy the content at iBankCoin, please follow us on Twitter

If the NASDAQ was divergent from the other indices, why would that be a indicator of risk on? Wouldn’t it be more of an indication of flight to safety? No trolling at all, just wanted to get your insight. Thanks Raul!

I never think you’re trolling bud. You’re right. What I was noticing was that only the Nasdaq was making a new LOD, while the others (including the Russell didn’t). Therefore it looked like the NASDAQ was lying, and about to rip back in line with the others.

But on the week, it is the biggest loser so far which suggests investors are less interested in the NAS 100 then they are the other indices.

The point is the Dow the spx and the NASDAQ all have similar stocks so if a msft or a nke rallies then it will lead to the rise of multiple indicies. The goal is to keep with the leaders and if they don’t break down and neither do most of the indicies then the odd man out has the biggest reward risk ratio.